Prices

July 12, 2018

HRC Futures: Buyers Look to Lock in Tons $100 Below Spot

Written by David Feldstein

The following article on the hot rolled coil (HRC) futures market was written by David Feldstein. As the Flack Global Metals Director of Risk Management, Dave is an active participant in the hot rolled futures market, and we believe he provides insightful commentary and trading ideas to our readers. Besides writing futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Global Metals website, www.FlackGlobalMetals.com. Note that Steel Market Update does not take any positions on HRC or scrap trading, and any recommendations made by David Feldstein are his opinions and not those of SMU. We recommend that anyone interested in trading steel futures enlist the help of a licensed broker or bank.

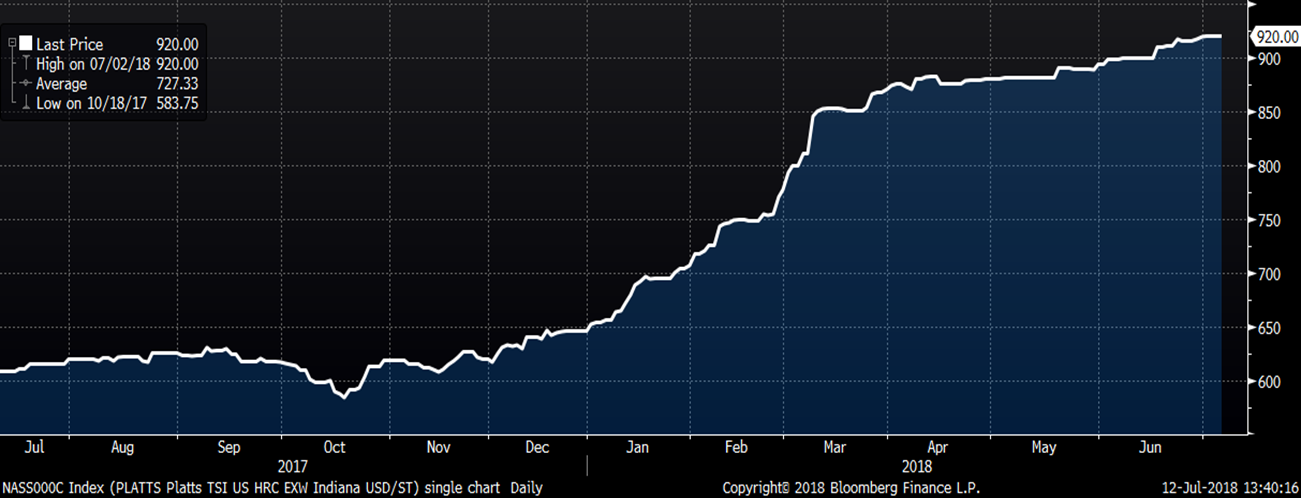

The Platts TSI Midwest HRC Index has now rallied 57.6 percent since October 2017.

