Prices

July 26, 2018

Steel Imports Down 15.3 Percent in June

Written by Brett Linton

Imports of foreign steel remain surprisingly resilient despite the 25 percent tariff imposed by the Trump administration. Imports saw a decline in June, but appear to be rebounding in July.

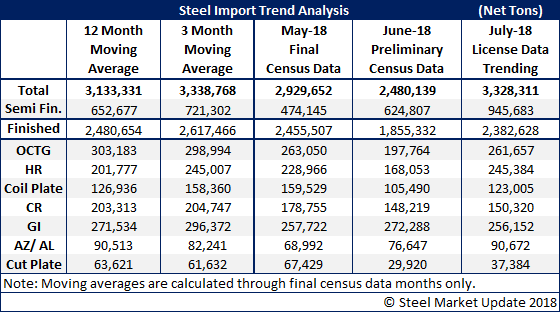

Imports of foreign steel declined by about 450,000 tons in June or 15.3 percent from the previous month, according to preliminary Census data released by the Commerce Department on Wednesday. Preliminary data for June shows imports of all steel products totaling 2,480,139 net tons, down from the final total for May of 2,929,652 tons.

While finished steel imports declined in June by 24 percent, imports of semi-finished steel–slabs and billets–increased by 31.8 percent. These purchases of semi-finished products by the domestic mills reflect the current strength of demand in the U.S.

The trend for July license data (average daily licenses multiplied by 31 days) suggests imports could increase to 3.3 million net tons. Much of the growth, not surprisingly, will be in semi-finished steels used by domestic steelmakers, projected to increase by more than 50 percent from June. But imports of finished steel in July could increase by more than 24 percent, as well, if the trend plays out for the entire month.

Showing double-digit increases are licenses for hot rolled, OCTG, plate and Galvalume, while galvanized and cold rolled imports look to be flat or down a bit in July.

The graphic below provides more details on license data by product.