Market Segment

February 25, 2021

Ternium Reports Successful Q4; Operating at Full Capacity

Written by Sandy Williams

The extreme cold snap that hit the southern U.S. disrupted production at Ternium Mexico, causing the loss of approximately 80,000 tons of production and an estimated $40 million. The facilities are now back to normal operations, but because the mill is operating at full capacity, lost production cannot be made up, said CEO Maximo Vedoya during the company’s latest earnings call. As a result, Ternium Mexico’s first-quarter shipments are expected to be similar to the fourth quarter.

The company expects steel shipments to be stable in the first quarter, supported by demand from industrial customers and finished goods exports as well as a strong construction and home improvement market. Slab shipments from Brazil to third parties are expected to decrease in Q1 due to significantly higher intercompany transfers.

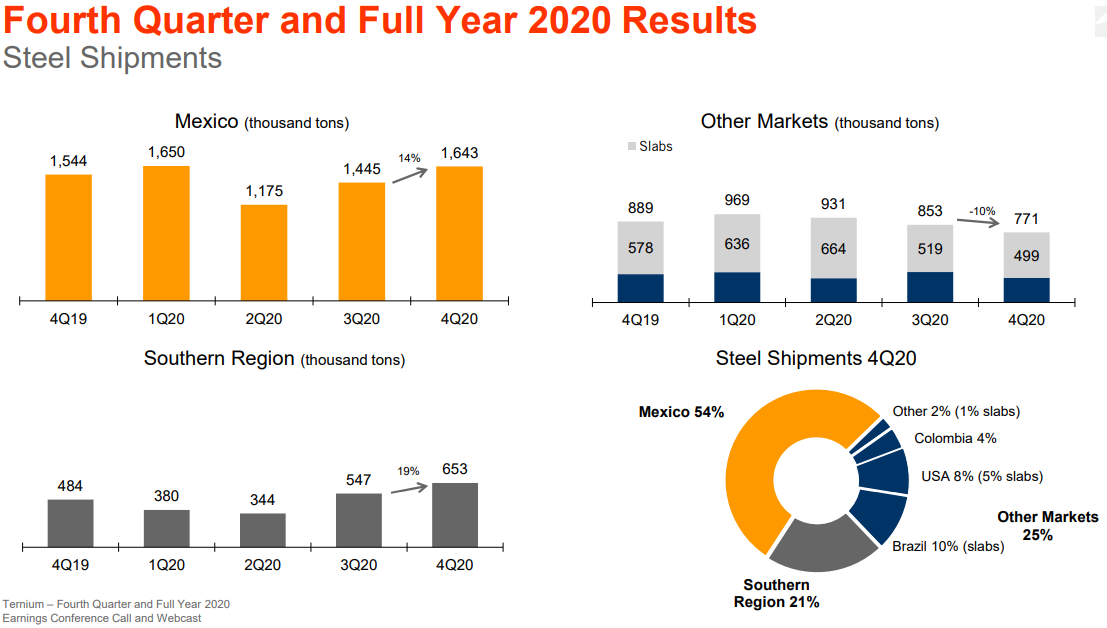

Ternium shipped 3.1 million tons of steel in the fourth quarter of 2020, an 8% increase sequentially and 5% year-over-year. Shipments in Mexico grew 14% during the quarter, following recovering from the pandemic. Shipments in the southern region increased 20% following significant recovery in the Argentine market. Iron ore shipments were up 9% from Q3 to 943,000 tons.

Ternium net sales jumped 21% to $2.6 billion in the fourth quarter resulting in net income of $670.6 million.

Full-year results were affected by the impacts of COVID-19 in 2020. Demand bottomed in the second quarter but grew steadily in the second half of the year as firms rebuilt inventories and consumption shifted toward consumer durables and residential construction. Steel shipments for the year fell 9% to 11.4 million tons. Iron ore shipments were down 6%. Net sales dropped 14% to $8.7 billion resulting in net income of $867.9 million.

The new rolling mill in Pesqueria will begin ramping up in the next few months. First production is expected in June; however, production will be used primarily to replace imports for the company. By 2023 the facility should be running at 3 million tons annually. The long ramp-up is a conservative estimate and is due to the certification process for customers, the company said.

Steel prices in North America are much higher than Vedoya anticipated. The U.S. industry is at a 70-75% capacity utilization level, and whether there will be more increases is difficult to see, he commented. “Prices will stabilize but will stay at high levels for longer than I thought.”

Mexico industrial sectors are running at full capacity including home appliances, HVAC and even the auto industry, which has seen constraints due to semiconductor shortages, said Vedoya.

With Ternium holding a strong cash position, organic growth is expected along with acquisition opportunities. At the moment, however, no acquisitions are under serious consideration.

The Argentine market is facing challenges with the stability of its economy and the renegotiation of debt with the International Monetary Fund (IMF). Inflation will need to come down to stabilize the debt problem, said Vedoya.

When asked about a possible mismatch between slab supply and demand in North America, Vedoya said “there’s always a lack of supply, that’s for sure. Before the pandemic and clearly now.”

By Sandy Williams, Sandy@SteelMarketUpdate.com