Analysis

June 13, 2024

Final thoughts

Written by Michael Cowden

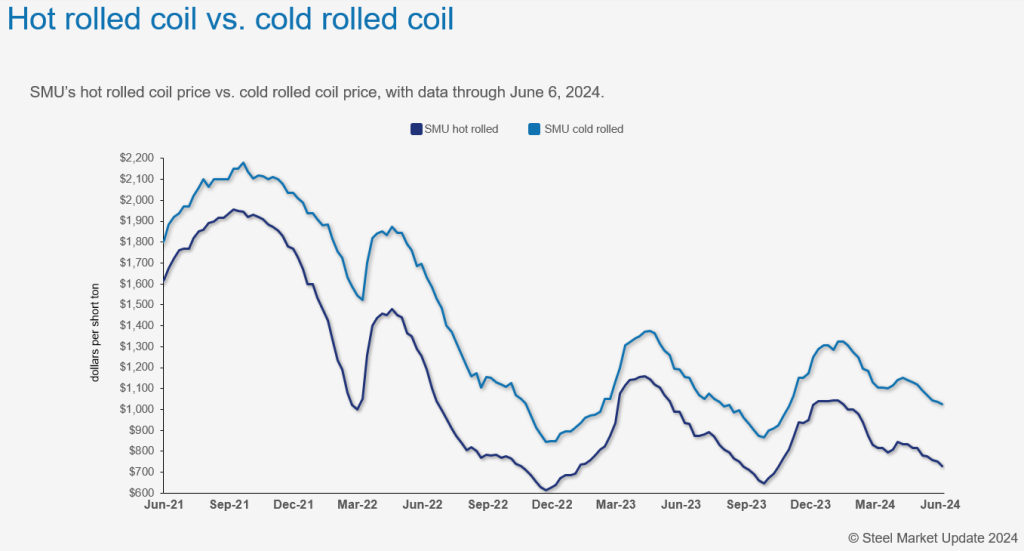

We’ve been writing a lot about sheet prices, and those for hot-rolled (HR) in particular, coming down. Here’s one thing that hasn’t dropped: The wide spread between HR and cold-rolled (CR) prices.

That’s what’s in the chart below. And I’m using it as a rough proxy for galv and G’lume base prices as well.

A picture tells a thousand words, as the saying goes. So I’m going to try to let the charts speak for themselves in this edition of Final thoughts.

(Editor’s note: If you read these charts on our website, they look fine. If you’re reading this in our newsletter, click on the charts to expand them.)

The $300/st HR-CR spread abides

SMU’s HR price stands at $710 per short ton (st), down $20/st from last week and down $65/st from a month ago. Our CR price is $1,020/st on average, down $5/st from last week and down $50/ton from a month ago. Notice a pattern, right?

The spread between HR and CR, meanwhile, stands at $310/st on average, up $15/ton from $295/st last week and a month ago. Not exactly the same pattern, that.

As we’ve noted before, a $200/st HR-CR/coated spread had been roughly the norm for the post-pandemic era. But it ballooned to approximately $300/st in January of this year. And it has stayed there since.

No imports, eh?

Some of you tell me that no one is interested in buying imports anymore. That does not surprise me when it comes to offshore HR. As David Schollaert notes in today’s newsletter, US HR prices and offshore HR prices are on par once you factor in freight and other costs. Why not buy from a domestic mill when lead times are as short as 3-4 weeks?

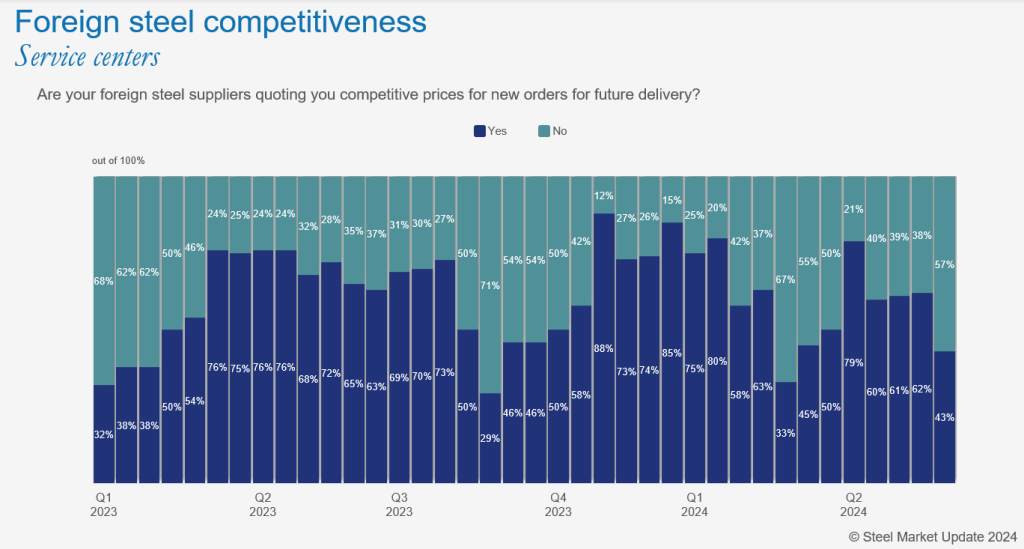

That explains some of the results we’ve seen in recent surveys, like this one:

The dark blue bars here mean people consider import pricing competitive. The green bars mean they don’t find offshore pricing attractive.

