Sheet

February 17, 2025

January service center shipments and inventories report

Written by Estelle Tran

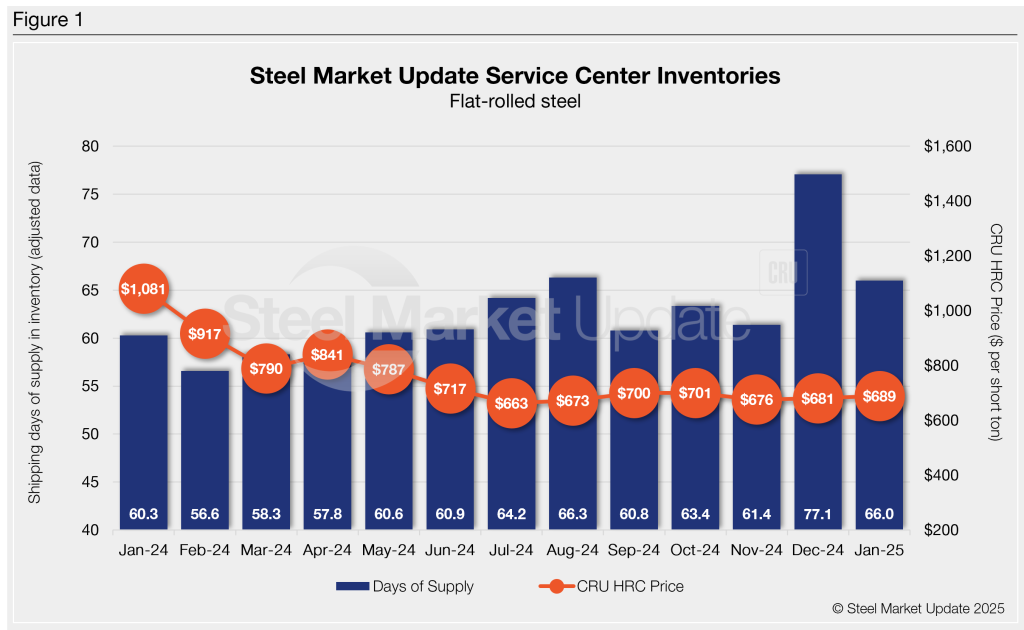

Flat rolled = 66 shipping days of supply

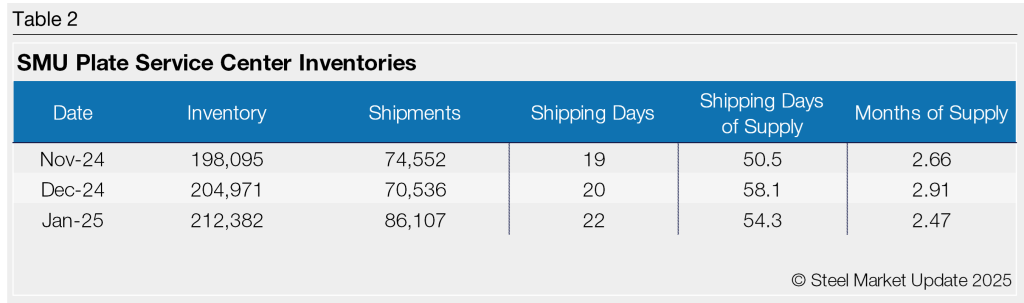

Plate = 54.3 shipping days of supply

Flat rolled

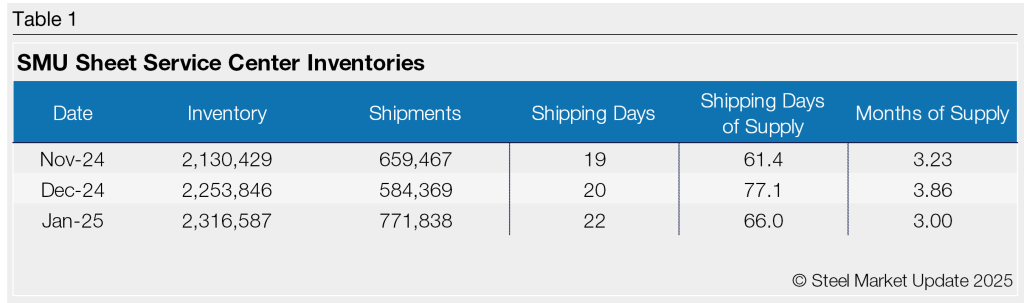

US service center flat-rolled steel supply declined in January month on month (m/m) but is up about 10% year on year (y/y), according to SMU data. At the end of January, US service centers carried 66 shipping days of supply on an adjusted basis, down from 77.1 days in December but still higher than 60.3 days in January 2024. Flat-rolled steel supply in January represented 3.0 months of supply, down from 3.86 months in December.

January had 22 shipping days, while December had 20 shipping days and the typical seasonal slowdown in shipments. January 2024 also had 22 shipping days, making shipments directly comparable. Shipments in January 2025 were essentially the same as January 2024.

Intake at service centers rose in January, which is typical to start the year. General trade uncertainty and some opportunistic buying fueled additional buying late last year.

Hot-rolled coil lead times hovered around five weeks, according to the latest SMU survey on Feb. 4. With the turnaround in pricing and trade uncertainty, we have heard lead times are extending slightly but remain around 4-6 weeks. Apparent demand has picked up m/m with renewed buying interest from service centers, though real demand reportedly has not been as strong.

At the end of January, material on order was down vs. December. It was also down y/y. Given the uncertainty with trade policy, we expect material on order to continue to rise in February.

Plate

US service center plate supply decreased as shipments recovered in January. At the end of the month, service centers carried 54.3 shipping days of supply, down from 58.1 shipping days on an adjusted basis in December. Plate inventories represented 2.47 months of supply in January, down from 2.91 months in December.

Sparse inventories in the last few months have driven the need for restocking. Steel mills have also seized the opportunity to announce multiple rounds of price increases. Service center customers have been pulling forward orders, amid uncertainty surrounding President Trump’s tariff policy. Questions remain as to whether there will be any deals struck with countries – Canada and South Korea in particular for plate – and what downstream products will be included.

Plate shipments increased 2% y/y; though this is not massive, it is a sharp contrast from the 14% drop-off in sheet shipments. SMU recorded plate lead times at 4.56 weeks in its Feb. 5 survey, up from 3.92 a month before. Market contacts, however, have said that plate mills are canceling quotes for large projects and holding off on opening April order books.

At the end of January, service centers shipping days of plate supply on order was up slightly vs. December. Though intake at service centers is rising with higher levels of material on order, inventories remain too low for the seasonal pickup in demand. Therefore, we expect material on order to continue to rise and lead times to extend.