Analysis

February 4, 2024

Final thoughts

Written by Michael Cowden

SMU’s latest survey results make it clear that the sheet market has hit an inflection point and headed lower.

But while some market participants think that sheet prices might bottom within the next month or so, others expect a more protracted downturn.

I’ll divide those camps into the “mini-cyclers” and the “structural decliners” – but more on that in a moment.

The nuts and bolts

Let’s first review nuts and bolts: prices, lead times, and mill negotiation rates.

We reported on Thursday that hot-rolled (HR) coil lead times had fallen to approximately five weeks on average, their lowest level since late September. (That’s when prices hit a 2023 low of $645 per short ton). Also, approximately 80% of steel buyers reported that mills were willing to negotiate lower HR spot prices.

We in addition saw a big change when it came to galvanized lead times. They fell from approximately eight weeks on average to a little over seven weeks – also the lowest reading since late September. Another seismic shift: Nearly 80% of steel buyers said mills were willing to negotiate lower galvanized prices, up from 54% in our last check of the market.

Galvanized prices have been stickier than HR prices. That has led to the spread between HR and galvanized ballooning to ~$300/st, up from the ~$200/st that has been a rule of thumb in recent years. (I realize that ~$200/st figure still seems high to those who recall when it was more like ~$100/st.)

Will that HR-galv base spread (now $275/st) hold above $250/st, or will slide back to the post-pandemic norm of $200/st? I don’t have an answer to that. But it’s one to keep an eye on.

Looking forward

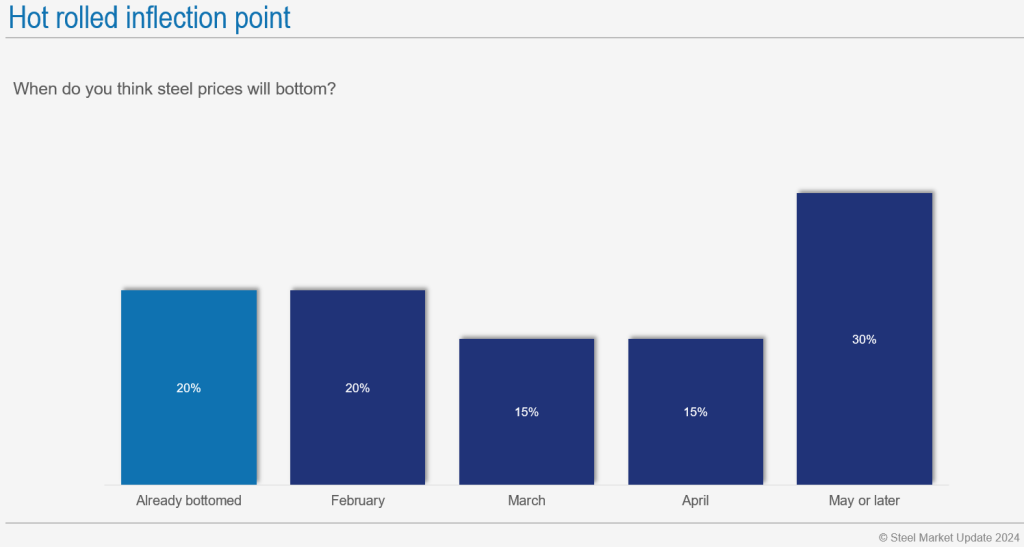

Few respondents, only 20%, think that sheet prices have already hit bottom:

But approximately 20% think they will bottom in February and another 15% think they will bottom in March. In other words, 55% see prices bottoming sometime in Q1 and then cycling upward again. That’s what I’d call the “mini-cycle” camp.

As they might see it, prices will come down from the frothy, UAW-strike, and maintenance-outage-influenced highs of late 2023. Tags will then rebound and normalize at whatever our new normal is. (Side note: Analysts at the Tampa Steel Conference agreed the “new normal” for HR would be higher than pre-pandemic levels.)

