CRU

June 7, 2024

CRU: Longs prices continue to fall in North, South America

Written by Alexandra Anderson

Sufficient inventories resulting in softer demand continued to drag down US longs prices this month. Furthermore, lower scrap prices in May added to the downward pressure and expectations for June scrap are turning increasingly bearish. Import interest was also limited, particularly as competition among domestic producers rose.

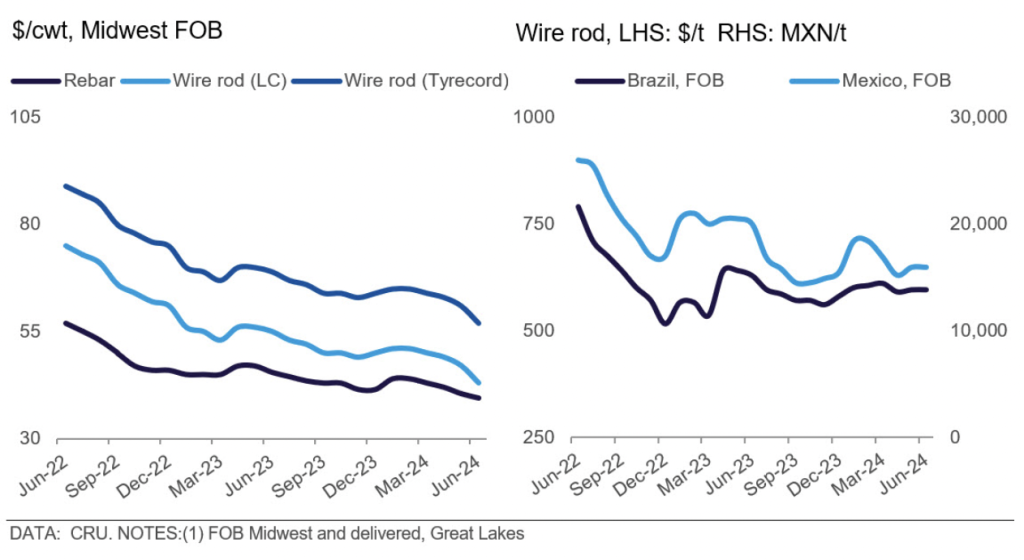

Rebar prices declined $1.00 per cwt month over month (m/m) to $39.50/cwt, while merchant bar and structurals prices were unchanged. Market participants reported instances of select discounts and better pricing for larger volume purchases. However, buyers are still reluctant to purchase bigger volumes, both domestically and for import, as they anticipate prices may continue to fall. Sellers noted that transactions are occurring more on an as-needed basis i.e., smaller tonnages for a slightly higher price and a shorter lead time.

Prices for wire rod fell $4.00/cwt given continued lackluster demand and lower scrap costs. Suppliers noted that order books were largely flat m/m, and without significant motive, demand is likely to remain sluggish. While imports rose in April, May import licenses fell ~48% m/m, according to the US Department of Commerce.

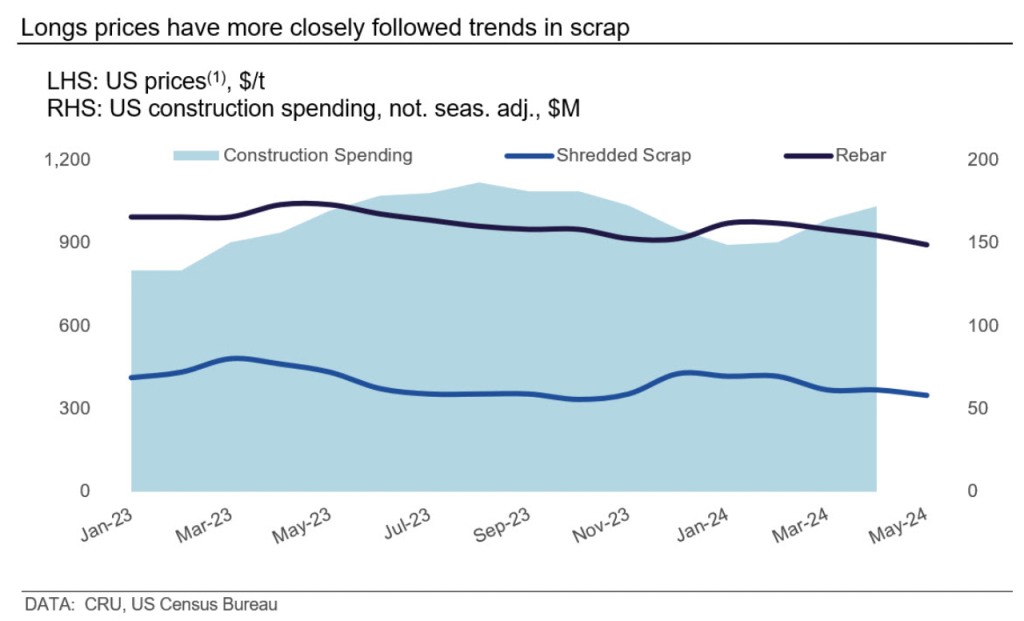

While the longs order books stayed flat, construction spending marched higher in April. This indicates ample supply and inventory levels have dampened purchases, but downstream construction demand remains supported, particularly in relation to infrastructure. Market participants reported that rebar demand from precast producers was better than other sectors, especially with demand from Department of Transportation projects. Demand from fabricators was stable, but bidding was more active than actual project starts.

Without the stronger restocking activity that is typical in Q2, downward movements in scrap are having an amplified effect on longs prices. The May scrap trade was prolonged as mills and dealers struggled to settle on price movements. Mills were pushing for lower prices for order books that were like April levels, amid ample material availability. Meanwhile, dealers wanted to hold prices steady as inbound flows to yards remained largely unchanged. Ultimately, prime grades were flat m/m, while secondary grades fell $20/long ton.

Brazilian domestic rebar prices decreased slightly, by 2% m/m. According to market participants, consumption and domestic supply were like last month, but import volumes are higher year over year (y/y). On the supply side, Gerdau stopped two production plants in Rio Grande do Sul state due to the natural disaster caused by heavy rains in the region. There is no physical damage to the equipment, but it is not possible to operate now. Furthermore, Gerdau also stopped operations in their plant in Barao de Cocais in Minas Gerais, with a capacity of 300,000 metric tons (mt) per year, due to the high cost of raw materials, not enough own supply of iron ore in the State of Minas Gerais, and the technology of the plant.

To learn more about CRU’s services, visit www.crugroup.com.