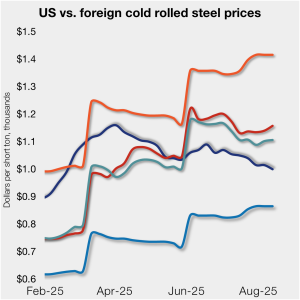

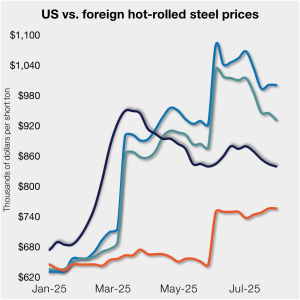

CR import price gap widens with US

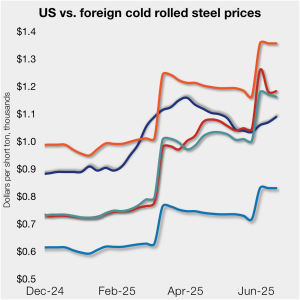

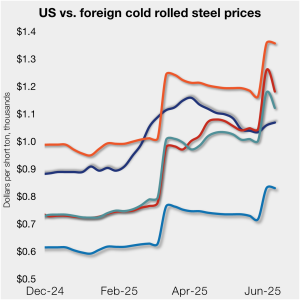

Cold-rolled (CR) coil prices continued to decline in the US this week, while prices in offshore markets diverged and ticked higher.

Cold-rolled (CR) coil prices continued to decline in the US this week, while prices in offshore markets diverged and ticked higher.

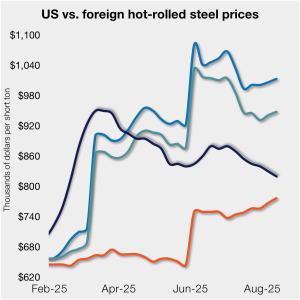

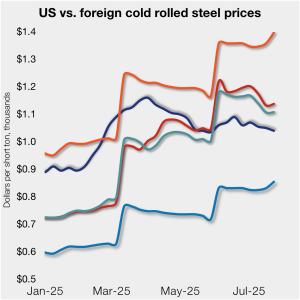

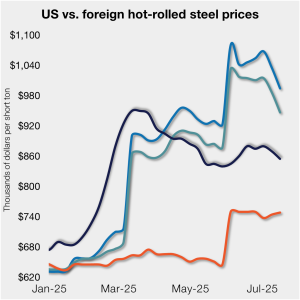

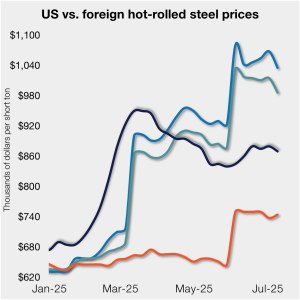

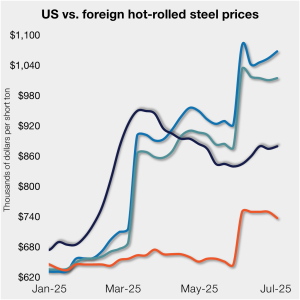

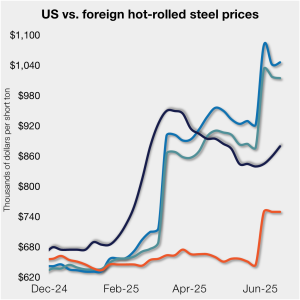

Hot-rolled (HR) coil prices in the US declined again last week, while offshore prices ticked higher again week over week (w/w).

The amount of finished steel coming into the US market increased 3% from May to June, climbing to one of the highest rates seen in recent years, according to SMU’s analysis of Department of Commerce and American Iron and Steel Institute (AISI) data

Hot-rolled (HR) coil prices in the US declined again last week, while offshore prices increased week over week (w/w).

Following January’s pre-tariff surge, imports have remained low since February compared to post-pandemic volumes

Veteran trade attorney Lewis Leibowitz will join SMU for a Community Chat on Wednesday, Aug. 13, at 11 am ET.

