Product

March 12, 2020

Hot Rolled Futures: HRC, Busheling Futures Break Lower Under Weight of Coronavirus

Written by David Feldstein

The following article discussing the global ferrous derivatives markets was written by David Feldstein. As an independent steel market analyst, advisor and trader, we believe he provides insightful commentary and trading ideas to our readers. Note that Steel Market Update does not take any positions on HRC or scrap trading, and any recommendations or comments made by David Feldstein are his opinions and not those of SMU or the CRU Group. We recommend that anyone interested in trading steel futures enlist the help of a licensed broker or bank.

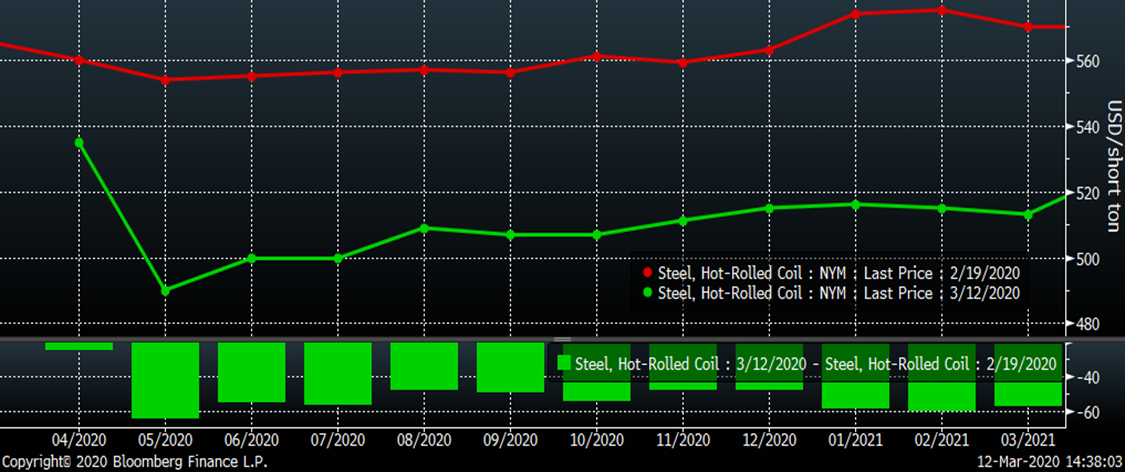

Fundamentals for the steel industry have been impressive thus far in 2020. This seasonality chart of unadjusted monthly auto sales shows February sales going back to at least 2014. 2020 year-to-date sales are the second best of the seven years listed below and the best since 2016.

Monthly Unadjusted U.S. Auto Sales

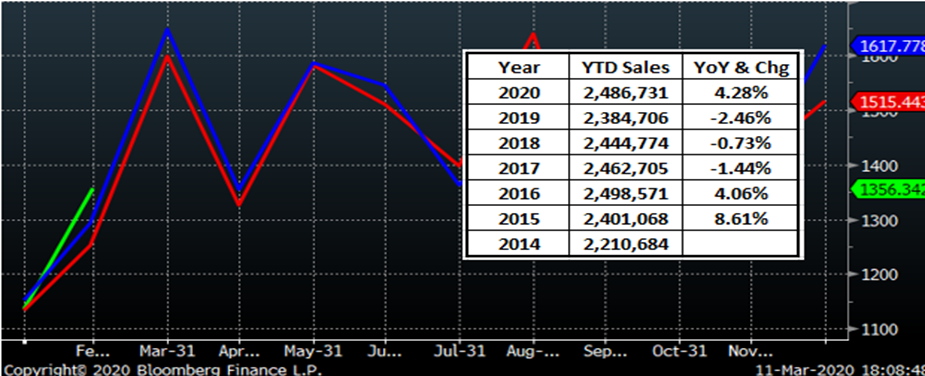

After an unexpected jump in January’s ISM Manufacturing PMI, February’s was down slightly, but remained above 50, which resulted in the three-month rate of change crossing above the 12-month rate of change for the first time since December 2017. This chart indicates the business cycle for manufacturing is turning higher.

