Prices

June 22, 2021

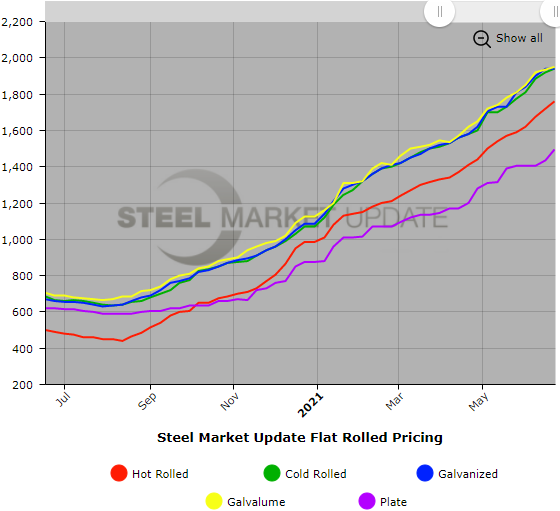

SMU Price Ranges & Indices: Still Rising

Written by Brett Linton

If you’re seeking a peak, keep looking. Because it wasn’t this week. Steel Market Update found that spot prices for most sheet and plate products were again higher – despite scattered reports of increased availability for some contract buyers.

SMU’s benchmark hot-rolled coil prices stands $1,760 per ton ($88/cwt), up $40 per ton from last week and quadruple a 2020 low, recorded last August, of $440 per ton. Cold rolled prices are up $20 per ton versus a week ago. And galvanized prices are flat. On the plate front, SMU’s price rose $60 per ton following a $100-per-ton increase from SSAB Americas and new, higher pricing from another domestic mill, market participants said.

Will more balanced inventories and more available tons cause prices to flatten out and drop? Or will mills’ “take this price or shove it” approach win out?

Time will tell. Pro tip: If you’re looking for a peak, keep an eye on the spreads between lows and highs. Wider spreads can indicate a market at or near an inflection point

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $1,670-$1,850 per net ton ($83.50-$92.50/cwt) with an average of $1,760 per ton ($88.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to one week ago, while the upper end increased by $90 per ton. Our overall average is up $40 per ton from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 8-12 weeks

Cold Rolled Coil: SMU price range is $1,880-$2,000 per net ton ($94.00-$100.00/cwt) with an average of $1,940 per ton ($97.00/cwt) FOB mill, east of the Rockies. The lower end of our range is unchanged compared to last week, while the upper end increased by $40 per ton. Our overall average is up $20 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 8-14 weeks

Galvanized Coil: SMU price range is $1,880-$2,000 per net ton ($94.00-$100.00/cwt) with an average of $1,940 per ton ($97.00/cwt) FOB mill, east of the Rockies. Both the lower and higher ends of our range are unchanged from a week ago. Our overall average is unchanged from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,949-$2,069 per ton with an average of $2,009 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 8-16 weeks

Galvalume Coil: SMU price range is $1,900-$2,000 per net ton ($95.00-$100.00/cwt) with an average of $1,950 per ton ($97.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to last week, while the upper end increased by $20 per ton. Our overall average is up $15 per ton from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,191-$2,291 per ton with an average of $2,241 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 11-16 weeks

Plate: SMU price range is $1,400-$1,590 per net ton ($70.00-$79.50/cwt) with an average of $1,495 per ton ($74.75/cwt) FOB mill. The lower end of our range increased $80 per ton compared to one week ago, while the upper end increased by $40 per ton. Our overall average is up $60 per ton from one week ago. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 8-13 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.