Prices

May 26, 2021

SMU Price Ranges & Indices: HRC Nears $1,600 Per Ton

Written by Brett Linton

Hot-rolled coil prices continue their unrelenting march upward. Steel Market Update’s benchmark hot-rolled coil price now stands at $1,590 per ton ($79.50/cwt), up $20 per ton from a week ago and up $180 per ton versus last month. Lead times remain extended at eight to 12 weeks. And SMU’s Price Momentum Indicator continues to point to higher prices over the next 30 days. That dovetails with sentiment that prices have room to rise over the short-term, even as carbon steel prices approach levels more typically associated with stainless steel. But long-term opinion is divided. Some market participants think prices have nowhere to go but up for the balance of the year. Others are growing concerned that prices could wobble as the market enters the traditionally slower summer months and on anecdotal evidence that some mills are catching up on late orders. “There is a shortage of steel. But we’re on the sidelines,” one service center source said. “I’ve bought all I’m going to buy. I’m going to let everyone else fight over it.”

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $1,500-$1,680 per net ton ($75.00-$84.00/cwt) with an average of $1,590 per ton ($79.50/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to one week ago, while the upper end increased $40 per ton. Our overall average is up $20 per ton from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 8-12 weeks

Cold Rolled Coil: SMU price range is $1,700-$1,850 per net ton ($85.00-$92.50/cwt) with an average of $1,775 per ton ($88.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $40 per ton compared to last week, while the upper end increased $50. Our overall average is up $45 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 11-14 weeks

Galvanized Coil: SMU price range is $1,720-$1,900 per net ton ($86.00-$95.00/cwt) with an average of $1,810 per ton ($90.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $40 per ton compared to one week ago, while the upper end increased $120. Our overall average is up $80 per ton from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,789-$1,969 per ton with an average of $1,879 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 12-16 weeks

Galvalume Coil: SMU price range is $1,720-$1,900 per net ton ($86.00-$95.00/cwt) with an average of $1,810 per ton ($90.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $40 per ton compared to last week, while the upper end increased $100. Our overall average is up $30 per ton from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,011-$2,191 per ton with an average of $2,101 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 12-16 weeks

Plate: SMU price range is $1,320-$1,490 per net ton ($66.00-$74.50/cwt) with an average of $1,405 per ton ($70.25/cwt) FOB mill. The lower end of our range remained unchanged compared to one week ago, while the upper end increased $30 per ton. Our overall average is up $15 per ton from one week ago. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 6-9 weeks

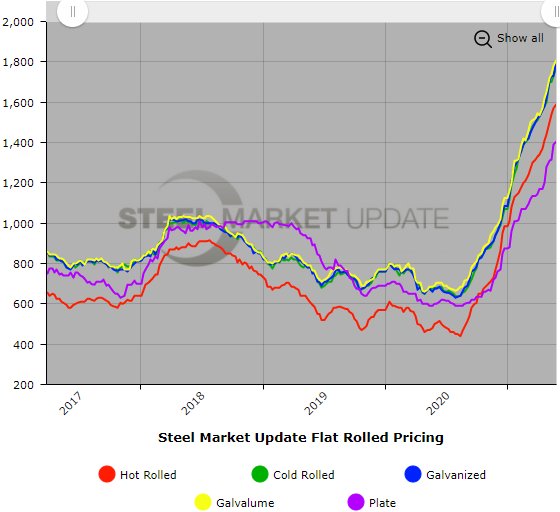

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.