The other 45% think prices won’t bottom out until April, May, or later. That’s what I’d call the “structural decliners” camp. They might cite increased domestic capacity colliding with older capacity amid relatively flat demand.

Service centers pivot

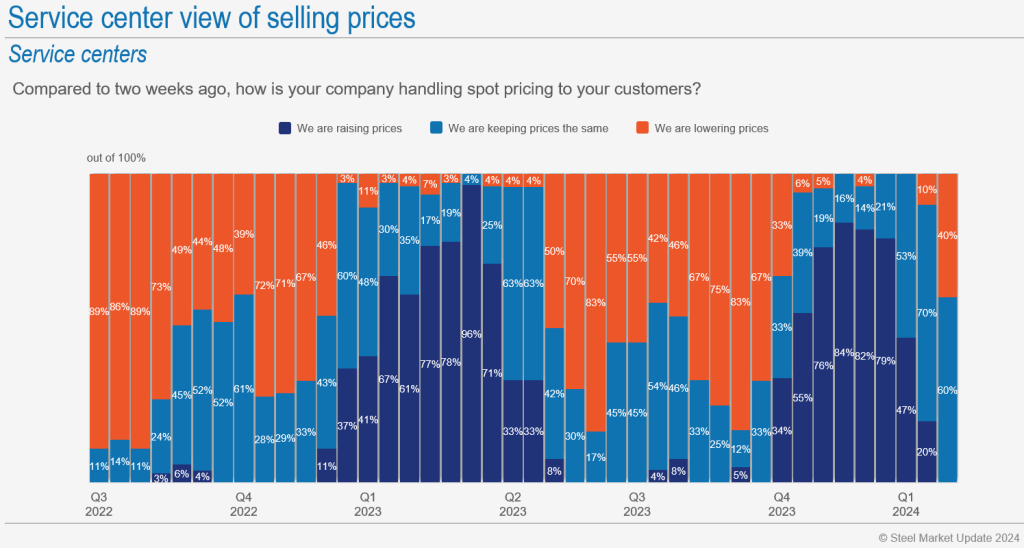

Another big pivot has happened when it comes to how service centers are handling prices:

Approximately 40% of service center respondents tell us they are lowering prices, 60% say they are keeping prices steady, and none say they are increasing prices.

That’s a big change from our last survey:

The 10% who said they were reducing prices two weeks ago don’t look like outliers anymore. Instead, it looks like they were the beginning of a trend.

As you can see in that chart, once you’ve got 40% of service centers dropping prices, it becomes harder for others to hold the line. It’s not uncommon for the percentage of service centers reducing prices to expand to 70-80%. But after that point, we’ve found, that mills often roll out price hikes that service centers – tired of declining inventory values – are willing to support.

If this downward cycle in service center prices looks like the one we saw in Q3’23, it would last approximately 1.5-2 months. That’s how long it took the percentage of centers decreasing prices to balloon from ~40% to ~80%. And then mills would start rolling out increases again. So could we start to see increases in mid/late March or early April?

