Analysis

June 11, 2024

Influx of coated products fuels recent import surge

Written by Laura Miller

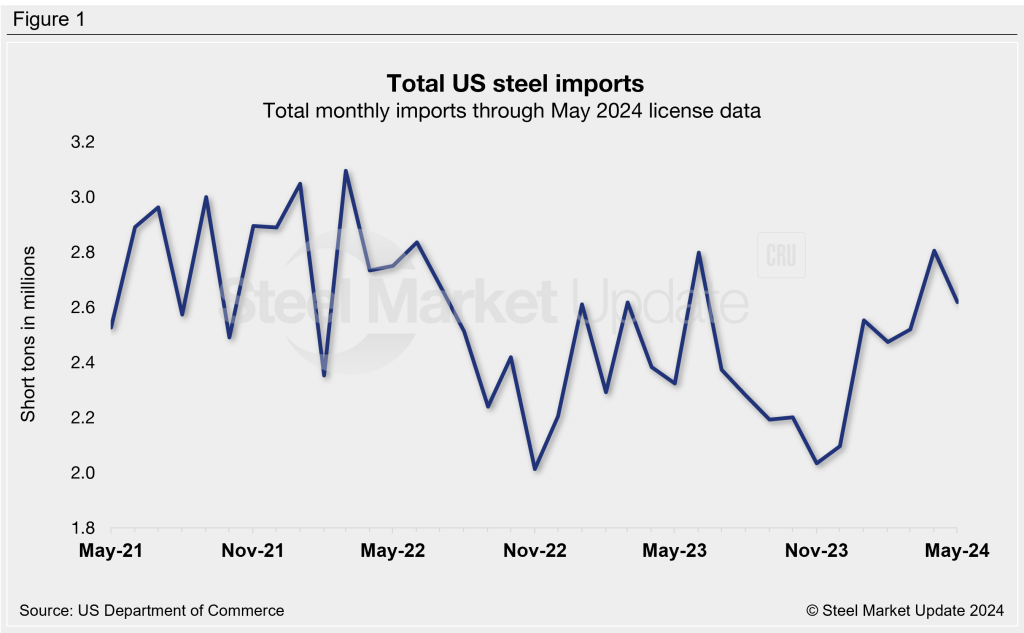

Steel imports fell back in May from April’s recent high but remained elevated compared to the levels seen over the past year. A deeper dive into the data confirms what SMU has been hearing from sources: Coated sheet is driving the recent rise in overall import levels.

Licenses to import steel totaled 2,618,700 short tons (st) in May, according to US government data. While down 4.9% from April’s final count of 2,804,330 st, remember that imports were at a 22-month high in April (Figure 1). Compared to the same month last year, May licenses are up 12.7%.

