Government/Policy

July 9, 2018

SMU Market Trends: Most Feel Auto Imports Not a Real Threat

Written by Tim Triplett

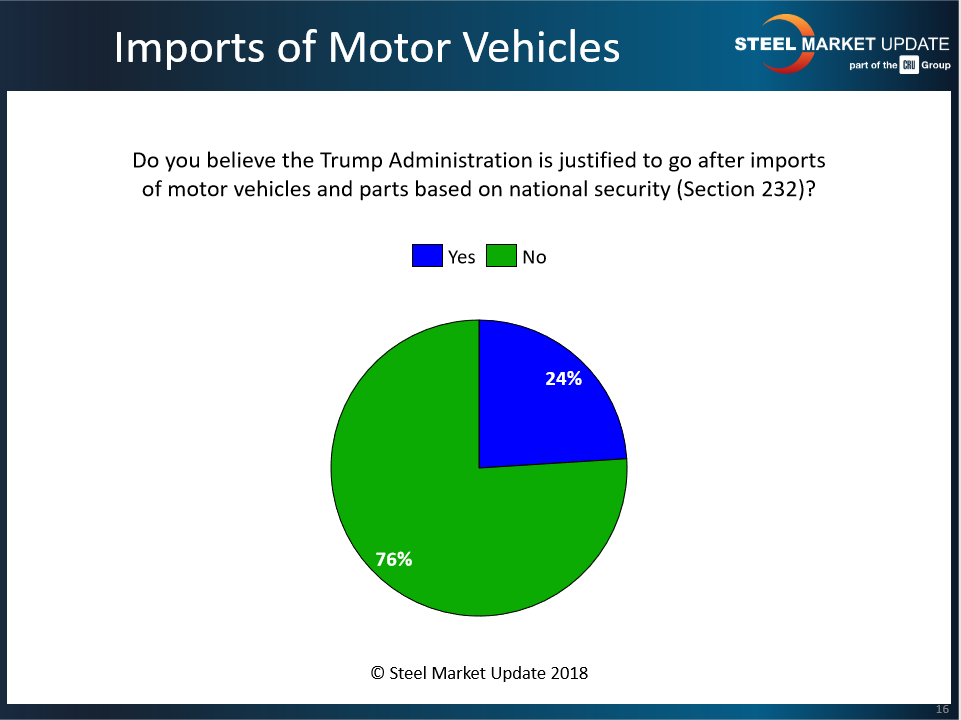

Are imports of motor vehicles and auto parts a threat to the security of the United States? More than three out of four respondents to last week’s Steel Market Update market trends questionnaire say no.

Citing the same argument that it used to justify the tariffs on steel and aluminum under Section 232 of the Trade Expansion Act of 1962, the Trump administration contends imports of cars and trucks are a danger to a healthy domestic automotive industry. “Core industries such as automobiles and automotive parts are critical to our strength as a nation,” said the White House.

In late May, President Trump instructed Commerce Secretary Wilbur Ross to investigate whether imports of foreign-made vehicles and parts pose a threat to U.S. automakers, and thus to national security. The administration reportedly is considering tariffs of 25 percent, up from the current 2.5 percent. Public hearings on the proposal, which faces strong opposition from both inside and outside the auto sector, are set for July 19-20 in Washington.

Only 24 percent of the steel industry executives polled by SMU support the administration’s plan for automotive tariffs. Following is a sampling of respondents’ comments:

• “Stupefyingly ridiculous!”

• “None of this is justified, but it’s still happening.”

• “The current administration is determined to rebalance trade deficits and will do whatever they feel they need to do in order to achieve this—at the expense of all common sense and with disregard for the negative long-term high-cost effects on the U.S. economy.”

• “Ford, GM and Fiat also import parts from other countries for their assembly plants. The Big Three could end up as collateral damage.”

• “Yes, it’s justified on cars made outside of the United States. Especially luxury cars. Tax them more; they are bought by the wealthy anyway.”