ISM Manufacturing PMI

Net imports of flat rolled and other finished steel products continue to see dramatic decreases on a year-over-year basis and a three-month moving average basis. The cumulative effect has had a major impact on the supply and demand balance in the industry. Further, service center flat rolled inventory levels are near historically low levels with a very healthy months-on-hand following an outstanding January shipping month. Last, the residential housing market is booming while public construction spending is up sharply. Indeed, these backward-looking fundamentals are impressive.

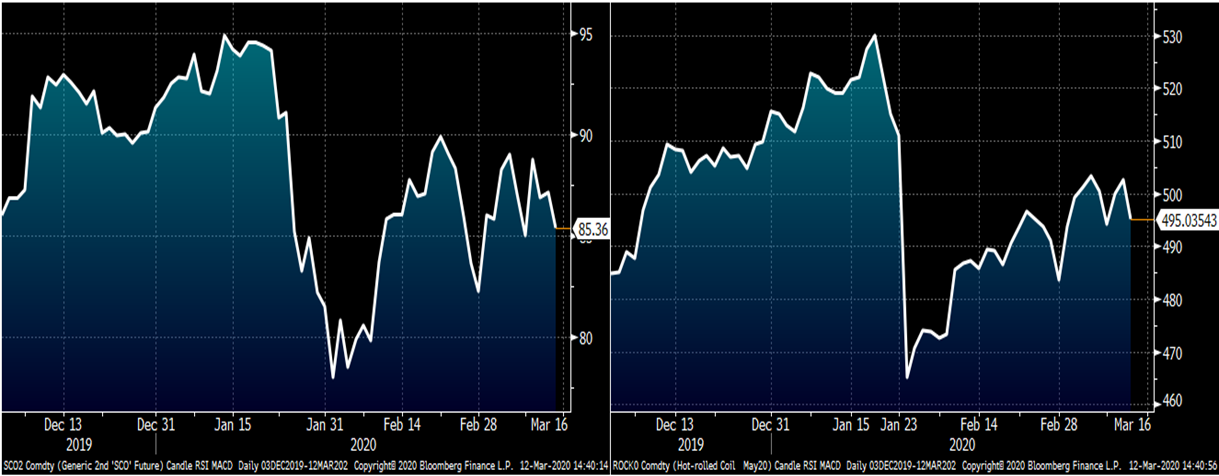

U.S. Net Imports

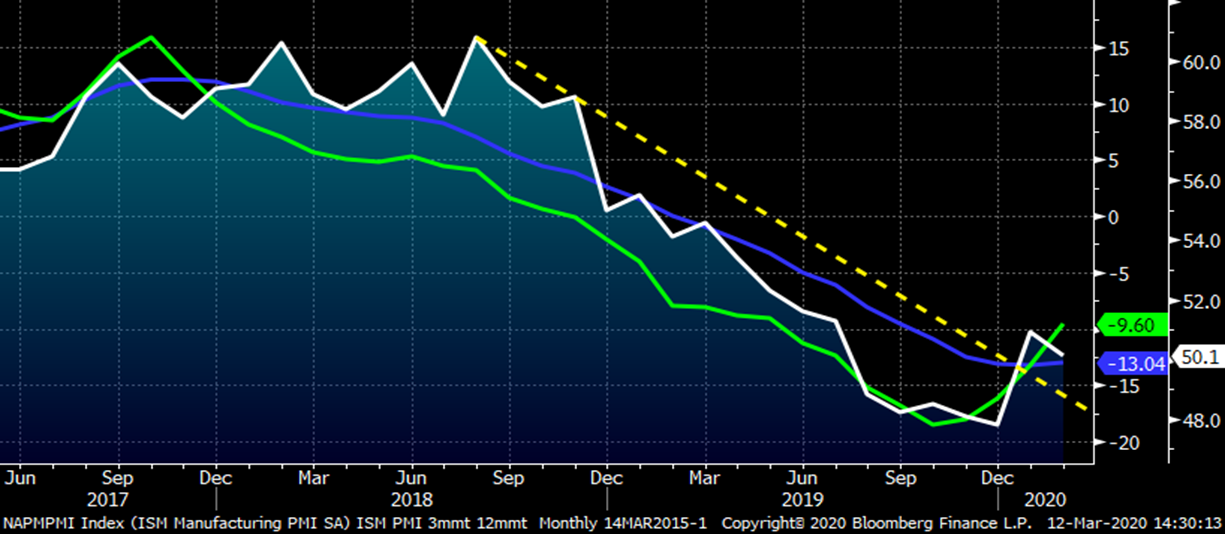

Unfortunately, all of the positive momentum these fundamentals looked to be providing is meaningless versus the exponential growth in the spread of coronavirus, which has put a stranglehold on the global economy. Domestic steel prices have been resilient and held up well despite the events in China until this week. Oil prices crashed at the outset of the week after Saudi Arabia announced an oil price war, but it was the realization that the economy will be forced to slow down abruptly that has led to this week’s massive losses in the CME Midwest HRC futures market. Over 71k tons traded hands today with size traded at $495 and $500 in May through December. This was one of the worst days, if not the worst day, I have ever seen in the HRC futures market.

