Market Data

November 11, 2018

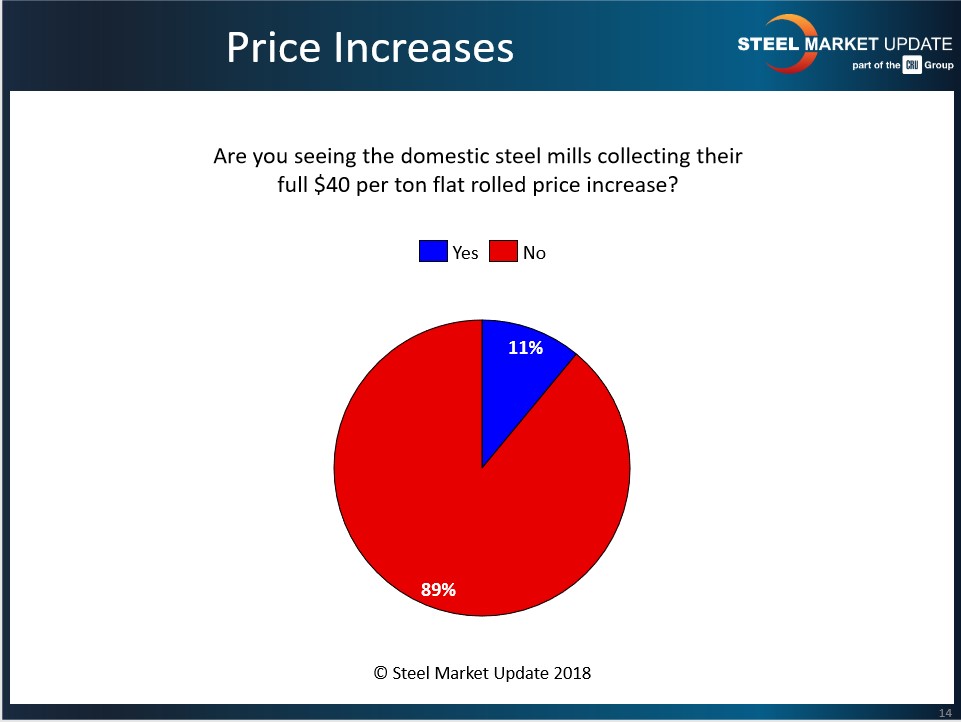

SMU Market Trends: Mills Unsuccessful in Collecting Price Increase

Written by Tim Triplett

Nearly nine out of 10 of the steel buyers responding to Steel Market Update’s market trends questionnaire earlier this week believe the domestic mills will be unsuccessful in their attempts to collect the $40 price increased they announced this time last month.

Since those announcements, flat rolled steel prices are little changed, if not down marginally. According to Steel Market Update data, the price of hot rolled has moved from around $805 to $795 per ton, cold rolled is unchanged at $920 per ton, and galvanized has declined by about $20 to a price of $910 per ton.

Steel demand is strong and the cost of ferrous scrap has increased in the past two months. The domestic mills are increasing their market share as they fill the gaps caused by tariffs that are discouraging imports. All factors that should support higher prices for finished steel. Yet the market’s consensus is that the price hike was premature:

“Prices have gone down since they announced the increase,” said one respondent. “Prices are basically flat on the West Coast,” said another. “They are collecting part, not all,” said third. “At the end of the day, the mills that were discounting have stopped. Those mills that were already at the upper limits have not collected anything more,” commented another executive. In a market with rising prices, negotiations would be firm, but “there are lots of deals being done,” reported yet another source.