Analysis

April 24, 2025

CRU: Rising protectionism will continue to weigh on Chinese steel export prices

Written by Juliana Guarana

Chinese steel export prices are expected to remain stable or fall in the coming weeks as trade restrictions rise and tensions between the country and the US escalate.

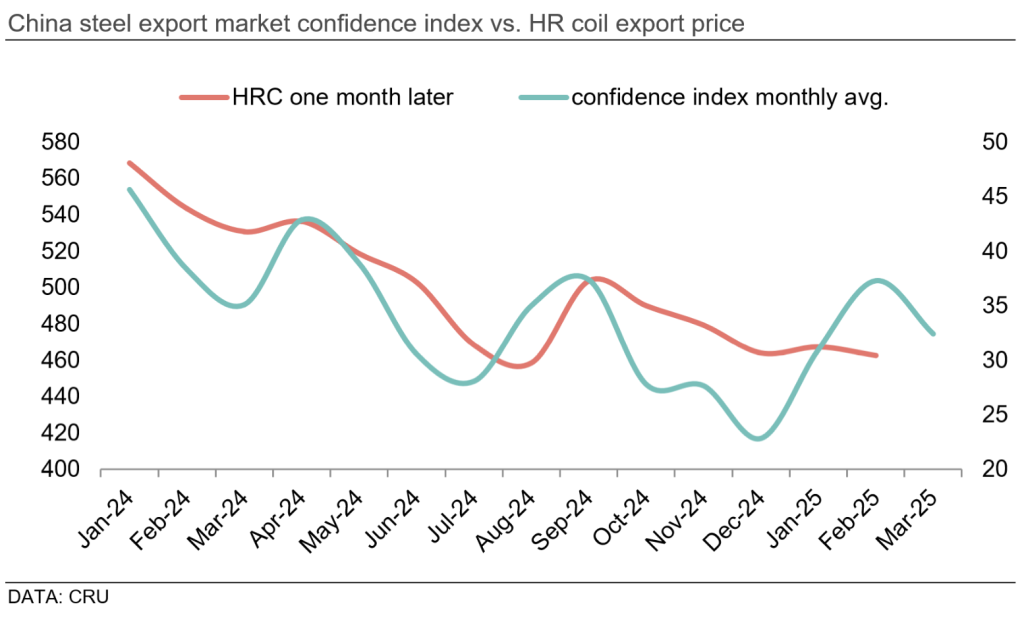

Although the US accounts for less than 1% of direct steel exports from China, steel-containing products exported to the US by China will be impacted and this may reduce Chinese domestic steel demand. These ongoing trade tensions have dampened market confidence in China as indicated by the CRU China Steel Export Market Confidence Index (please see below).

The upside risk to this scenario is the improvement in local demand as the seasonally strong steel demand period continues. In addition, tax-evading steel exports are likely to be reduced due to the new clearance VAT certificate requirement, and steel export prices might receive some support. However, significant price gains are unlikely.

Similarly, in Southeast Asia, upside to steel prices is expected to be limited as regional demand remains subdued. In Japan, the reduced export prospects to the US and the EU are also likely to keep steel export prices subdued.

In India, growth in domestic demand is expected to mostly offset the impact of turbulence in global trade, while the exposure of Indian steel containing goods to the US market is quite limited. In parallel, Indian flat steel imports are expected to reduce sharply because of the recently imposed safeguard duty, and this will result in steelmakers prioritizing displacing imports over raising export sales.

Tariff hikes in the US are expected to reduce end-users’ purchases

Although the reset of Section 232 tariffs has effectively re-priced the market, domestic steel prices in the US are expected to drift lower in the short term as the buying activity – which spiked over the past few months – is likely to fade. In addition, rampant increases in tariffs are expected to weaken industrial activity overall, while end-use consumers are likely to exhibit more caution in making new spot purchases.

In parallel, due to the recently announced preliminary anti-dumping duties on imports for corrosion-resistant products, some US buyers are likely to shift to domestic mills as there is sufficient domestic capacity (installed and soon-to-be installed) to displace imports.

In Brazil, slab export prices are expected to remain stable due to the higher competition from other exporting regions, as the trade quotas previously secured by the country have been removed.

EU domestic prices are likely to fall despite stricter import policies

In Europe, domestic sheet prices are expected to decline in the coming weeks despite stricter import policies as real demand remains weak. In addition, the market is moving into a seasonally slower period and the recent inventory restock has come to an end, with some idled capacity having restarted in response to rising steelmaking margins.

Meanwhile, Turkish steel exports will continue to be attractive to European customers, and this will support Turkish steel export prices. However, price increases are likely to be limited as real demand remains constrained in the key export destinations.

This article was first published by CRU. To learn about CRU’s global commodities research and analysis services, visit www.crugroup.com.