Mexico

January 31, 2025

CRU Zinc: North American premium rises as Teck lowers output guidance

Written by Tom Rutland

On Jan. 18, Teck Resources announced that it expects its Trail smelter in Canada to produce 190,000 to 230,000 metric tons (mt) in 2025, down 10-25% from its 256,000 mt output in 2024. The company announced that the lower output was to maximize profitability and value amid the current tightness in zinc concentrate availability relative to available smelter capacity. With refined output expected to remain relatively flat elsewhere in North America, refined production from the region is anticipated to decline by 4.4% y/y in 2025.

However, there are also some downside risks to CRU’s North American refined zinc output forecast for 2025 due to the tight concentrate supplies and a record-low TC. Meanwhile, Trafigura’s Clarksville (125,000 mtpy) in the US could also potentially see a decline in output as the operation has historically been fed by the company’s Middle Tennessee mines; however, the mines have not been operating since late 2023, meaning the smelter could soon deplete its concentrate stocks.

Tariff uncertainty weighs on US demand

The US demand outlook remains mixed. On the one hand, the Trump administration is promising to focus heavily on reindustrialization efforts, which are positive for zinc demand. On the other hand, the US is a net importer of refined zinc, and 25% tariffs on goods from Canada and Mexico, if realized, could be detrimental to US demand. CRU does not expect a blanket approach to tariffs even if they are implemented. We believe tariffs are likely to affect manufacturing goods that can be produced in the US but should not apply to natural resources, for which there are no import substitutions and no refined supplies immediately available.

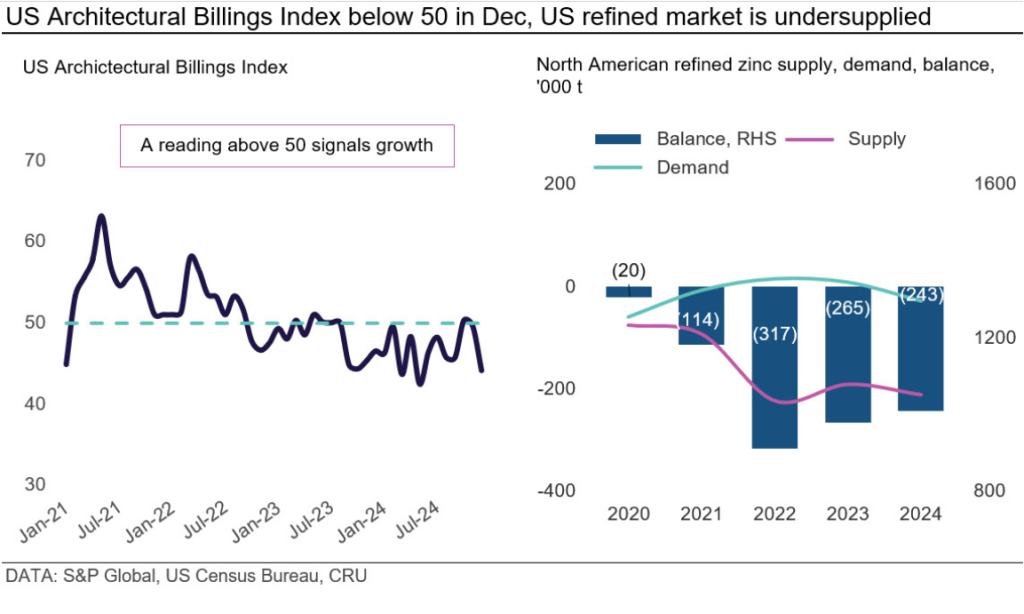

However, the market remains cautious. The forward-looking AIA/Deltek Architectural Billings Index (ABI) declined significantly to 44.1 in December from 49.6 in November. The US manufacturing index remained in contractionary territory at 49.3.

US spot zinc prices rise on decline in spot material availability

Market participants noted that some annual contract volumes for 2025 have been concluded, indicating terms were slightly higher than our premia assessment for late 2024 of around 15.50 ¢/lb. The US spot premia is assessed to have risen in January as the threat of tariffs has resulted in consumers buying material at firmer terms. Meanwhile, the unexpected decline in output from Teck has meant there is now reduced material available for the spot market. As a result, we have increased our US Midwest delivered premia to 16.00 ¢/lb for January from 15.25 ¢/lb in December.

This analysis was first published by CRU. To learn about CRU’s global commodities research and analysis services, visit www.crugroup.com.