Analysis

February 13, 2024

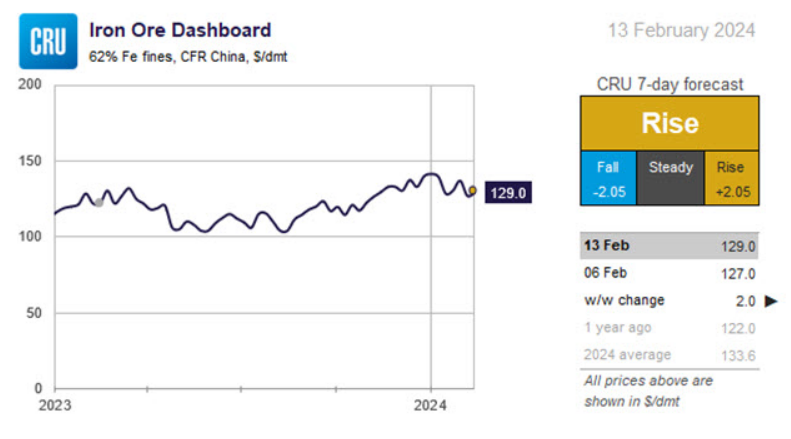

CRU: Iron ore steady amid Chinese holidays

Written by Aaron Kearney-Keaveny

The iron ore market has been largely calm, with China observing the Chinese New Year (CNY) holiday period, while demand in Europe and JKT has been slow to pick up. Supply has been somewhat weaker, but overall, the price has held steady.

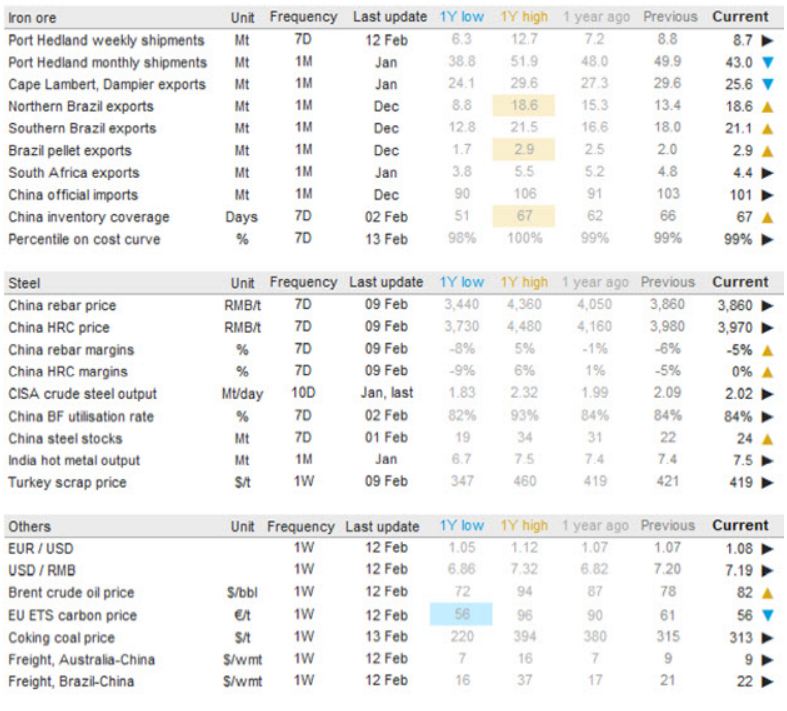

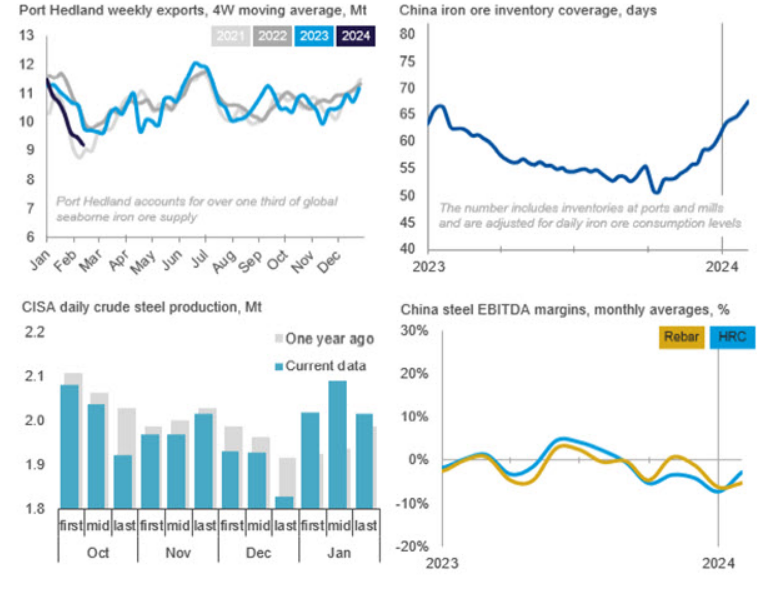

Supply from Port Hedland remained unchanged w/w despite Roy Hill having no shipments due to maintenance, with this loss being offset by increased volumes from FMG. The Australian Bureau of Meteorology has identified a “very low” risk of a potential cyclone developing in the Northern Territory and moving towards the Pilbara region over the upcoming week. Additionally, BHP rail workers are set to strike for 24 hours this Friday as negotiations with the company persist. BHP stated it has measures to minimize this disruption, though port inventories are already very low and could exacerbate outflow loss.

Elsewhere, Brazilian shipments slowed down w/w overall, even though there was an increase from the north. Rainfall has continued to hold at a low level this week. In Sweden, LKAB reported further delays to rail repairs amid cold weather conditions, pushing the restart date to early next week. In South Africa, Anglo American’s Kumba reported a fall in iron ore production of 2.5 million metric tons (mt) q/q and almost 3 million mt y/y for Q4’23. This fall was cited as being part of planned production cuts in response to high mine inventories, which resulted from the country’s major rail issues.

Demand is weak, with China being largely inactive as the country celebrates CNY. In Europe, BFs have continued to be idled as the outlook for demand is not believed to be strong. Tata Steel’s Ijmuiden asset (2.9 million mtpy) in the Netherlands restarted at the end of January. However, with numerous assets facing significant financial issues, further capacity coming online is expected to be limited in the immediate future. This weakness in steel production is reflected in import volumes in Europe, despite inventories being at the lowest level since Q1’22. Next week, we are likely to see a boost to iron ore demand as Chinese steelmakers return to the market and restock after the holiday period concludes. There are some supply risks, but overall, there are low chances of major disruptions, with heavy Brazilian rainfall and Australian cyclones being unlikely.

Learn more about CRU’s services at www.crugroup.com.