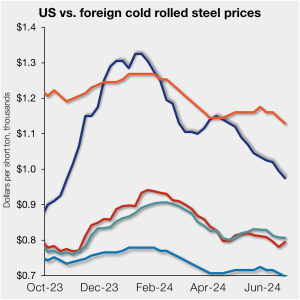

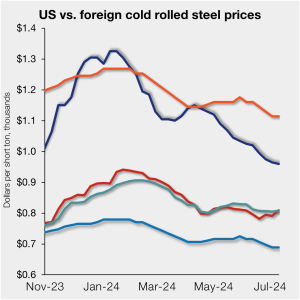

Imported CR still cheaper despite declining US prices

Offshore cold-rolled (CR) coil remains cheaper than domestic product. The gap continues to tighten, however, as US CR coil prices slip to a nine-month low. Domestic CR coil tags averaged $960 per short ton (st) in our check of the market on Tuesday, July 9, down $5/st from the week before. CR tags are now […]