Prices

June 15, 2021

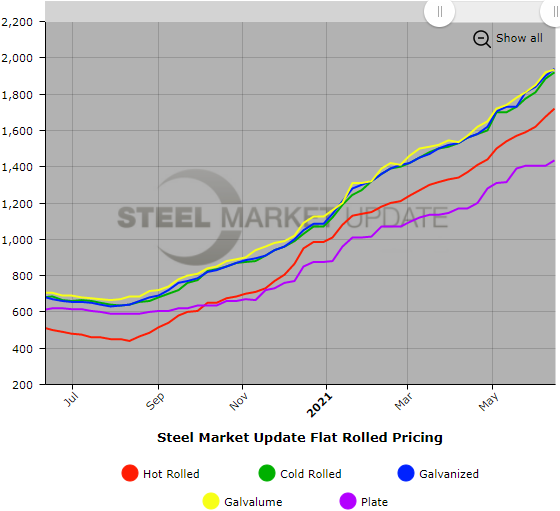

SMU Price Ranges & Indices: HRC Smashes $1,700/ton Ceiling

Written by Brett Linton

Hot-rolled coil prices have broken through the $1,700 per ton ($85 per cwt) threshold and now average $1,720 per ton. That’s up $45 per ton from a week ago and closing in on quadruple a 2020 low – reached last August – of $440 per ton.

The latest gains come after Steel Market Update’s sentiment index reached its highest point ever. And the increases continue to be reflected across all sheet and plate products tracked by SMU. Cold-rolled coil prices are up $35 per ton compared to last week, galvanized base prices are up $40 per ton versus a week ago, and Galvalume prices are up $15 per ton over that time. Plate tags also jumped up $30 per ton compared to the week prior amid chatter that one major producer might soon roll out new and higher base prices.

Might changes to Section 232 on the EU, new capacity or higher import volumes derail a rally that has lasted for more than 10 months? Maybe. But there are no signs of it happening this week. And some sources continue to predict that the market will remain on solid footing into 2022.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $1,680-$1,760 per net ton ($84.00-$88.00/cwt) with an average of $1,720 per ton ($86.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $80 per ton compared to one week ago, while the upper end increased by $10 per ton. Our overall average is up $45 per ton from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 8-16 weeks

Cold Rolled Coil: SMU price range is $1,880-$1,960 per net ton ($94.00-$98.00/cwt) with an average of $1,920 per ton ($96.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $80 per ton compared to last week, while the upper end decreased by $10 per ton. Our overall average is up $35 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 10-16 weeks

Galvanized Coil: SMU price range is $1,880-$2,000 per net ton ($94.00-$100.00/cwt) with an average of $1,940 per ton ($97.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $80 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is up $40 per ton from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,949-$2,069 per ton with an average of $2,009 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 10-18 weeks

Galvalume Coil: SMU price range is $1,890-$1,980 per net ton ($94.50-$99.00/cwt) with an average of $1,935 per ton ($96.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $50 per ton compared to last week, while the upper end decreased by $20 per ton. Our overall average is up $15 per ton from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,181-$2,271 per ton with an average of $2,226 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 12-18 weeks

Plate: SMU price range is $1,320-$1,550 per net ton ($66.00-$77.50/cwt) with an average of $1,435 per ton ($71.75/cwt) FOB mill. The lower end of our range remained unchanged compared to one week ago, while the upper end increased by $60 per ton. Our overall average is up $30 per ton from one week ago. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 9-18 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.