Analysis

August 2, 2024

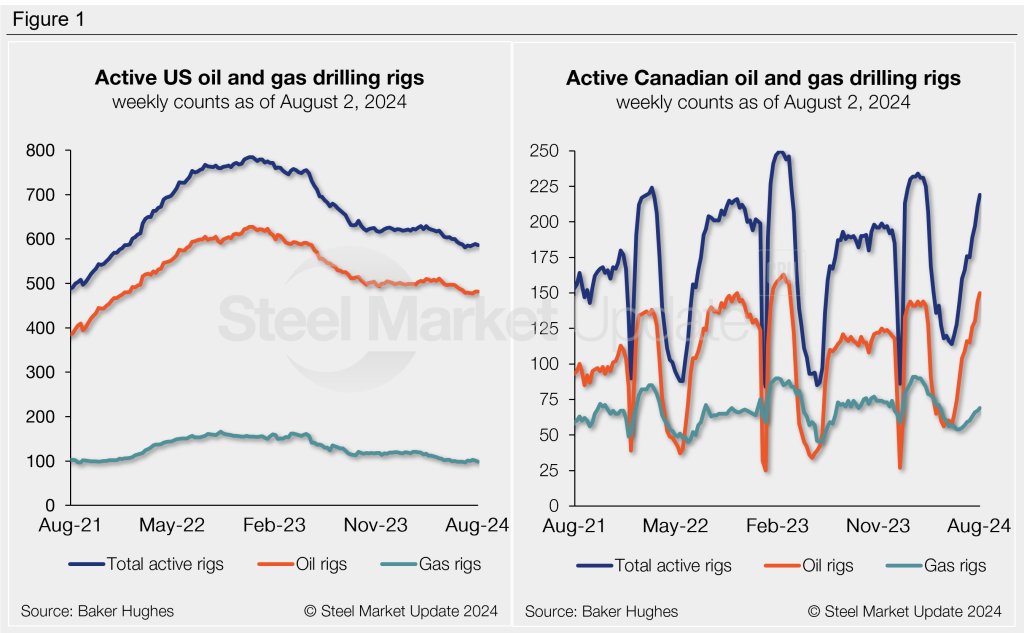

Rig count: US activity slips, Canadian count rises

Written by Brett Linton

US drill rig activity resumed its downward trend last week, according to the latest data from Baker Hughes. Meanwhile Canadian counts ticked higher for the fifth consecutive week. They now stand near a five-month high.

US rigs

Through August 2 data, the number of active drilling rigs in the US declined by three week over week to a total of 586 rigs. Oil rigs were unchanged at 482, natural gas rigs fell by three to 98, and miscellaneous rigs held steady at six.

There were 73 fewer active rigs in the US this week compared to the same week last year. The number of active oil rigs was down by 43, gas rigs were down by 30, and miscellaneous rigs were unchanged.

Canada rigs

The number of rigs operating in Canada increased by eight to 219. Oil rigs rose by six to 150. And gas rigs increased by two to 69. This marks the highest Canadian count since early March.

Currently, there are 31 more drilling rigs operating in Canada than there were one year ago. Oil rigs were up by 32, gas rigs were down by one, and miscellaneous rigs were unchanged.

International rig count

The international rig count is updated monthly. The total number of active rigs for the month of July fell to 934. That’s down by 23 compared to the June count and 27 less than levels one year prior.

The Baker Hughes rig count is important to the steel industry because it is a leading indicator of demand for oil country tubular goods (OCTG), a key end market for steel sheet. A rotary rig rotates the drill pipe from the surface to either drill a new well or sidetrack an existing one. For a history of the US and Canadian rig counts, visit the rig count page on our website.