Analysis

February 27, 2025

CRU: Trump orders Section 232 probe into copper

Written by Robert Edwards

President Donald Trump has directed Commerce Secretary Howard Lutnick to investigate copper imports into the US under Section 232 of the Trade Expansion Act of 1962 on national security grounds. Meanwhile, Alcoa’s CEO has warned of a 100,000 job losses in the aluminum industry from the latest wave of tariffs.

The copper investigation will be completed quickly “in Trump time,” Reuters news agency reported White House trade adviser Peter Navarro as saying. He argued China is using state subsidies and excess capacity to undermine competition and gain control over global production.

“Like our steel and aluminum industries, our great American copper industry has been decimated by global actors attacking our domestic production. American industries depend on copper, and it should be made in America, no exemptions, no exceptions. It’s time for copper to come home,” he added.

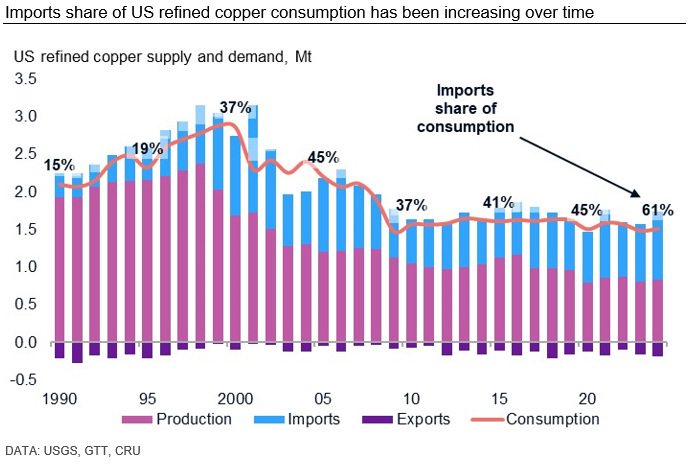

According to US government data, the country last year depended on imports for 45% of its copper demand. The main suppliers of refined copper, copper alloys and copper articles were Chile, Canada and Mexico.

The investigation will also look at imports of raw mined copper, concentrates, alloys, scrap and derivative products, a White House official said, who added copper is a critical material for solar energy, global electrification and is the second most used material in US weapons platforms.

Any potential tariff rate would be determined by the investigation, with the president preferring tariffs over quotas, the official said. President Trump used the Section 232 legislation in his first term to impose import duties of 25% on steel and 10% on aluminum.

Meanwhile, Alcoa’s CEO William Oplinger says around 100,000 US aluminum sector jobs, 20,000 direct and 80,000 indirect, could be lost because of President Trump plans to impose levies of 25% on imports of the metal in March.

According to the Aluminum Association, the industry directly employs more than 164,000 workers in the US and supports nearly 700,000 other jobs, generating more than $228 billion for the economy.

United States’ domestic aluminum production falls short of demand by 4 million metric tons per year, with imports from Canada and Mexico making up most of the deficit, said Oplinger.

The company will advocate for a tariff exemption on Canadian imports, which would allow two-thirds of the metal consumed in the US to continue to come across the border without a tariff, he added. “We’re clearly advocating based on the fact that this [tariff] is bad for the aluminum industry in the US. It’s bad for American workers,” the Wall Street Journal quoted him as saying in an industry conference.

He also warned a tariff against Canada would most likely cause more global aluminum production to shift to Europe under current conditions.

The Pittsburgh-headquartered company has some idle production capacity in the US, but it is very old and inefficient, has not been run for many years and would be costly to restart, he said.

“We make decisions around aluminum production that have a horizon of 20 to 40 years. We would not be making an investment in the United States based on a tariff structure that could be in place for a much shorter period of time,” Oplinger added.

For the company to have more US-based aluminum production, he said Alcoa would need to secure cheap, low-cost energy.

First aluminum and steel; now copper faces US tariffs

President Trump has followed up on a statement made at the end of January, that tariffs will be placed on copper, with the launch of a Section 232 investigation on 25 February. Ostensibly, the action has been taken on the basis that “copper is a critical material essential to the national security, economic strength, and industrial resilience of the United States”. As the chart below shows, the US has become increasingly dependent on overseas cathode, such that imports as a percentage of domestic consumption have risen from 15% in 1990 to 45% in 2020 and 61% in 2024. This compares to current import dependency ratios of ~15% for steel and ~85% for primary aluminum. One possible mitigating factor for copper is that the US relies on Chile for 70% of its cathode imports, but runs a general trade surplus (goods and services) with the South American country. The Section 232 investigation extends to downstream products and derivative products, where import dependency ratios are 20-30%.

Editor’s note

This analysis was first published by CRU. To learn about CRU’s global commodities research and analysis services, visit www.crugroup.com.