Prices

September 14, 2021

SMU Price Ranges & Indices: Was That the Peak?

Written by Brett Linton

Sheet prices continue to wobble with hot-rolled coiled prices actually declining, albeit modestly, for the first time in more than a year. The concern: that the market is at a peak – and perhaps heading down the other side.

Hot rolled coil prices have been flat in prior weeks, but they have not declined since Aug.11 of last year – when they dropped to a post-pandemic low of $440 per ton ($22 per cwt). Cold-rolled and galvanized prices are unchanged this week.

Galvalume prices declined by $35 per ton on continued concern about import competition. “Everyone has imports on their way or already at the port,” one market participant said. Plate prices, meanwhile, were also down $30 per ton.

With import offers as much as $500 per ton below domestic prices, it’s worth considering how long the U.S. can remain an island of high prices. With market prices apparently now in transition, SMU has switched its Price Momentum Indicators on all products from Higher to Neutral until the market’s direction becomes more certain.

Hot Rolled Coil: SMU price range is $1,900-$2,000 per net ton ($95.00-$100.00/cwt) with an average of $1,950 per ton ($97.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to last week, while the upper end remained unchanged. Our overall average is down $5 per ton from one week ago. Our price momentum on hot rolled steel will remain Neutral until the market establishes a clear direction.

Hot Rolled Lead Times: 7-12 weeks

Cold Rolled Coil: SMU price range is $2,100-$2,200 per net ton ($105.00-$110.00/cwt) with an average of $2,150 per ton ($107.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained unchanged compared to one week ago. Our overall average is unchanged from last week. Our price momentum on cold rolled steel will remain Neutral until the market establishes a clear direction.

Cold Rolled Lead Times: 9-13 weeks

Galvanized Coil: SMU price range is $2,100-$2,200 per net ton ($105.00-$110.00/cwt) with an average of $2,150 per ton ($107.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained unchanged compared to last week. Our overall average is unchanged from one week ago. Our price momentum on galvanized steel will remain Neutral until the market establishes a clear direction.

Galvanized .060” G90 Benchmark: SMU price range is $2,178-$2,278 per ton with an average of $2,228 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 10-14 weeks

Galvalume Coil: SMU price range is $1,960-$2,200 per net ton ($98.00-$110.00/cwt) with an average of $2,080 per ton ($104.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $80 per ton compared to one week ago, while the upper end increased by $10. Our overall average is down $35 per ton from last week. Our price momentum on Galvalume steel will remain Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,251-$2,491 per ton with an average of $2,371 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 8-15 weeks

Plate: SMU price range is $1,650-$1,840 per net ton ($82.50-$92.00/cwt) with an average of $1,745 per ton ($87.25/cwt) FOB mill. The lower end of our range remained unchanged compared to last week, while the upper end decreased by $60 per ton. Our overall average is down $30 per ton from one week ago. Our price momentum on plate steel will remain Neutral until the market establishes a clear direction.

Plate Lead Times: 8-10 weeks

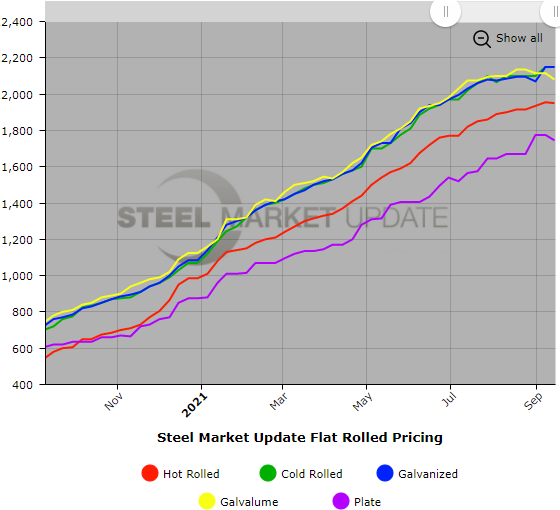

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.