CME Midwest HRC Futures

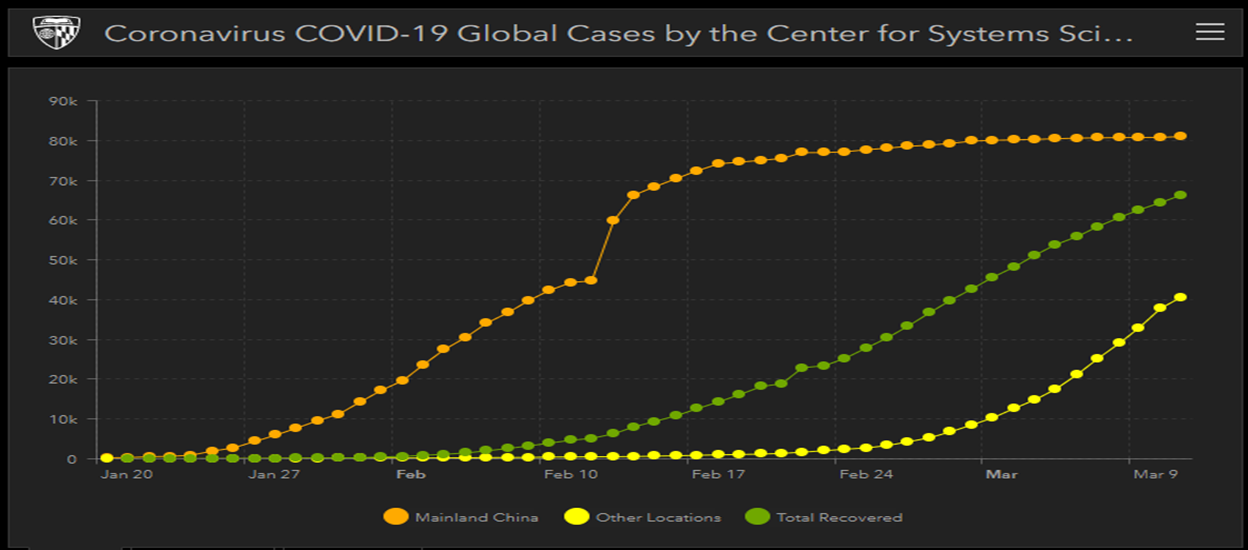

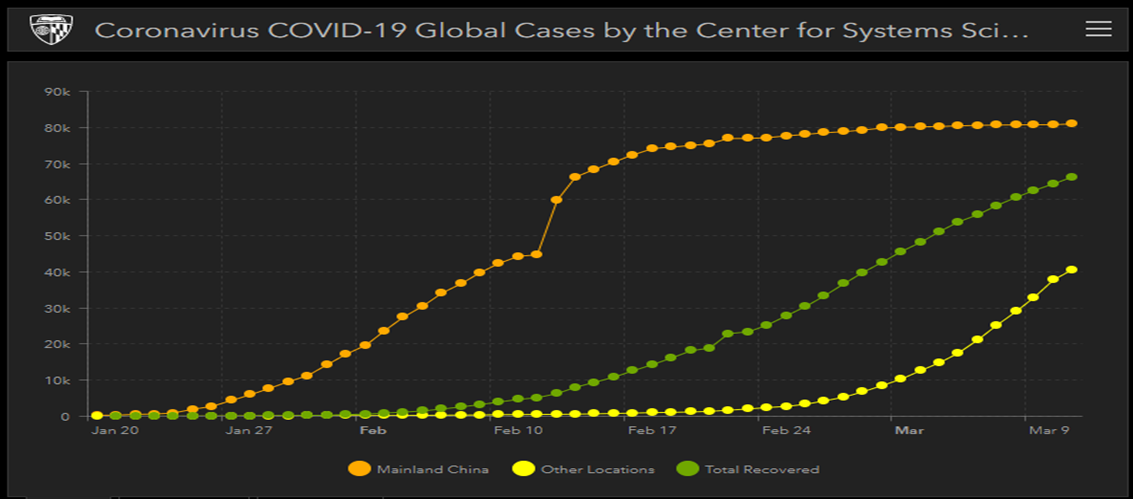

If you have been wondering if and why coronavirus is a big deal, it is. It’s extremely serious. It is deadly, especially for those above the age of 60 with pre-existing conditions and obesity. What is so powerful about the virus is not only that it is extremely contagious, but also it can be transmitted from one person to another without the contagious individual even knowing they are infected. This has resulted in a pattern of exponential growth in those infected. As you can see in the chart below, the first wave of exponential growth hit China (orange) and now the second wave (yellow) is spreading across the globe.

Coronavirus Infections & Recoveries

https://www.arcgis.com/apps/opsdashboard/index.html#/bda7594740fd40299423467b48e9ecf6

There is no vaccine or cure and the only way to fight it is by avoiding other people. This is being called social distancing, which basically means everyone has to stay at home for the next couple of weeks. A