Prices

July 11, 2025

HRC vs. busheling spread widens again in July

Written by Ethan Bernard & Stephen Miller

The price spread between prime scrap and hot-rolled coil (HRC) widened marginally again in July, based on SMU’s most recent pricing data.

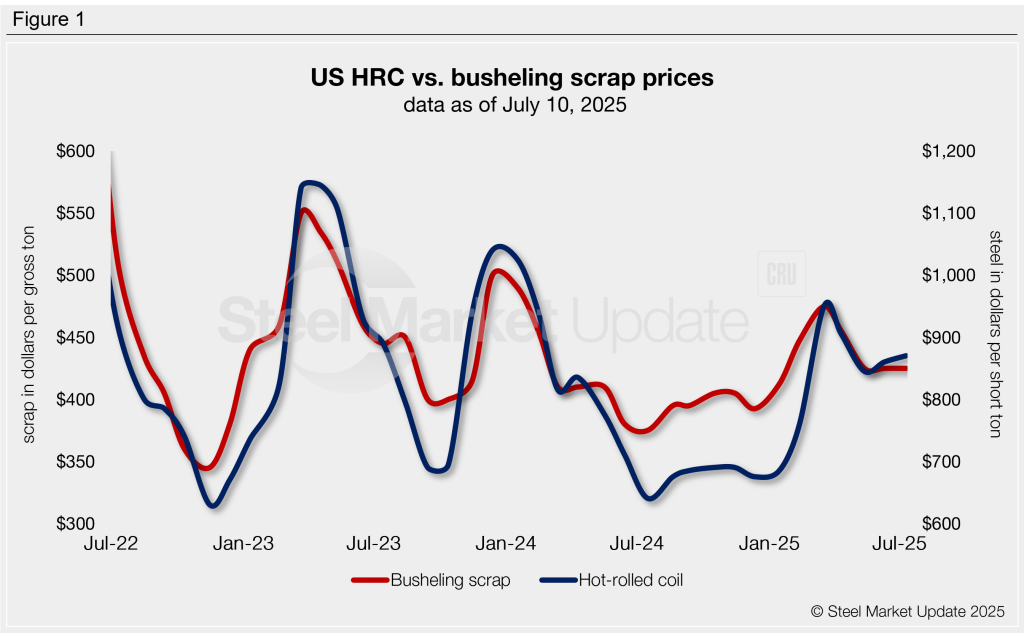

SMU’s average HRC price as of July 8 was $870 per short ton (st) FOB mill, east of the Rockies. That’s off $10 from the previous week and a $5 decline from a month earlier.

July’s busheling tags landed sideways for the second consecutive month, averaging $425 per gross ton.

Figure 1 shows price histories for each product.

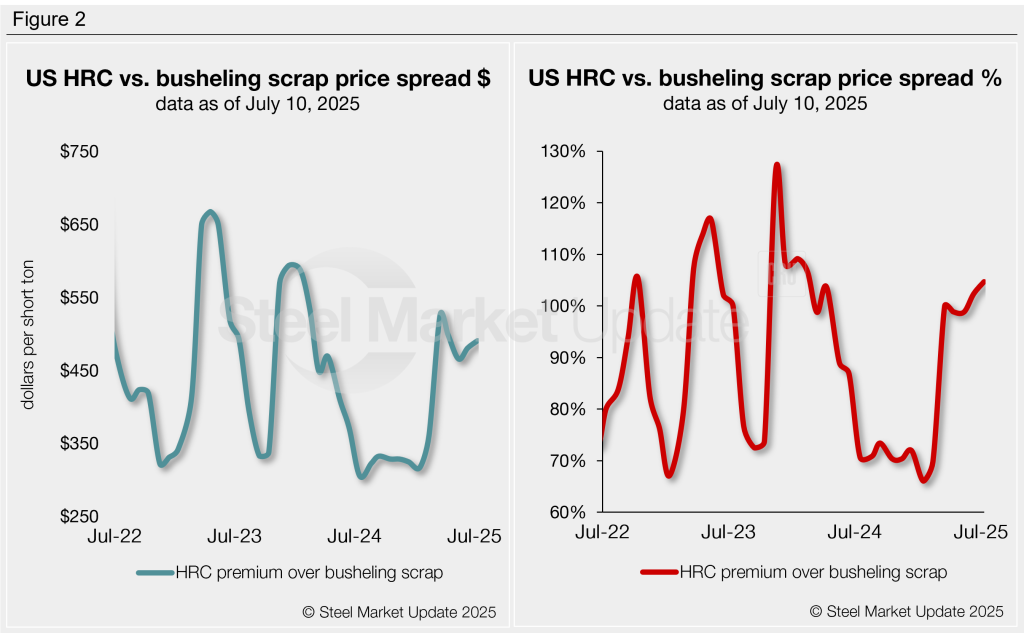

After converting scrap prices to dollars per short ton for an equal comparison, the differential between HRC and busheling scrap prices was $491/st as of July 10. That’s a slight rise of $10/st from a month earlier (Figure 2). The low so far this year was in January when the spread was $317/st, and the high was in March at $526/st.

What’s going on?

The July busheling price, as noted, traded sideways despite a reduction in industrial scrap generation. Mills, however, were comfortable with the supply of busheling, given that demand remained stable in July.

There are at least two recent developments that have the potential for this spread to seriously narrow in the months ahead, assuming HRC prices do not rise significantly. They have to do with increased tariffs on pig iron from Brazil and ferrous scrap from Canada.

If pig iron from Brazil is subject to a 50% tariff starting in August, the procurement cost will rise dramatically. This will put upward pressure on #1 busheling prices in the US and on material imported from Canada.

If import tariffs on Canadian goods increase to the 35% level as President Trump has threatened, this will further aggravate the situation. It will deprive US-based steelmakers of an important source of prime scrap that could mitigate, to some extent, the rise in busheling prices brought on by a shortage of or rising price of pig iron.

SMU spoke with a mill purchasing executive in the Great Lakes district. He said Canadian tariffs of 35% “will certainly stop the flow of cheap Canadian scrap. Prime scrap will certainly get much tighter with manufacturing rates being down.”

HRC premium as a percentage

The graph on the right-hand side of Figure 2 shows the spread relationship differently: We have graphed HRC’s premium over busheling scrap as a percentage. HRC prices now have a 105% premium over prime scrap, rising from 102% a month ago.

Ethan Bernard

Read more from Ethan Bernard