Distributors/Service Centers

June 26, 2014

Service Centers Apparent Flat Rolled Inventory Deficit at 632,000 Tons

Written by John Packard

Last week, while we were in New York City for various steel conferences, the Metal Service Center Institute (MSCI) published steel inventory and steel shipment data for the month of May. Based on this information and a special analysis of the data by Steel Market Update we produce our SMU Apparent Excess or Deficit of the U.S. steel service center flat rolled steel inventories. This is normally a product we reserve for our Premium Level members but we thought our Executive Level members would also find this analysis of interest.

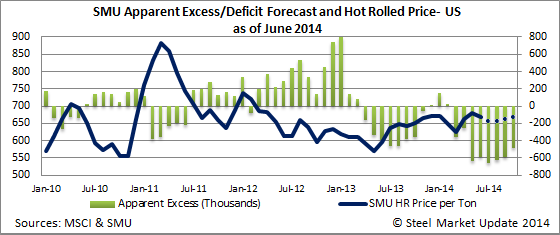

We have seen service center shipments exceeding expectations for the months of March, April and May. Shipments were up 8.1 percent in March, 11.2 percent in April and 7.6 percent during the month of May. At the conclusion of the month of May our Apparent Deficit (service center inventory deficit) had grown from -251,000 tons at the end of April to -632,000 tons. Our original forecast was -482,000 tons but we added an inventory adjustment of 200,000 tons to the final inventories which accounts for the difference in our forecast and where our proprietary calculation concluded inventories to be at the end of May.

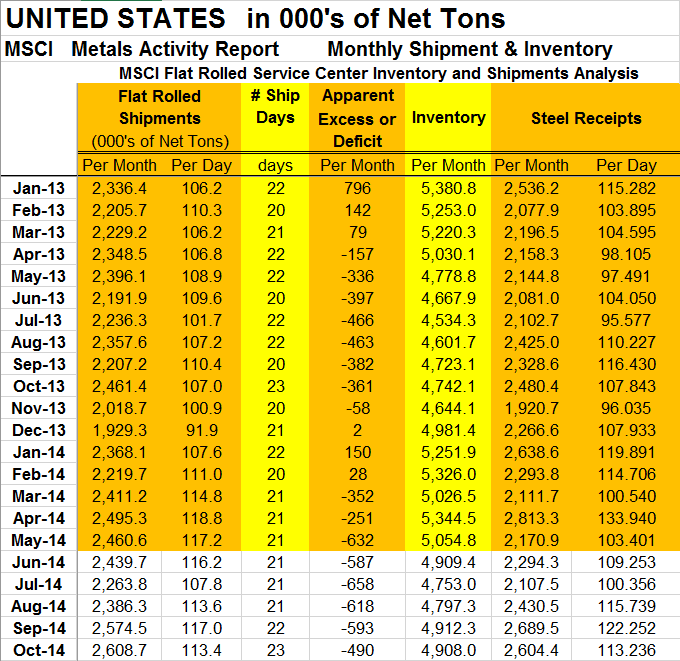

In the table below, we are sharing the shipment data and inventory data as produced by the MSCI. We also show the number of shipping days in each month as well as the receipts (total and by day). The Apparent Excess or Deficit is based on a proprietary formula part of which is based on our forecast for shipments and receipts for the month. As you can see we are forecasting flat rolled steel inventory deficits through the next five months. The “kicker” will be whether foreign imports are being added to inventory or replacing domestic mill shipments. For the month of May we thought there would be growth in steel distributor inventories which did not occur. We will see what June brings.

As we move into the June through October, Steel Market Update is projecting a continuation of the negative steel inventories at the service center level even though we are forecasting shipments to be up 6 percent year-over-year. We are projecting inventories will remain negative by approximately 500,000 tons each month through October 2014. This would be good news for the domestic steel mills.

We have adjusted our SMU hot rolled coil price forecast to reflect the anticipated negative inventory position over an extended period of time at the service centers. We believe prices will move lower through the end of June, trend sideways to slightly lower in July and then rise in August and September.