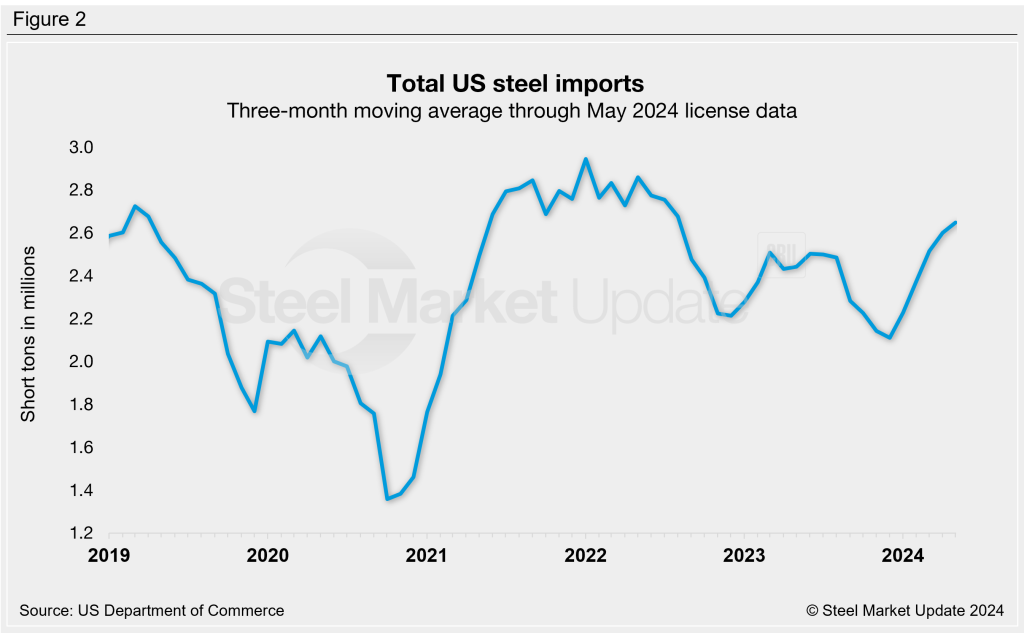

3MMA

Looking at imports on a three-month moving average (3MMA) can highlight longer-term trends. In Figure 2 below, we can see a significant rise in imports this year from an almost three-year low of 2,110,140 st in December 2023. May’s 3MMA of 2,647,000 st was the highest since September 2022.

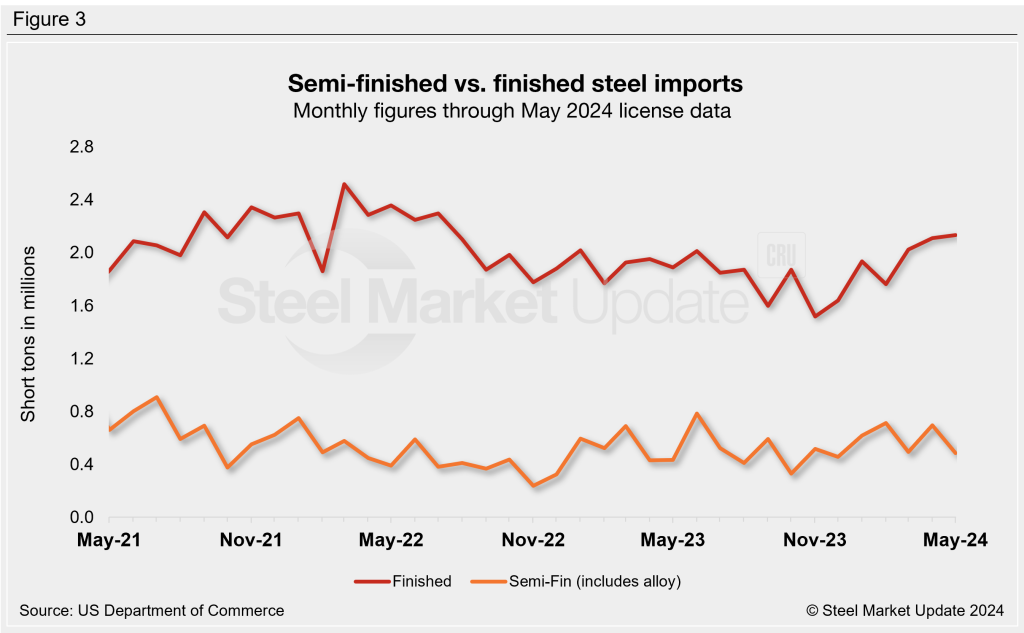

Semi-finished and finished steel

Finished steel imports, climbing higher for a third consecutive month, drove the increase in import arrivals with 2,133,360 st of May licenses. This marks the highest month for finished steel imports since August 2022 (Figure 3).

Semi-finished steel imports, at 485,370 st of licenses in May, declined to the lowest monthly level so far this year.

