Prices

January 13, 2022

U.S. Prices Still High vs. Latest Foreign Offers

Written by Michael Cowden

South Korean mills are out with new lower prices for steel sheet and steady prices for plate, according to recent offers reviewed by Steel Market Update.

The trend is important because U.S. mills are increasingly willing to compete with imports, meaning that the latest import offers give an indication of where domestic prices are headed.

![]() Case in point: South Korean steelmaker Hyundai Steel’s latest offer for hot-rolled coil for March-April shipment DDP to Los Angeles-area ports is $1,340 per ton ($67 per cwt). That’s down $90 per ton from the $1,450 per ton DDP the company offered last month for hot-rolled for February-March shipment.

Case in point: South Korean steelmaker Hyundai Steel’s latest offer for hot-rolled coil for March-April shipment DDP to Los Angeles-area ports is $1,340 per ton ($67 per cwt). That’s down $90 per ton from the $1,450 per ton DDP the company offered last month for hot-rolled for February-March shipment.

It’s also $140 per ton below SMU’s U.S. hot-rolled coil price, which currently stands at $1,480 per ton – or roughly on par with Hyundai offers in December.

Recall that South Korea agreed to a quota and so is not subject to the Section 232 tariffs of 25% that imports from many other nations face.

Imports offered now for March-April ship dates should arrive at U.S. ports around April-May assuming normal transit times. But delays are likely given a continued backlog of ships waiting to unload, market participants said. And most U.S. sources expect domestic prices to continue to fall – meaning that imports ordered at a competitive price today risk arriving at a higher price than future domestic numbers.

Still, in the meantime, here is another indication of how high U.S. prices are compared to those in the rest of the world: South Korean steelmaker Hi Steel is offering hollow structural sections (HSS) for April/May shipment at $1,570-1,600 per ton DDP Los Angeles – or around the high end of SMU’s HRC price range.

Hot-rolled coil is the raw material used to make steel tubing such as HSS. And the high end of SMU’s U.S. HRC price is $1,560 per ton. In other words, domestic tubers could in theory face raw material prices that are nearly as high as the landed price of the imported HSS they are competing against.

On the plate side, meanwhile, Hyundai is offering $1,500 per ton DDP base for A36 material for March/April shipment to LA/Long Beach, Calif. The price is lower, $1,470 per ton, for delivery to Houston or New Orleans.

Recall that steel delivered to West Coast ports is typically more expensive than tonnage delivered to the Gulf Coast.

Those pricing levels are unchanged from December offers. And they are higher than offers from Dongkuk Steel, one of Hyundai’s primary South Korean competitors.

Dongkuk is offering A36 base prices for February/early March shipment at $1,450 per ton DDP to LA/Long Beach and $1,400 per ton delivered to Houston.

The offers from both Hyundai and Dongkuk are hundreds of dollars per ton below current plate pricing from U.S. mills. SMU’s domestic plate price is at $1,825 per ton – $355 per ton above Hyundai’s price to the Gulf Coast and $425 per ton above Dongkuk’s offers.

In short, U.S. prices remain well above those in the rest of the world despite declining sheet tags and because of roughly steady plate pricing.

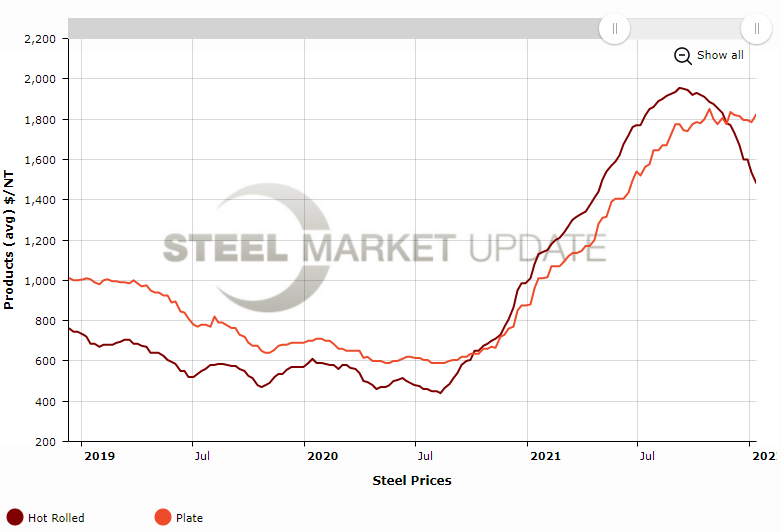

Another notable trend: Domestic plate prices, which were below HRC prices for most of 2021, have regained and widened their premium over sheet. The spread between the two products now, $345 per ton, is roughly on par with spreads in early 2019:

You can recreate that chart using our interactive pricing tool.

By Michael Cowden, Michael@SteelMarketUpdate.com