Prices

September 20, 2018

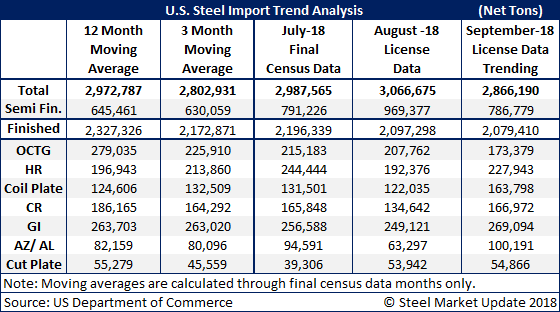

September Steel Import Trend Just Shy of 3 Million Tons

Written by John Packard

Earlier this week, the U.S. Department of Commerce released license data for the month of September. Steel Market Update takes that data, turns it into a daily average and then uses that number to project where we see the trend taking the total by the end of the month. The past few months have been consistent with foreign steel imports averaging close to 3 million net tons. The September trend is for the month to come in somewhere in the 2.8-2.9 million net ton level.

As with prior months, semi-finished steels (mostly slabs) remain a large percentage of the total. This despite the Section 232 tariffs, which are hitting countries like Russia and Mexico, two major slab suppliers to the U.S. markets. Brazil is the largest supplier of slabs into the U.S. market and they are currently exempt from the tariffs, but subject to quotas. Semi’s are now trending toward an 800,000 net ton month. This is in line with July, but down 150,000 to 200,000 net tons below August levels.

Finished imports, the number of tons imported after removing the semi-finished tonnage, have been averaging just above 2 million net tons. September is trending toward 2,079,000 tons based on the most recent license data. This is below both the 12-month and 3-month moving average. This means finished imports continue to recede as the impacts of antidumping, countervailing and Section 232 duties/tariffs hit home.

The one product that seems to be bucking the trend is Galvalume, which is trending toward a 100,000 net ton month.