At the beginning of this quarter, nearly 80% of service centers we polled found imports attractive. The script has flipped. Now most tell us they don’t find imports competitively priced. (I think you could make a case that Nucor’s CSP in April was trying to get ahead of another spike in US prices, followed by another spike in imports.)

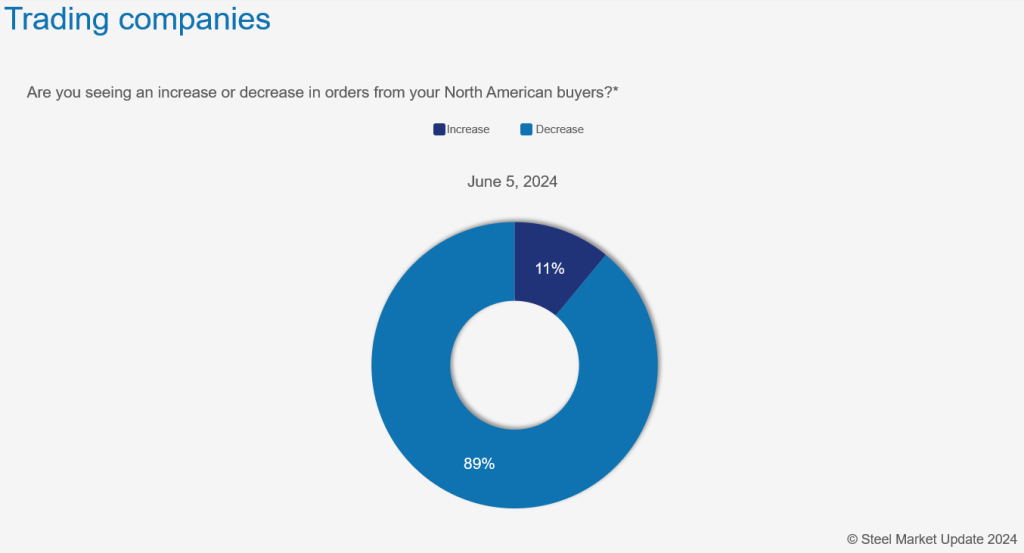

And it’s not just service centers who say that imports are less appealing. Traders tell us that they’re seeing business from their US buyers decreasing.

I didn’t pull this slide by product. (You can see that here. Check slides 52-43 from the June 7 survey.) The one area where traders pretty much unanimously tell us that their prices remain competitive is coated.

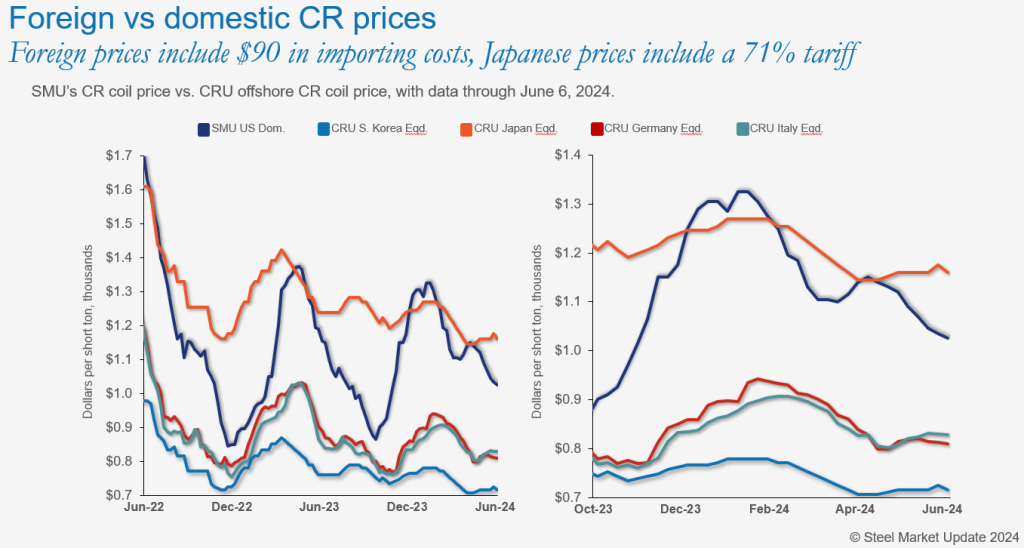

David will be updating charts on the spread between foreign and domestic CR prices for our Sunday issue. But I’m guessing we won’t see a big change from when we last updated things:

Yes, US CR prices (which, again, I’m using as proxy for coated base prices) are starting to come back down to earth. And as Laura Miller noted in her article earlier this week on May import licenses, steel imports in general are down from recent highs.

