Market Data

February 20, 2025

Architecture firm billings remain down in January

Written by David Schollaert

Architecture firms continued to report a sharp reduction in billings in January, according to the latest Architecture Billings Index (ABI) released by the American Institute of Architects (AIA) and Deltek.

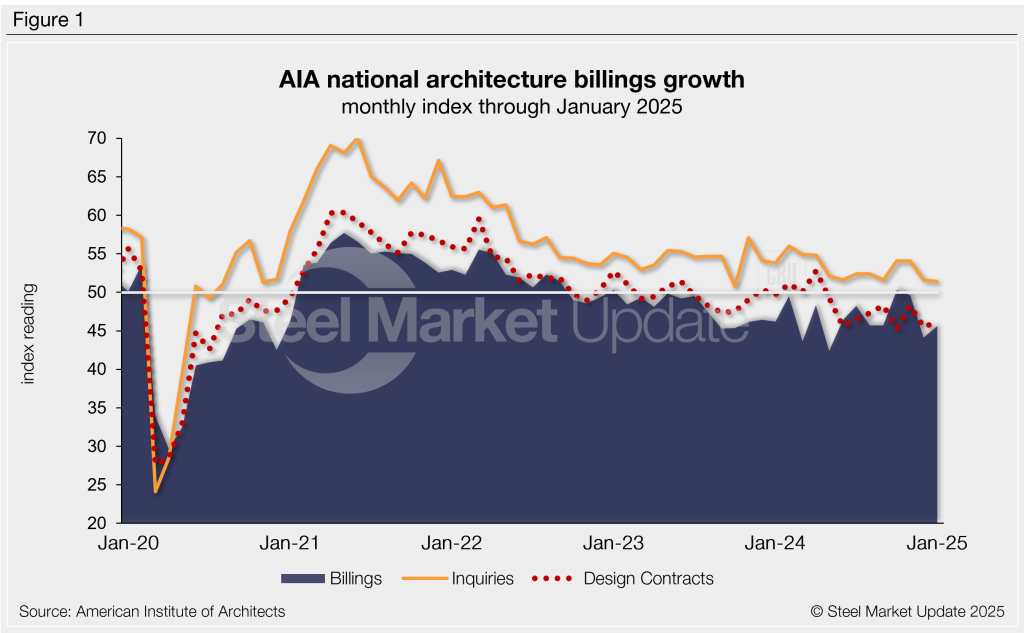

The January ABI edged up 1.5 points month over month (m/m) to 45.6, still one of the lowest readings over the past year (Figure 1). Despite the slight improvement, the index remains in contraction, indicating business conditions continue to decline.

The AIA/Deltek release noted that while most architecture firms saw billings decline in the last month, the proportion experiencing a decrease was slightly less than in December.

“Stubborn inflation, persistently high interest rates, and labor concerns continue to weigh on the willingness of owners and developers to move ahead with construction projects,” said AIA chief economist Kermit Baker.

He also commented that “architecture firms have been moving to right-size their operations in response to softer market conditions.”

There was a net loss of 1,400 positions at architecture firms nationally in 2024, and firm employment has declined by a total of 4,100 positions since the post-pandemic peak in June 2023, Baker said.

The ABI is a leading indicator for near-term nonresidential construction activity and projects business conditions approximately 9-12 months down the road (the typical lead time between architecture billings and construction spending). An index score above 50 indicates an increase in architecture billings, while a reading below 50 indicates a decrease.

Sub-index trends

The new project inquiries index fell to a 15-month low in January but remained in positive territory.

Following a slight setback in December’s reading, the design contracts index recovered a bit in January to 46.2, though it remained in declining conditions for a ninth straight month.

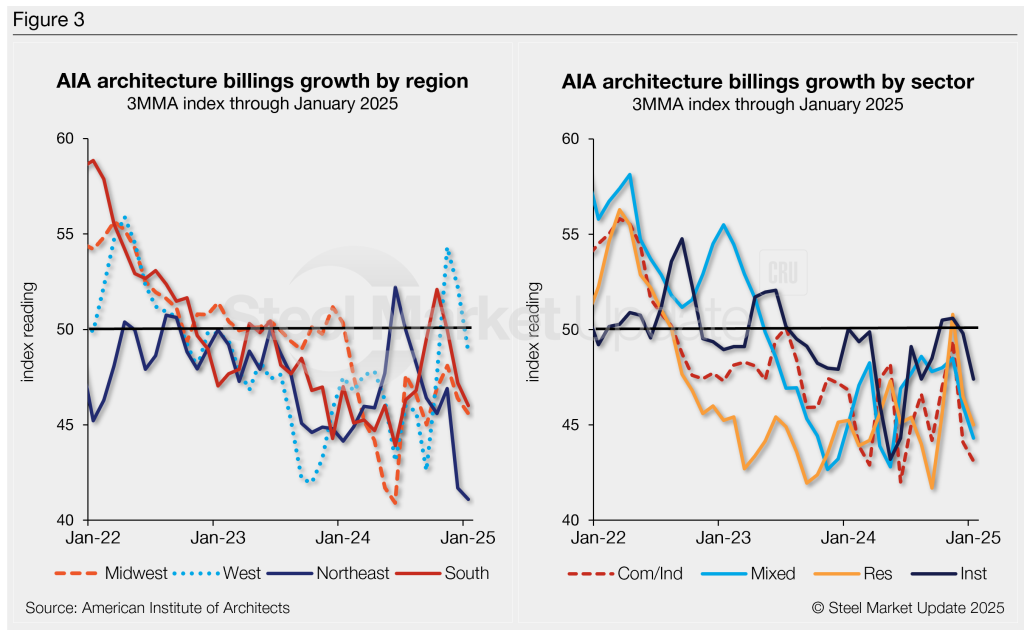

Each of the regional indices declined from December to January, pulling all regional indices below the 50 threshold (Figure 2, left).

All four of the sub-sector indices saw a decrease in billings in January as well (Figure 2, right). The institutional, residential, mixed practice, and commercial/industrial sectors all remain in contraction, a trend that has persisted for over a year now.

An interactive history of the December Architecture Billings Index is available here on our website.