Imports by category

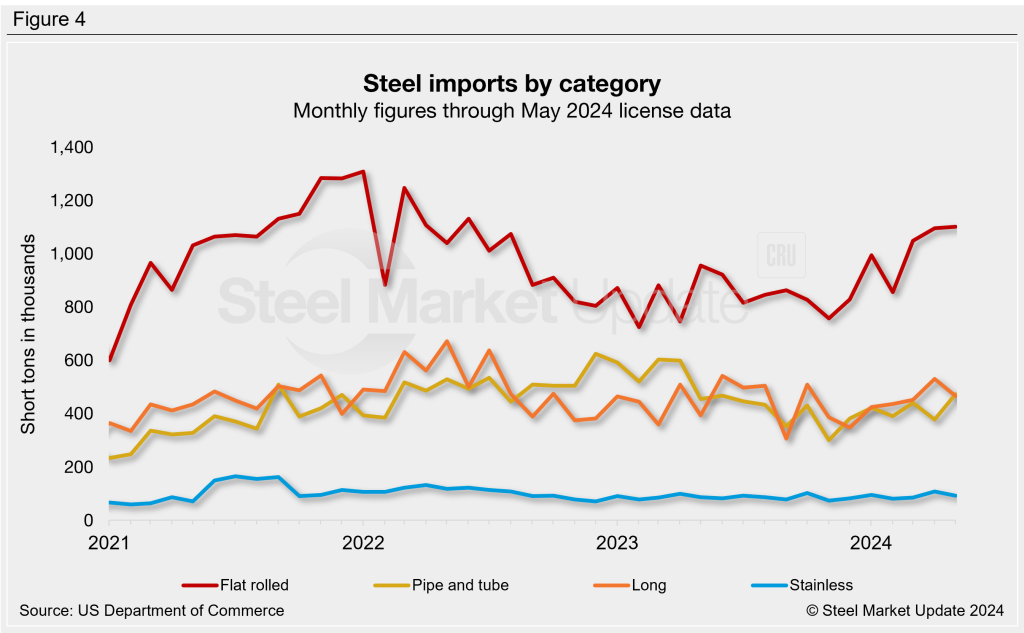

Driving the increase in finished steel imports were flat-rolled and pipe and tube products (Figure 4).

Flat-rolled steel imports were near a two-year high, with 1,101,360 st of licenses counted in May.

Imports of pipe and tube products rose to a 13-month high with 472,850 st of May licenses.

Flat-rolled steel

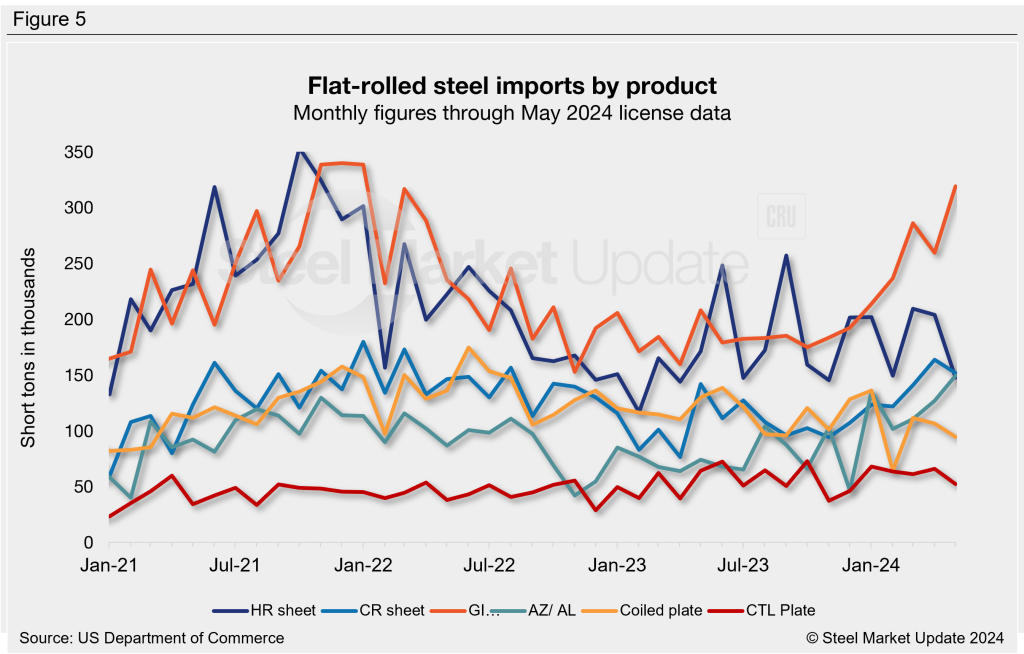

Breaking out flat-rolled steel imports by product, we can see coated sheet imports have been on the rise while imports of other FR products have been falling (Figure 5).