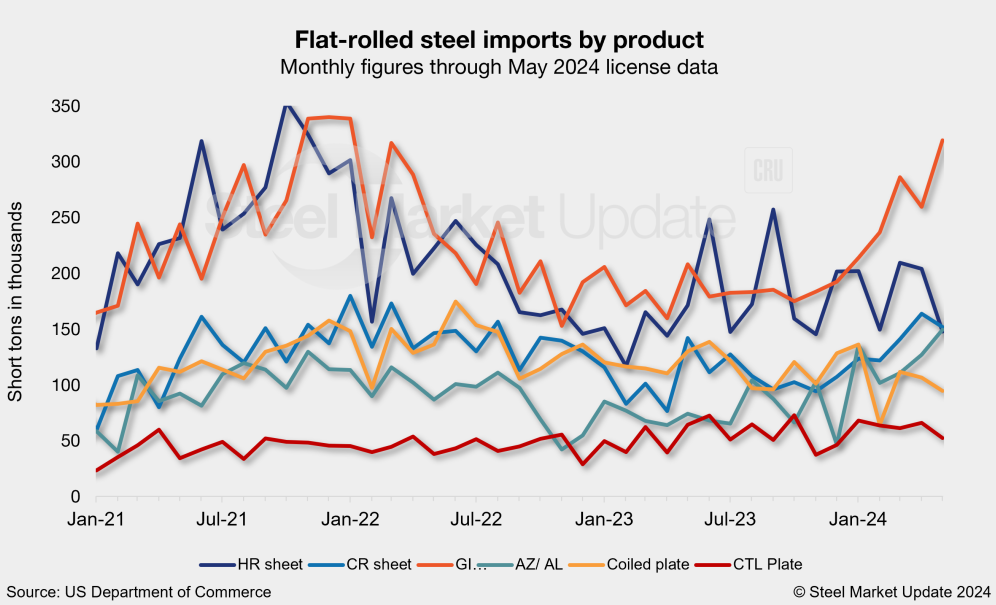

But if you look at flat-rolled in general, it’s leveled off but at a high level. Though it’s not coming down yet. And it’s a different story entirely if you look at coated products. Galvanized and “other” metallic products – a category that includes Galvalume – are still trending up.

I think it’s worth drawing attention to this chart again.

As Laura reported, galvanized import licenses show a 42% year-on-year increase through May, the last month for which full data is available. And “other” coated imports are up 70%. I can see why some of you whose business is tilted more toward coated products tell me that you haven’t seen import volumes this high in years.

Trade cases, or CR in the $800-900s/st

Do US mills somehow maintain a wide spread between HR and CR/coated base prices? That’s been the case in plate, where a wide spread between HR and discrete plate has held thanks in part to consolidation and more trade protections.

By that logic, and as some have been speculating for a while now, we should see trade actions against coated imports. Or do we instead see (as we have already seen in HR) CR/coated prices drop closer to prices abroad?

I’ve heard some chatter about how the CR/coated base price needs to get to around $900/st, and maybe it soon will. That’s a little hard for me to get my head around. There had been talk in some corners earlier this year that $800/st was the “new normal” floor for HR.

But it makes some sense. HR prices bottomed in the $600s/st on average in 2022 ($615/st just before Thanksgiving) and again in 2023 ($645/t in late September). CR prices bottomed in the mid/high $800/st both times.

What goes down must come up

To be clear, I’m not saying prices will go down forever. Most people continue to meet or exceed forecast. Yes, more are missing forecast than we’ve seen in a little while. But I think you could also make the case that the market isn’t terrible. It’s just getting back to something resembling normal – which might feel rough after a few of the best years steel has ever seen.

And, of course, an extended outage or unexpected idling can tighten things quickly. Remember AHMSA going out around Christmas 2022. The consensus has been that prices would drift lower into 2023. Instead, the new year brought shortages and rapid-fire price increases.

I know sentiment can be a squirrely indicator. But there is a reason we track it closely. The market is driven not only by the supply/demand fundamentals and unexpected events (aka, the news) but also by emotion. And by that metric, it looks like we might already have hit bottom and started to rebound.

Even so, I wouldn’t be surprised if we see things get a little sloppy over the summer. We might see some extended outages or idlings. But then the market might improve as lead times get into the fall. In other words, back to the normal seasonal patterns of a normal steel market.

Of course, that’s just my opinion. It might not age well. But here’s on thing I can guarantee…

Steel Summit – Aug. 26-28 at the GICC in Atlanta!

A big “thank you” from all of us at SMU to everyone who attended our Steel 101 course in Ft. Wayne, Ind., this week. Hats off as well to the instructors and to SDI for their support of our biggest 101 ever.

The next big event on the SMU calendar is Steel Summit on Aug. 26-28 at the Georgia International Convention Center (GICC) in Atlanta. More than 700 people are registered to go. You can see the companies attending and add your name to that list here.