Prices

August 6, 2017

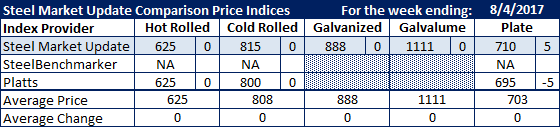

Comparison Price Indices: No Changes

Written by John Packard

Flat rolled and plate steel prices were essentially flat this past week as both Steel Market Update and Platts saw hot rolled, cold rolled, galvanized and Galvalume steel prices remaining the same as the previous week.

With Section 232 being put on the back burner, the flood of foreign steel imports (prompted by the original threat of the Section 232 investigation) has prompted steel buyers to become more cautious in their buying of spot inventories.

One large service center VP of Purchasing told Steel Market Update earlier this past week, “It’s funny (not really) because for months we’ve said that if we only knew what was happening with 232, we’d be in a better position to manage our business and help our customers. Now that we know something, we don’t feel any less confused in the short-term. Inventory is too high, and with a lack of clarity on market direction, we’re inclined to work it down until we see some end-of-year deals.”

Other steel buyers are seeing good demand levels and somewhat balanced inventory situations. They continue to buy as needed, but are not necessarily out there trying to expand inventories. One Texas area buyer told us, “Inventory: We just had a lot of import steel land, so inventory is sitting at about 2.2 months on hand now. But I am not reducing inventory and have no plans to due to demand. Prices: I have not quoted anything spot this week due to import that arrived.”

From our perspective, the spot price market is searching for direction. As the week ended, we were hearing rumors of at least one steel mill (Nucor) considering raising prices due to higher scrap prices. This may help keep a floor on steel prices. Then we will have to wait and see if the mill order books improve due to the anticipated drop-off in imports during the August, September and October time frames.

Plate prices were mixed with SMU seeing the number up $5 per ton and Platts seeing it down $5 per ton. Remember, SMU’s plate number is freight prepaid/delivered, while Platts is FOB Southeast steel mill.

SMU Note: Galvanized prices include $78 in extras for a .060″ G90 product. Galvalume prices include $291 in extras for a .0142” AZ50 Grade 80 product.

FOB points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Plate price FOB points are different for each of the indexes:

SMU: FOB Delivered to the Customer (includes freight)

Platts: FOB Southeaster Mill (does not include freight)

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.