Market Data

July 11, 2025

SMU Scrap Survey: Sentiment Indices rise

Written by Ethan Bernard & Stephen Miller

Both current and future scrap sentiment jumped this month, though survey participants reported responses before key trade news was announced.

On Wednesday, President Trump threatened a 50% tariff on Brazilian imports, which would include pig iron. They are set to start on Aug. 1

Additionally, Trump threatened a 35% tariff on Canadian imports (separate from Section 232). It appears all USMCA-compliant items will not be hit with the tariff. But for ferrous scrap, that would mean it has to come from material produced in Canada.

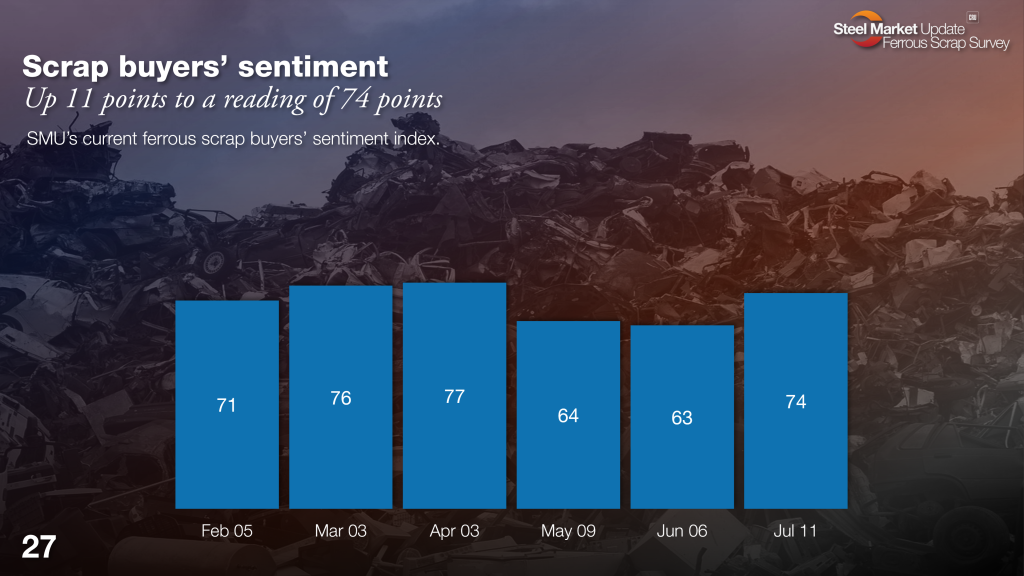

Current Sentiment Index

SMU’s Current Sentiment Index for scrap rose 11 points to +74 in July vs. a month earlier. Though May and June dipped into the lower +60s, July has brought a return to similar territory from earlier in the year.

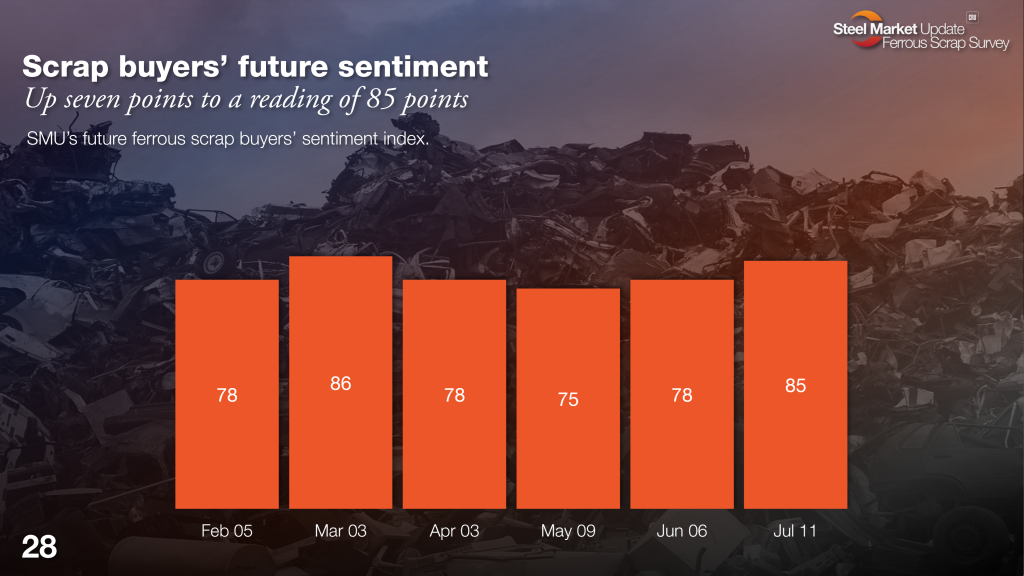

Future Sentiment Index

SMU’s Future Sentiment Index for scrap increased seven points, standing at 85 in July. Future Sentiment has hovered at a 10-point band between 75-85 so far this year.

What’s the post-tariff info outlook?

If either or both of these tariffs are enacted anywhere close to these levels, scrap sentiment should significantly increase above current levels.

Regarding pig iron, if there is a shortage or a dramatic price rise, hot-rolled coil (HRC) producers will be trying to source as much prime scrap as possible to make up for it. Obsolescent scrap would also increase with the rise in prime.

If a 35% tariff on Canadian ferrous scrap is imposed, it will severely impede the flow across the border to American mills.

This flow averages about 200,000 gross tons per month. Most of the Canadian scrap is industrial grade. This would raise prices for US mills, especially in the North. It would have a domino effect for mills in the southern US.

But much remains fuzzy on the tariff front, and the Trump administration has shown that it can make snap decisions that drastically alter the trade landscape. We will keep you updated as we receive more information.

About SMU’s Scrap Sentiment

SMU’s Current and Future Scrap Sentiment Indices mirror our Steel Buyers’ Sentiment Indices in our flat-rolled steel survey. Our Scrap Sentiment Indices are both a diffusion index. A reading above 50 indicates a more bullish outlook. A reading below 50 indicates a more bearish one.

Sentiment is only one of the indicators we measure. Our scrap survey, like our steel survey, is available only to premium members. If you would like to upgrade from executive to premium, please contact SMU account executive Luis Corona at luis.corona@crugroup.com.

Ethan Bernard

Read more from Ethan Bernard