Product

August 30, 2018

Steel Summit Polling Reveals a Divided Market

Written by Tim Triplett

Results from live polling during Steel Market Update’s Steel Summit Conference this week in Atlanta produced a few surprising results.

Using the SMU App, Steel Market Update was able to capture the views of more than 450, or about half, of the steel industry executives in attendance at the event.

For the most part, the attendees appear upbeat about the market and their companies’ prospects in 2019. Sixty-one percent are forecasting better business conditions next year.

But the executives’ view of the Trump administration tariffs reflect widespread disagreement in the marketplace, keeping in mind that the conference was attended by both mill executives and steel buyers, including a cross-section of service centers and manufacturers.

About half (49 percent) reported that the Section 232 steel tariffs are having a negative impact on their businesses. Another 43 percent said the tariffs are having a positive impact, while 8 percent see no impact at all.

Looking ahead, the attendees were asked: Will the Section 232 tariffs make the United States and your company more competitive? Thirty-one percent said their companies, and the country, will come out stronger as a result of the tariffs on steel imports, while another 28 percent said they don’t know what the market will look like. The remaining 41 percent believe their companies, and the United States as a whole, will be net losers as a result of the Trump trade policy. The crowd was evenly split on whether President Trump will follow through on his threats toward foreign producers to extend tariffs to imports of automobiles and auto parts.

So far, the 25 percent tariff has reduced steel imports by a reported 24 percent, suggesting that domestic mills can expect less competition from foreign producers. Surprisingly, only 4 percent of the respondents said they will be moving foreign orders to domestic mills. Thirty-five percent said they will be buying foreign material at the same level in 2019, while another 19 percent said they will be sourcing even more foreign next year. Only 19 percent said they anticipate buying less foreign steel in 2019. These figures suggest the majority of steel buyers believe domestic prices will remain so high next year that foreign offers, including the tariff, will still be worth considering. (The remaining 23 percent are not purchasers of foreign steel.)

So far, the 25 percent tariff has reduced steel imports by a reported 24 percent, suggesting that domestic mills can expect less competition from foreign producers. Surprisingly, only 4 percent of the respondents said they will be moving foreign orders to domestic mills. Thirty-five percent said they will be buying foreign material at the same level in 2019, while another 19 percent said they will be sourcing even more foreign next year. Only 19 percent said they anticipate buying less foreign steel in 2019. These figures suggest the majority of steel buyers believe domestic prices will remain so high next year that foreign offers, including the tariff, will still be worth considering. (The remaining 23 percent are not purchasers of foreign steel.)

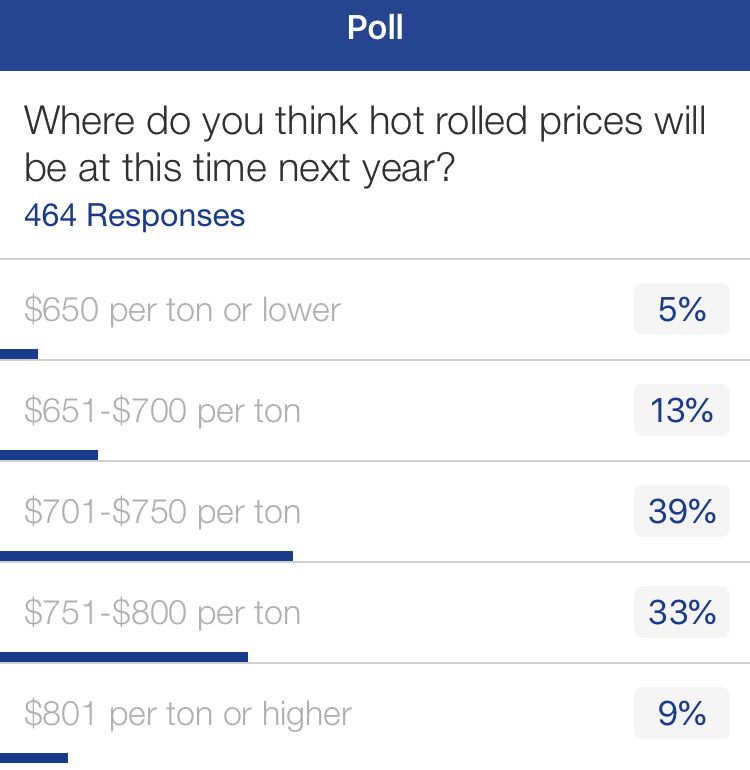

Asked to forecast the price of hot rolled steel at this time next year, the $701-750 range was the most popular choice, picked by 39 percent of attendees. Another 33 percent indicated $751-800 and 13 percent $651-700. About 9 percent expect a hot rolled price over $800 next year, while 5 percent predict it will decline below $650. To put these figures in perspective, the current price of hot rolled is around $900 per ton, very high by historical standards, which virtually no one predicted in the poll during last year’s SMU Steel Summit. The 10-year average for the HRC price is far below $650 at $614 per ton. So, while average is typically the safest prediction, few foresee an average year in 2019. The wide range of the predictions reflects one certainty: no one can predict the price of steel a year in advance.

Asked to forecast the price of hot rolled steel at this time next year, the $701-750 range was the most popular choice, picked by 39 percent of attendees. Another 33 percent indicated $751-800 and 13 percent $651-700. About 9 percent expect a hot rolled price over $800 next year, while 5 percent predict it will decline below $650. To put these figures in perspective, the current price of hot rolled is around $900 per ton, very high by historical standards, which virtually no one predicted in the poll during last year’s SMU Steel Summit. The 10-year average for the HRC price is far below $650 at $614 per ton. So, while average is typically the safest prediction, few foresee an average year in 2019. The wide range of the predictions reflects one certainty: no one can predict the price of steel a year in advance.