Though imports of cold-rolled (CR) sheet declined from April, May licenses of 151,770 st are still high.

Coated sheet imports

Licenses to import galvanized sheet and strip surged 23% month on month (m/m) to 318,950 st in May. We have to go back more than two years to see higher import levels over the three-month period November 2021 through January 2022.

At the same time, licenses of ‘other metallic coated’ products (think AZ/AL, Galvalume, and aluminized sheet) jumped 18% m/m to 149,310 st, the second-highest monthly amount on record. June 2017 was the only month in which more of this product entered the US, according to SMU’s records.

Year to date through May licenses, total galvanized imports show a 42% year-on-year rise, and other coated imports are up 70%.

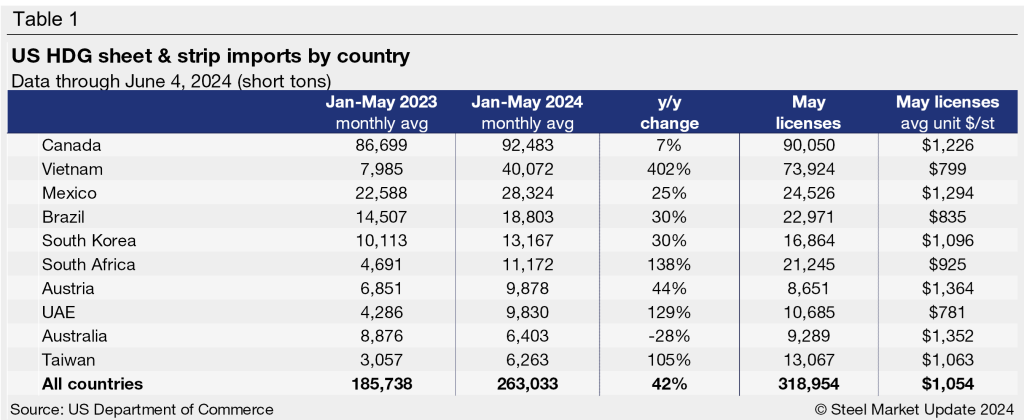

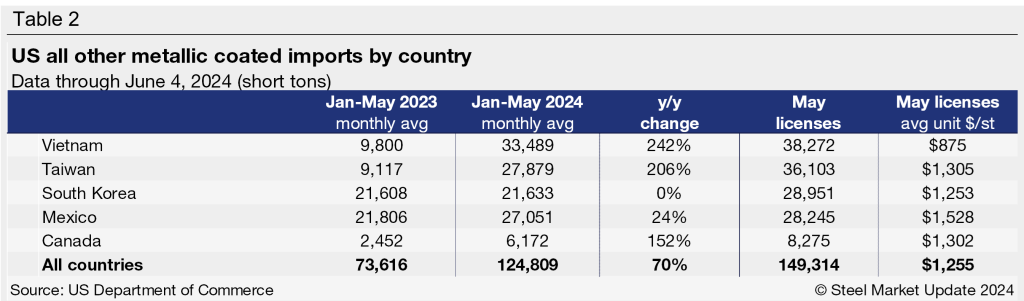

From where are the higher galvanized volumes coming? Tables 1 and 2 below show the countries supplying the most HDG and AZ/AL to the US and the difference in year-to-date shipments this year vs. 2023. Also shown are the May license counts and the average cost per short ton, according to the Department of Commerce’s US Steel Import Monitor.