major side effect of the virus for those that don’t have it is fear. Stock markets around the world have collapsed as well as interest rates. People are very afraid, and while this is going to affect all of us in all parts of our lives, the purpose of this article is to expound on steel futures. This week, fear has taken hold of the steel market. So, what is going to happen next?

Dow Jones Industrial Average (left) & U.S. 10-Year Treasury Rate

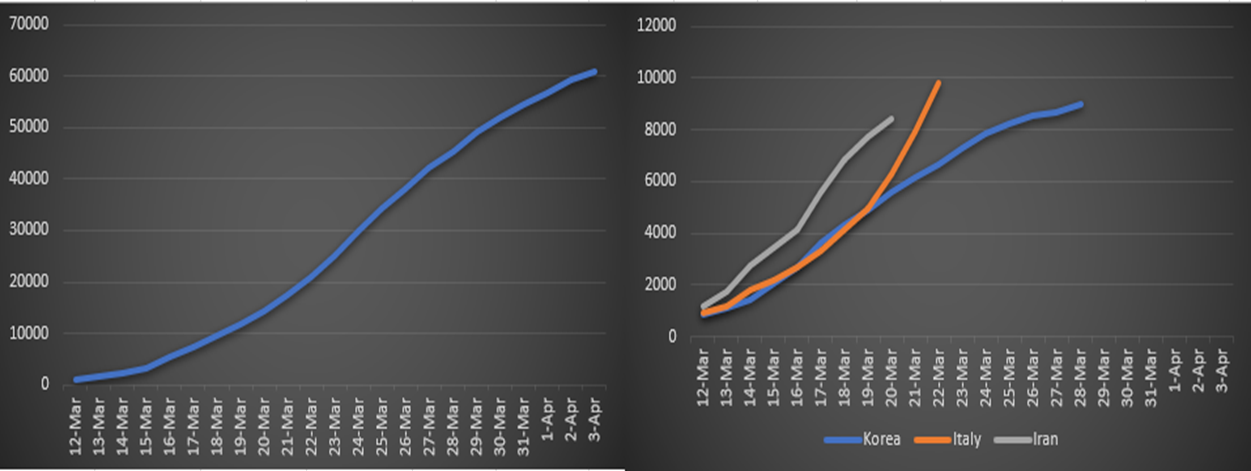

These two charts take the daily growth rate from China (left) and Korea, Italy and Iran (right) and apply it to the 696 people infected in the United States as of Tuesday’s official WHO update. I found the day for each of these countries that was closest to 696 and then applied the daily compounded growth rate for each country to forecast what could happen here. Depending on the size of the population and the way in which the country handled it, there were different outcomes, but the outcomes for these four countries were all generally the same—exponential growth.

