Product

August 25, 2019

New North American Steel Capacity: It’s Complicated

Written by Sandy Williams

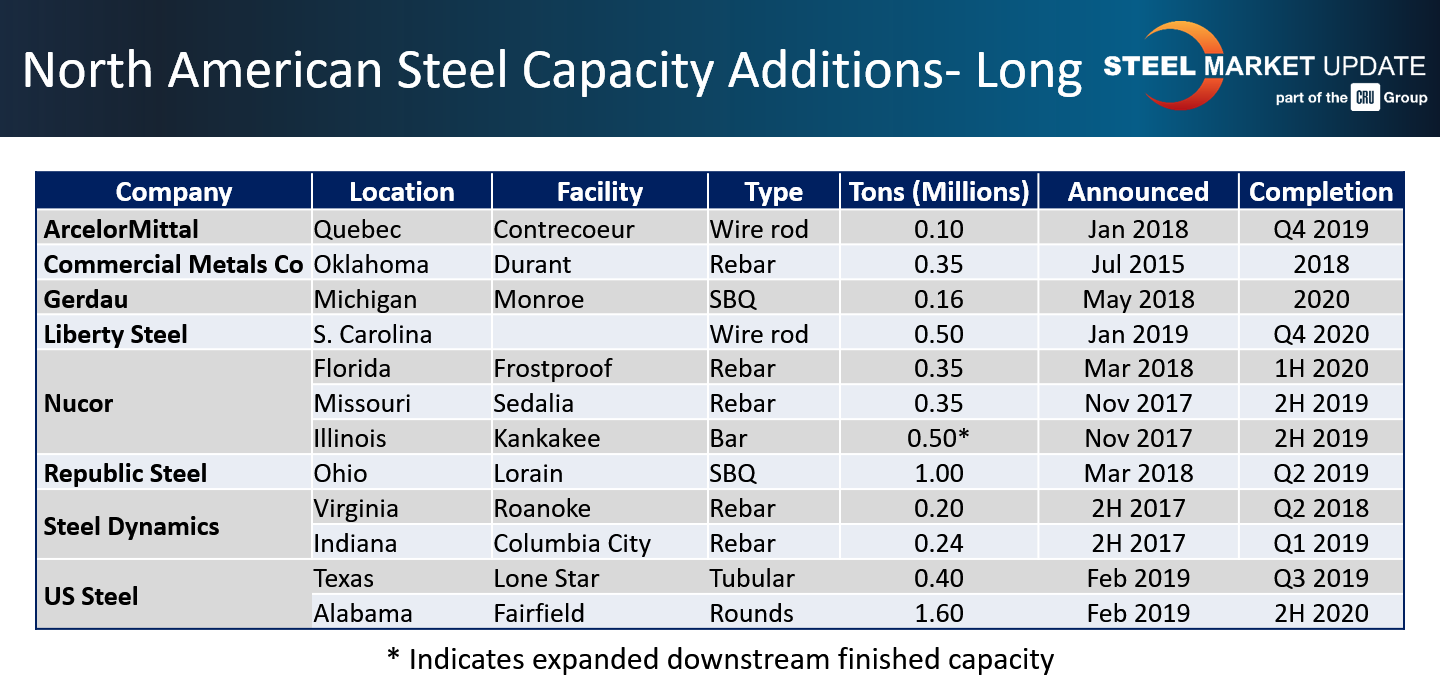

The steel industry enjoyed a profitable first half of 2018 due to a strong economy and tariffs on imports that drove up domestic prices. The welcome windfall prompted several companies to commit large investments toward expansion and modernization of their facilities. In all, about 31 million net tons of new steel capacity could potentially come online in North America by 2022—27.2 million tons of flat rolled capacity (minus AK Ashland Works) and 5.8 million tons of long products capacity—in the U.S., Canada and Mexico.

Some feel all that new capacity will prove positive for the industry, modernizing aging equipment, supplanting foreign imports, providing new jobs and delivering next-generation products to customers.Others are convinced it will prove disastrous as overcapacity drives steel prices to new depths.

Complicating the calculus is the question of whether the mills will follow through with their plans in the face of questionable demand, disappointing steel prices and an economy that some say is on the brink of a recession.

Slowing steel demand has led to production cutbacks and layoffs at U.S. Steel, ArcelorMittal and NLMK USA in the last several weeks. JSW USA just announced it will delay construction of the EAF planned for its Baytown plate mill due to unfavorable market conditions. Will other mills be forced to reconsider and postpone their projects?

The subject of new mill capacity will be a focal point at this year’s SMU Steel Summit Conference in Atlanta on Aug. 26-28. One strong mill panel will feature Mark Millett, CEO of Steel Dynamics; John Hritz, CEO of JSW USA; Ladd Hall, Executive Vice President, Flat Rolled, for Nucor; and César Jiménez, CEO, Ternium, Mexico. Each will discuss their company’s plans for capacity and the markets they are targeing. A separate panel with analysts from CRU, Steel Research Associates and Bank of America Merrill Lynch will weigh in on what the new capacity will mean to the U.S. steel industry.