Product

March 9, 2021

SMU Price Ranges & Indices: Flat Rolled Up Another $30-40/Ton

Written by Brett Linton

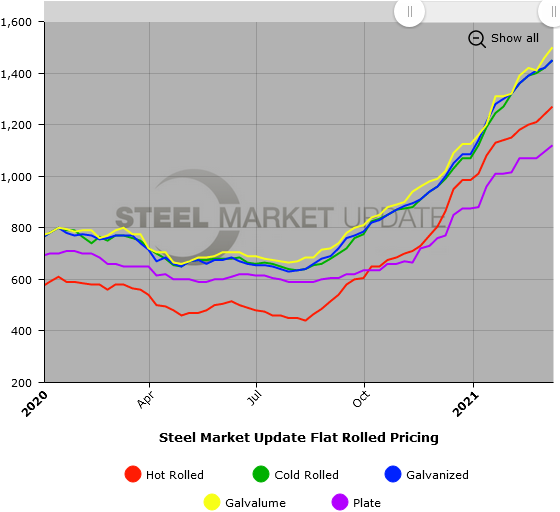

Steel prices simply continue to move higher—as do the anxiety levels of many service center and manufacturing executives. Hot rolled steel set yet another record this week, according to Steel Market Update’s check of the market, reaching an average of $1,270 per ton, topping the previous high mark set in 2008 by $200 per ton.

“This is crazy. I’ll tell you one thing, my customers can’t stay in business at these price levels. We’re having a hard time passing on the increases,” said one manufacturer in the Midwest. “Restricted supply with the current demand makes pricing anyone’s guess. There is nothing there to stop the madness, although we are reaching a critical cost/affordability point with customers. It could force some customers out of the game,” said a service center executive.

Supplies are at critically tight levels. For many buyers, price is secondary to availability. “With basically no spot tons available from mills, it sounds like it’s service centers selling to each other between now and May or June,” commented one respondent to SMU’s questionnaire. The market has actually tightened further in the last week or so, observed another: “The USS-announced BF outage, and now AM/NS Calvert outages in May, are examples of why it’s difficult to get the capacity utilization rate much higher in this environment. With HR Futures now over $1,000 through November, capitulation seems to have emerged and high prices may be here for a long time….”

Steel Market Update’s Price Momentum Indicators continue to point toward higher flat rolled and plate prices over the next 30 days.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $1,240-$1,300 per net ton ($62.00-$65.00/cwt) with an average of $1,270 per ton ($63.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $60 compared to one week ago, while the upper end remained unchanged. Our overall average is up $30 from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 6-12 weeks

Cold Rolled Coil: SMU price range is $1,420-$1,480 per net ton ($71.00-$74.00/cwt) with an average of $1,450 per ton ($72.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $40 compared to last week, while the upper end increased $20. Our overall average is up $30 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 7-12 weeks

ARTICLE CONTINUES BELOW

{loadposition reserved_message}

Galvanized Coil: SMU price range is $1,400-$1,500 per net ton ($70.00-$75.00/cwt) with an average of $1,450 per ton ($72.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago, while the upper end increased $40. Our overall average is up $30 from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,469-$1,569 per ton with an average of $1,519 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 8-14 weeks

Galvalume Coil: SMU price range is $1,480-$1,520 per net ton ($74.00-$76.00/cwt) with an average of $1,500 per ton ($75.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $60 per ton compared to last week, while the upper range increased $20. Our overall average is up $40 from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,771-$1,811 per ton with an average of $1,791 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 9-12 weeks

Plate: SMU price range is $1,090-$1,150 per net ton ($54.50-$57.50/cwt) with an average of $1,120 per ton ($56.00/cwt) FOB mill. The lower end of our range remained unchanged compared to one week ago, while the upper end increased $50. Our overall average is up $25 from one week ago. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 6-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.