Prices

March 9, 2017

Hot Rolled Futures: Highest Level Since 2014

Written by David Feldstein

The following article on the hot rolled coil (HRC) futures markets was written by David Feldstein. As the Flack Global Metals director of risk management, Dave is an active participant in the hot rolled coil (HRC) futures market and we believe he will provide insightful commentary and trading ideas to our readers. Besides writing Futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Global Markets website www.FlackGlobalMetals.com.

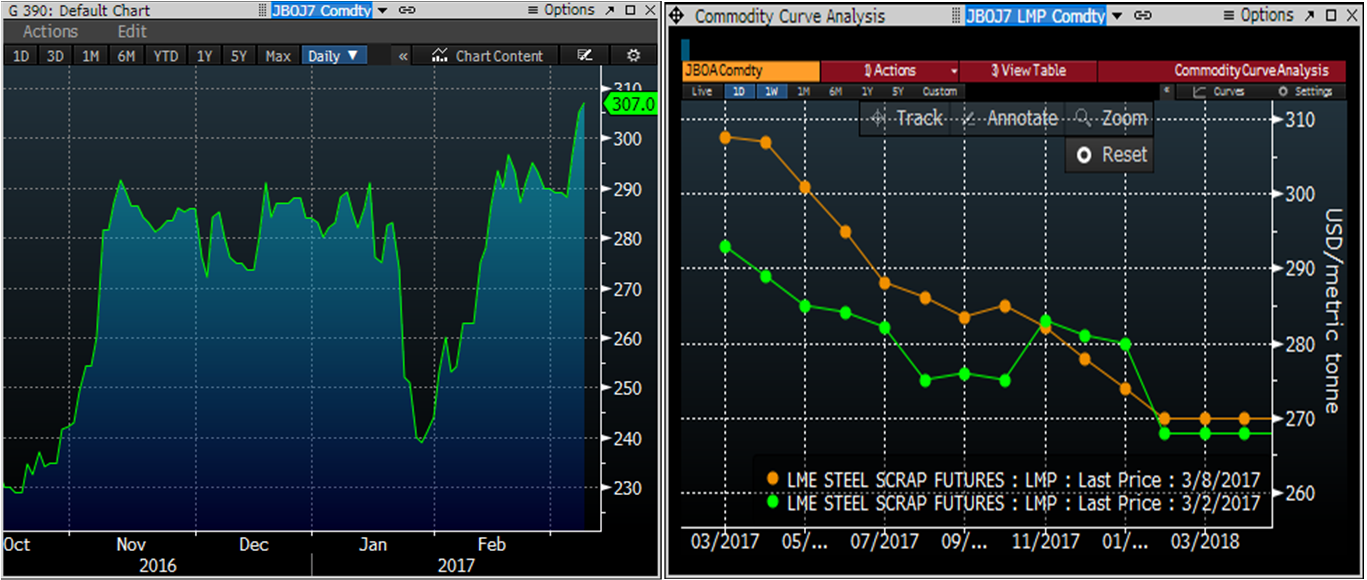

LME scrap futures have continued to move higher with April settling at $307/t yesterday, the highest since May, 2016. March’s domestic scrap settlement pop prompted Nucor to raise flat rolled prices $30/st yesterday following their February 20th price hike announcement.

