Market Data

October 15, 2024

September service center shipments and inventories report

Written by David Schollaert

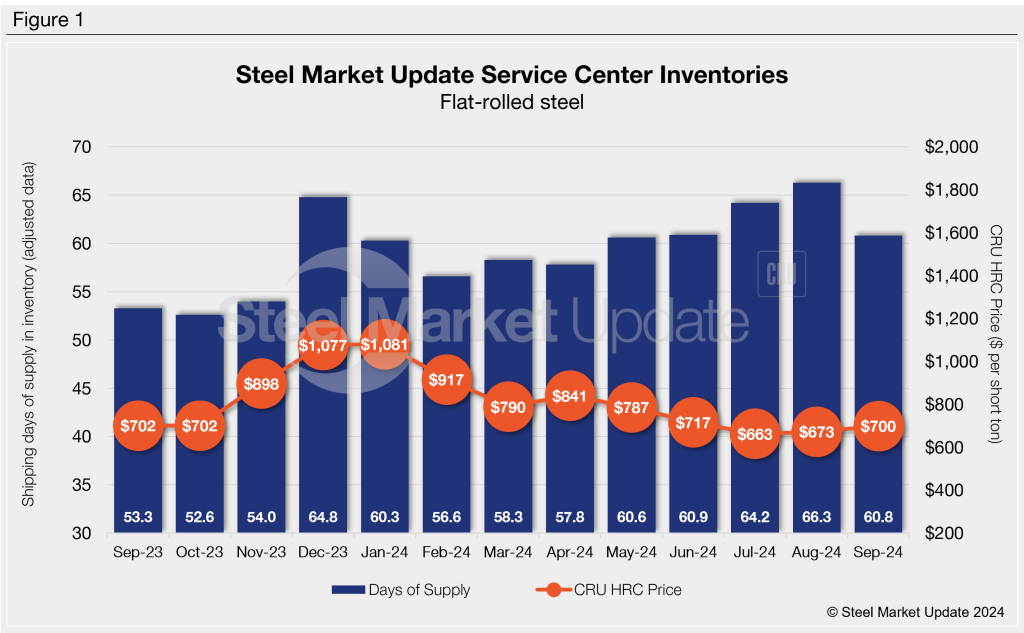

Flat rolled = 60.8 shipping days of supply

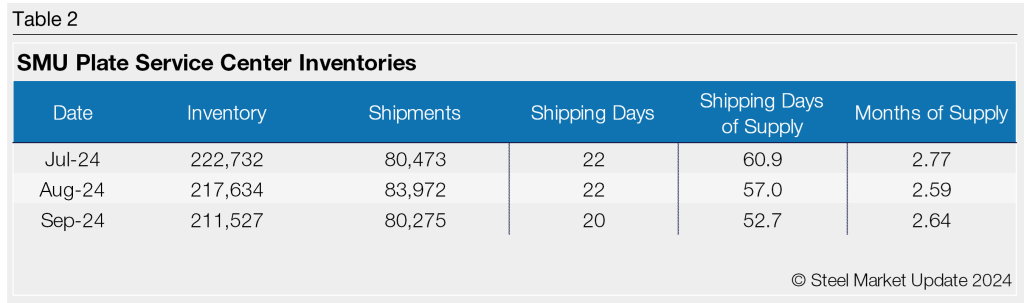

Plate = 52.7 shipping days of supply

Flat rolled

Flat-rolled steel supply at US service centers declined in September, though still seasonally high. September’s report reflects lower demand, stable lead times, and restocking early in the third quarter at a perceived bottom in prices. At the end of the month, service centers carried 60.8 shipping days of supply on an adjusted basis, according to SMU data.

This is down from 66.3 shipping days of supply in August but up from 53.3 shipping days in September 2023. Though down month-on-month (m/m), it’s still the highest September on record and one of the highest monthly figures year-to-date.