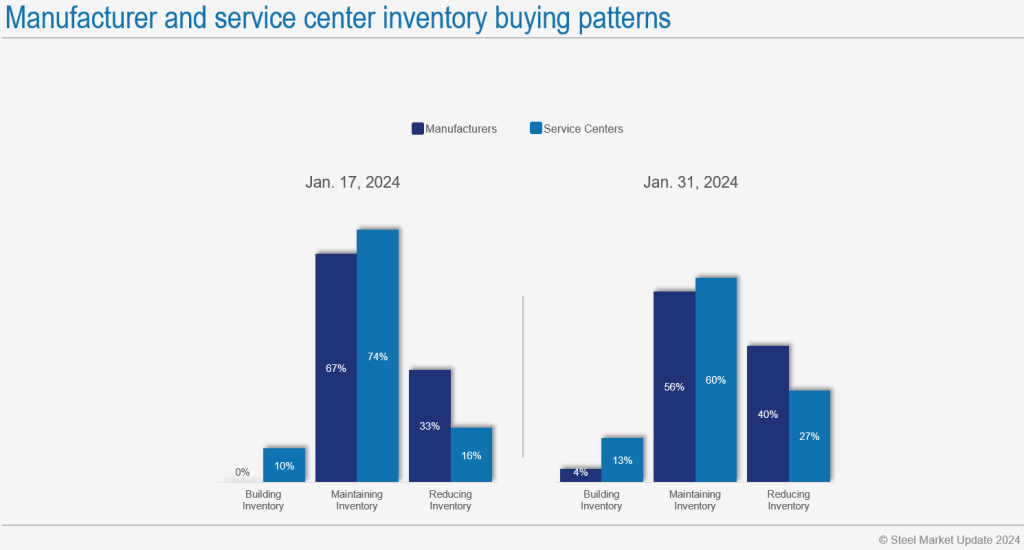

We’ll see. In the meantime, it appears that more steel buyers are reducing inventories in the face of falling prices:

The takeaway

I usually do a roundup of indicators that could be interpreted as negative for the sheet market – lower prices, shorter lead times, etc. – and then point to a few positive trends to offset the doom and gloom.

Often I note that 70-80% of survey respondents tell us that they continue to meet or exceed forecasts and/or that 80-85% say that demand is stable or improving. The good news: That remains the case.

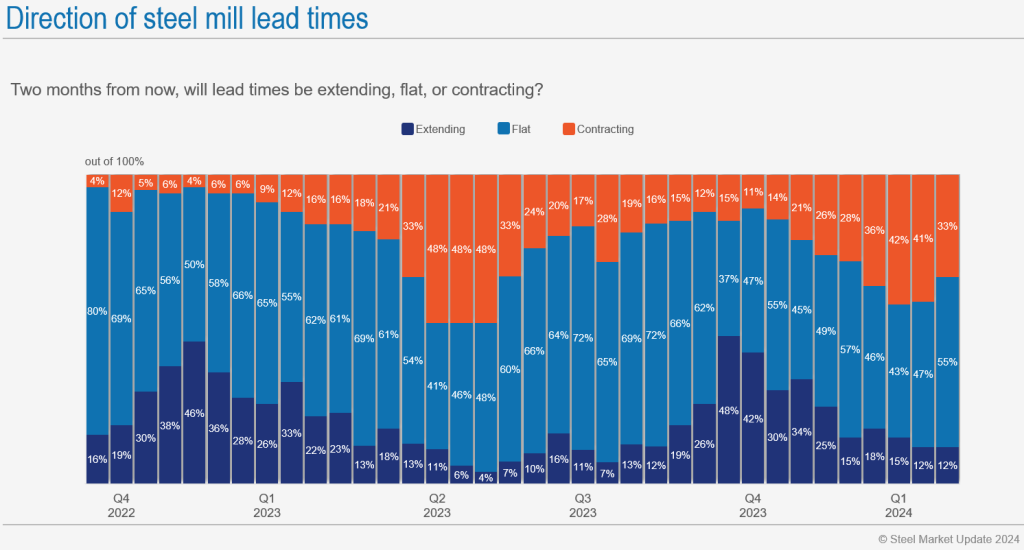

I’ll add a new tidbit this week. It comes from what has become one of my favorite charts – where people think lead times will be in two months:

We saw what I’ll call “peak bearishness” around lead times for about six weeks in Q2 of last year. (About half of respondents predicted falling lead times during that period.) Expectations around lead times improved in the third quarter. And then prices shot up early in the fourth quarter.

Perhaps we are past peak bearishness around lead times now: 33% think lead times will be contracting in two months, down from 42% in early January. Could that be an indicator, if we follow recent mini-cycles, that prices will fall and then rebound in Q2 or early Q3?

In other words, I’m placing my bets on the “mini-cyclers”. What about you?