Platts TSI Midwest HRC Index

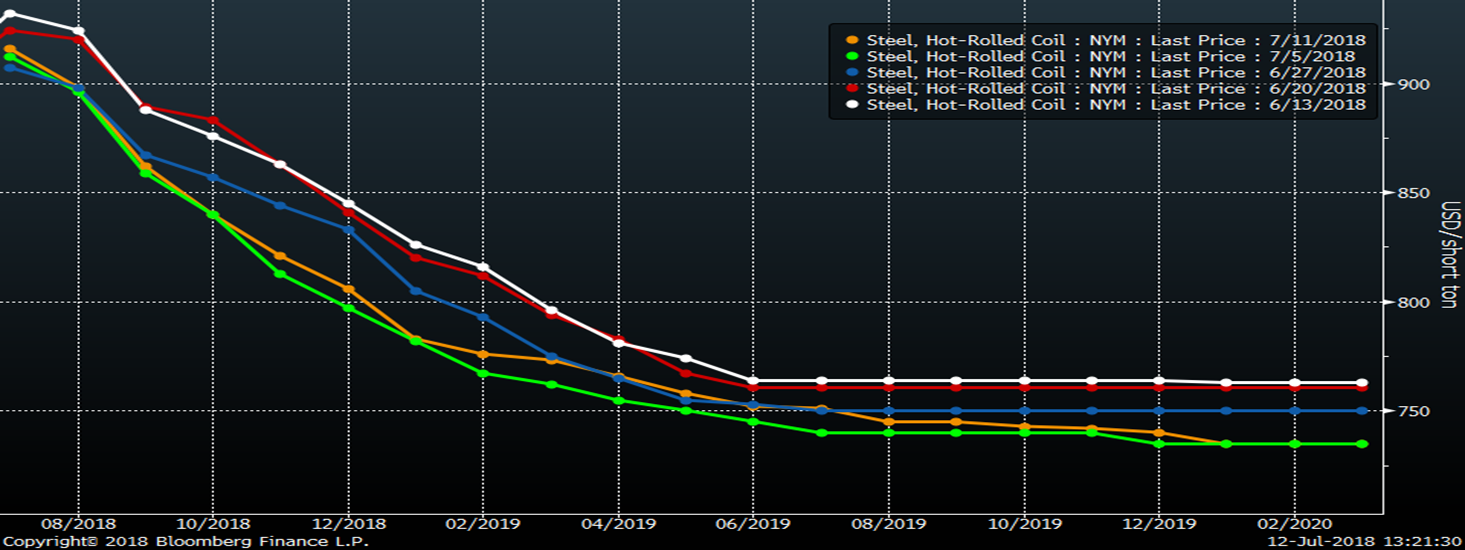

The CME Midwest HRC futures curve remains sharply backwardated with futures trading $100 or more below spot as early as the November 2018 future. Futures have deflated as much as $50 over the last month with buyers few and far between. However, buyers returning from holiday looked to lock in prices, especially in November, December and January, bidding them up $10 – $20 at the start of the week.

CME Midwest HRC Futures Curve

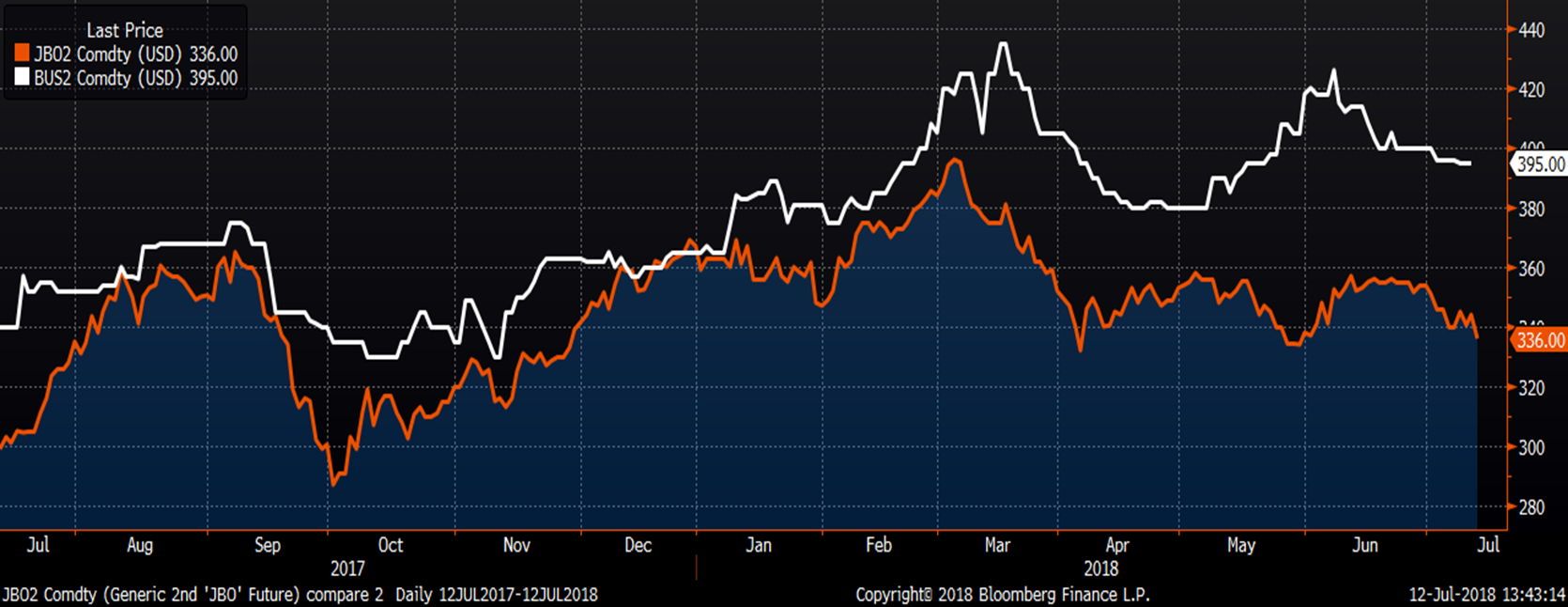

LME Turkish scrap futures have fallen $15 since the month began with August settling today at $336/mt. CME busheling futures are down $5 to $395/lt thus far in July. June futures settled at $402.35

2nd Month Rolling LME Turkish Scrap and CME Busheling Futures

This article and the “Week Over Week” report have been following the “triangle” pattern in iron ore futures for some time. When a chart pattern forms a triangle, it is expected that trading of that product will see compressed volatility like a coiling spring, and whichever side of the triangle it breaks through, it will then break hard in that direction as the pent-up volatility is released. SGX iron ore futures have traded in a tight range since March and the 2nd month future has finally broken through one of the sides, below its long-term uptrend line that started in 2015. High volume is always an important factor, so watch for iron ore to start trading down on high volume. It could portend that a sharp sell-off is close.

2nd Month SGX Iron Ore Futures