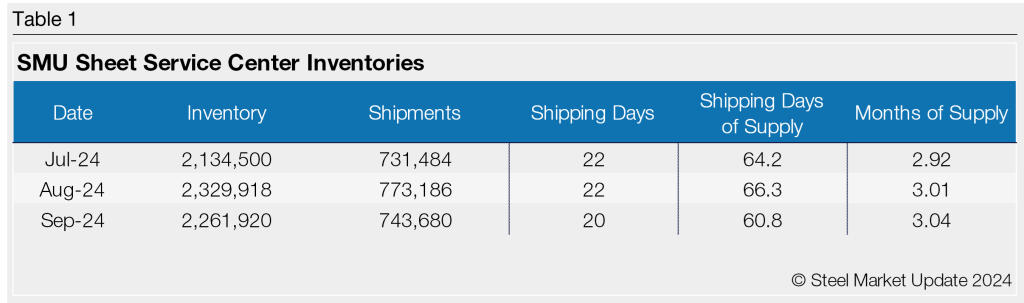

Flat-rolled steel supply in September was up marginally 3.04 months of supply, up from 3.01 months in August. September had 20 shipping days, two fewer than August. Sheet steel shipments typically hit a lull in July. The drop-off in shipments was more pronounced this year and appears not to have recovered much since.

The SMU survey data through Sept. 25 reported that more than two-thirds of service centers said they were releasing less steel than a year ago, while the remaining 37% said they were releasing the same amount. Notable was no service centers said they were releasing more steel vs. September 2023.

Flat-rolled steel prices have seen marginal gains since bottoming out in July, edging up some in August and remaining largely stable in September. Mills have been publicizing higher prices, but lead times have been slow to react. The Sept. 25 SMU survey marked hot-rolled coil lead times at 4.88 weeks, down from 4.91 weeks two weeks earlier. Lead times have been unusually stable of late, averaging right around five weeks since mid-April.

Similarly, the SMU survey also found that 48% of service centers described mill lead times for new orders as “shorter than normal,” while another 47% saw them as “normal.” Service center inventories ballooned at the end of July, with marginal relief to close out Q3.

The perception that prices were at or near a bottom at the end of July drove many service centers to buy heavily toward the end of the month. Because of the spike in flat-rolled steel on order and the lackluster demand outlook, inventories moved higher in August, with a slight correction in September.

Despite a slew of planned mill outages in September and October, the market still seems to be oversupplied relative to demand. It’s a trend highlighted by the lack of a price boost, notwithstanding repeated efforts from mills to prop tags up.

Plate

US service center plate supply ticked down again in September due to conservative buying patterns on sluggish demand. At the end of September, service centers carried 52.7 shipping days of plate supply on an adjusted basis, down from 57 shipping days of supply in August. Plate inventories represented 2.64 months of supply in September, up from 2.59 months of supply in August. In September 2023, service centers carried 63.5 shipping days of plate supply, representing 3.18 months of supply.

Plate mill lead times are much shorter this year, down roughly 30% from a year ago. The SMU survey from Sept. 25 found plate mill lead times of 4.0 weeks, basically flat from a month prior. The survey a year ago reported plate mill lead times of 5.73 weeks. Ramped-up capacity earlier in the year and weaker-than-expected demand have kept the US plate market oversupplied.

With prices falling and weak demand, service centers have worked to destock, remaining diligent in managing inventory levels. But with shorter lead times, there has been little incentive to restock. As a result, material on order remains very low for plate. At the end of September, service centers had 24.5 shipping days of plate supply on order, down from 26 in August.

While inventories appear more than sufficient to meet immediate demand, the slight gain of material on order to close out Q3 may suggest a decline in inventories in October.

Keep in mind that plate on-order in September was up 1.3% m/m but down 30% y/y. Inventories were down more than 10% vs. September 2023. And, while the daily shipping rate saw a boost of 17% m/m and 8% y/y, it was 5% lower year to date.

The increased shipping rate is likely a result of SSAB pulling forward an outage and could, therefore, be reversed in October. Regardless, inventories remain lean and should be watched closely. Pricing could react quickly to any shift in demand as inventories and material on order are below normal levels.