April LME Turkish Scrap & Curve

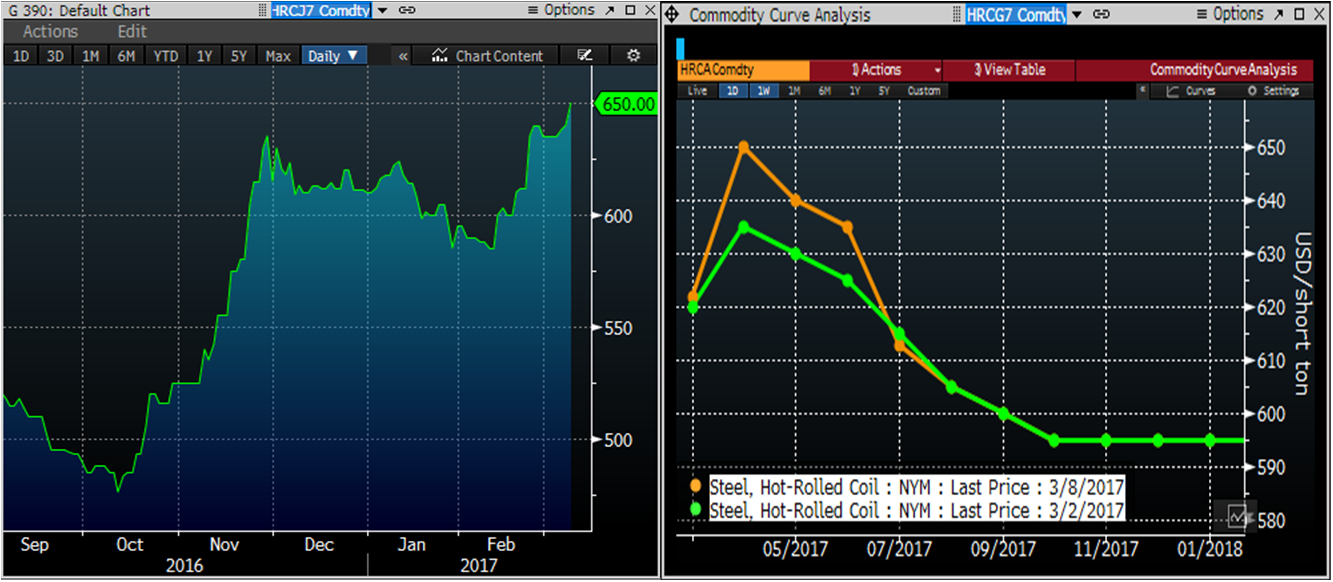

The sharp sell-off in scrap prices at the end of January looks to be long forgotten as domestic flat rolled prices have continued the rally started in mid-October, 2016. Midwest hot rolled is now at the highest price since the end of 2014. The front of the CME HRC futures curve moved up $10-$15/st over the past five trading days. Last night, April futures settled at $650/st. May and June traded $640/st today. The curve remains steeply backwardated or downward sloping with Q3 trading in the $605-$610 range and Q4 at 595.

April CME Midwest HRC Futures & Curve

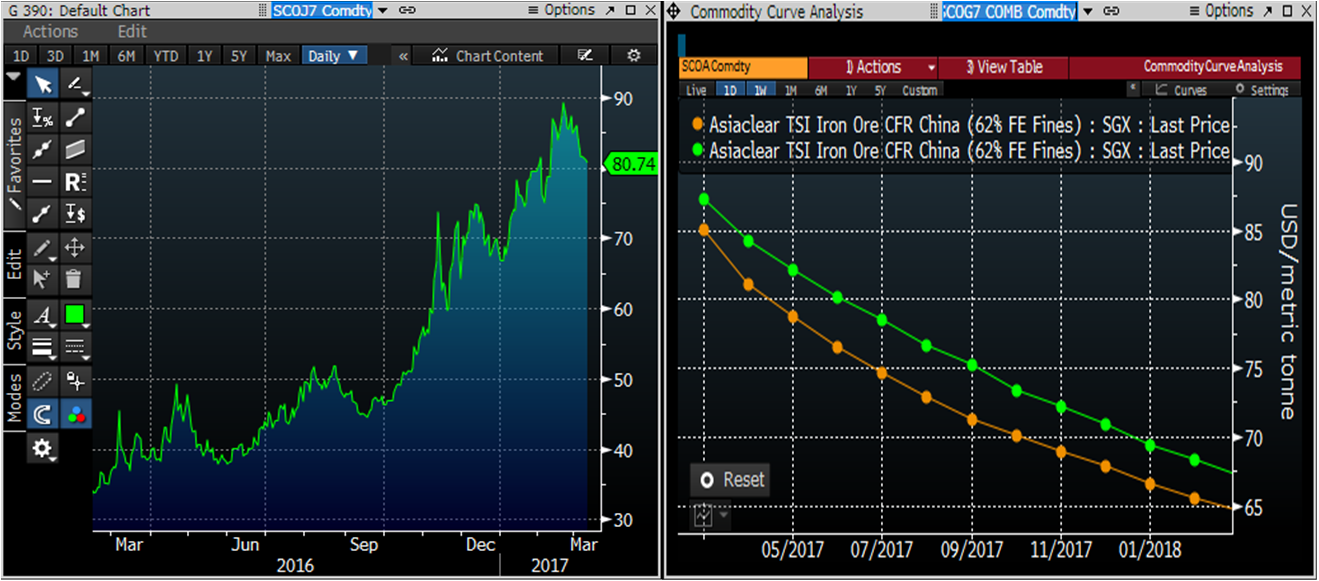

SGX iron ore futures have moved lower over the past week with April settling today at $81/t up $0.85 on the day. While prices have come off recent highs, the uptrend remains firmly intact. April ore futures have more than doubled over the last twelve months while the curve has remained extremely backwardated throughout. April 2018 futures are at $63.5/t; 22 percent below April, 2017 futures. At this time last year, April 2016 ore futures were backwardated 26 percent below April 2017 futures. So for anyone still hanging on to the notion that the shape of the futures curve is a reliable predictor of price direction, just look at the 12 month performance of April, 2017 ore futures. Don’t believe the hype!

April SGX Iron Ore Futures & Curve