The tariffs amount to a wholesale transformation of US trade policy from one promoting increasing international interaction to one of restricting trade to serve national strategic goals.

Hot-rolled (HR) coil prices in the US edged lower again this week, while offshore price were little changed. Stateside prices continue to trail imports from Europe, supported by Section 232 steel tariffs.

Earlier this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to tariffs, imports, and evolving market events.

Is this just a severe case of the summer doldrums? Will demand improve in the fall, as it often does? Or has uncertainty around tariffs and the economy created a more lasting impact?

Cold-rolled (CR) coil prices continued to decline in the US this week, while prices in offshore markets ticked higher.

Hot-rolled (HR) coil prices in the US edged lower again this week but have remained in a tight band for roughly four months. Stateside prices continue to trail imports from Europe, supported by Section 232 steel tariffs that were doubled in early June.

Cleveland-Cliffs lost more than $400 million for the third consecutive quarter but predicted results would improve in the second half of the year. And shares of the Cleveland-based steelmaker surged after company executives said during its Q2 earnings call on Monday that they could make billions by courting foreign investors or selling assets.

Cold-rolled (CR) coil prices continued to tick lower in the US this week, with a similar trend seen in offshore markets.

Chinese steel export prices are expected to rise and support prices across most of Asia in the coming month. In Europe, buyers are likely to frontload import orders ahead of CBAM imposition, while new trade agreements are likely to emerge in the US. Steel prices in the APAC are expected to rise, except in India […]

Stateside prices continue to trail imports from Europe, supported by Section 232 steel tariffs that were doubled in early June.

The volume of finished steel entering the US market remained elevated in May, in line with April figures, according to SMU’s analysis of Department of Commerce and American Iron and Steel Institute (AISI) data

Hot-rolled (HR) coil prices in the US ticked down this week but have fluctuated little over the past month. Stateside tags continue to trail imports from Europe, supported by Section 232 steel tariffs that were doubled in early June.

Following one of the lowest levels seen in more than two years, US steel imports rebounded from April to May. However, trade remains low relative to recent years. Preliminary license data suggests another fall in June.

David Schollaert presents this week's analysis of hot-rolled coil prices, foreign vs. domestic.

Most economists will tell you that universal tariffs will result in inflation and reduce demand, causing a recession or worse. (After all, this is what happened in the 1930s). It is a rare product that is so essential that demand will not go down if prices go up.

A roundup of trade news, what's up with Brazilian pig iron, SMU's latest survey results and more to keep you up to date.

Subsidized Chinese steel imports and cheap steel products from Association of Southeast Asian Nations (ASEAN) entering Latin American (LATAM) are threatening the region's steel market.

US cold-rolled (CR) coil prices continued to tick higher this week, while offshore markets were mixed.

The document makes clear that Nippon Steel, through Nippon Steel America, will have “100% ownership of [the] common stock.” So if you want to own an interest in U.S. Steel’s future success, you will need to buy shares in Nippon Steel on the Nikkei stock exchange. It certainly will not be in your domestic S&P 500 ETF.

US hot-rolled coil prices crept up again this week but still trail imports from Europe.

Getting back to the price increases I mentioned at the top of this article, to what extent are they aimed at raising prices and to what extent are they aimed at stopping the bleeding that was happening in the second half of May, before President Trump announced the 50% tariff?

Steel market participants learned that negotiations between the US and Mexico include discussions about Section 232 tariffs on steel and aluminum despite President Trump’s June 3 proclamation increasing the tariffs from 25% to 50% for all steel and aluminum imports—except for those from the UK.

US cold-rolled (CR) coil prices edged up again this week, and most offshore markets moved in the opposite direction. But the diverging price moves stateside vs. abroad did little to impact pricing trends. The bigger impact was from Section 232, which were doubled to 50% as of June 3. The higher tariffs have resulted in […]

Hashing out duty costs