U.S. Coronavirus Infection Forecasts

The point is that in the coming days and weeks, the U.S. is going to come home to a ballooning daily update of infected citizens. Based on the forecasts above, there could be somewhere between 6,000-10,000 infected by the end of next week and potentially 10,000-20,000 by the end of March. Hopefully, this doesn’t happen, but if we follow the same path as these other countries, this will compound the fear and uncertainty the country is already struggling with. The news cycle is going to exhaust the psyche of the country. It has already made the country a little nuts (go to Costco), but it is likely going to get harder on all of us from here. This means more events will be cancelled, more schools closed, more people staying indoors, etc., etc.

As far as steel goes, the purchasing of steel is going to slow significantly if not outright grind to a halt in the coming days and weeks, for two reasons. First, production is going to slow due to shutting down plants to control the spread of the virus as well as logistical problems. More importantly, expectations that prices will be cheaper tomorrow will likely result in a buyer’s strike feedback loop causing mill lead times to drop, prices to fall, expectations of lower prices, mill lead times dropping, etc., etc. We all know how that goes. That is why the futures market took such a huge drop in HR and scrap today.

May CME Midwest HRC Future

Rolling 2nd Month CME Busheling Future (white) & LME Turkish Scrap Future

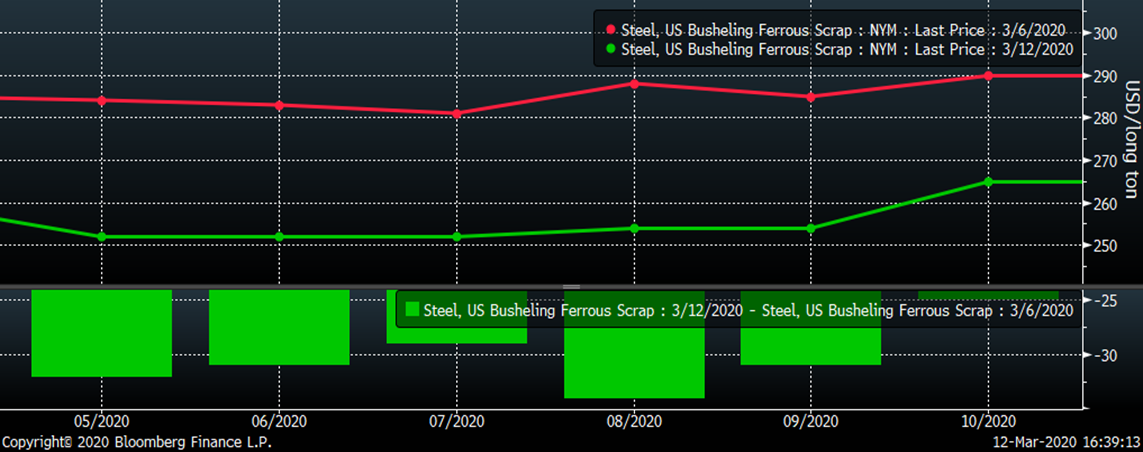

The CME busheling futures curve has fallen $30-35/lt since last week, which will also add pressure on domestic flat rolled prices.

CME Busheling Futures Curve

China was the first to deal with the virus and this was the effect it had on their PMI in February. One can expect a similar result in the U.S., Europe and other countries that are dealing with this problem, which is now at 117.

China’s Official Manufacturing PMI

What was interesting about China’s experience was how quickly their markets for iron ore, hot rolled, rebar and stocks rebounded.

Rolling 2nd Month SGX Iron Ore & May Chinese HRC Future

Reviewing the chart from above, one point of optimism is that the recovery rate is over 80 percent and happens rather quickly. The orange is China’s infections and green is recoveries, which so far has mostly been in China. The yellow is the rest of the world. Hopefully, this will run its course sometime in April, but it will be a rough road along the way.

Coronavirus Infections & Recoveries

With that assumption in mind, hopefully the economy will recover quickly and move back toward some semblance of the strong fundamentals discussed at the beginning of this article. If this is the case, looking out on the curve, there will be some fantastic opportunities to lock in prices for later in the year as there is sure to be a sharp rebound once the economy and life normalizes.

CME Midwest HRC Future