March ferrous scrap market: Trends and turmoil

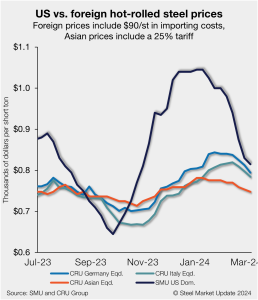

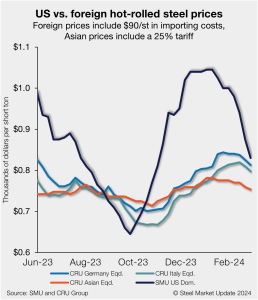

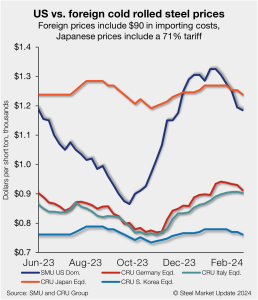

As I see it, the market looked to be a perfect storm for consumers this month while two large steel mills tried to put a floor on hot-rolled coil (HRC). One source speculated that “flat rolled mills coordinated their downtime and will take out 250,000 tons of capacity in April,” which made them attempt to put a bottom on flat-rolled product.