Prices

March 22, 2022

SMU Price Ranges & Indices: HRC Logs Another Week of Triple-Digit Gains

Written by Brett Linton

Steel prices continued to shoot upward at a breakneck pace as mills raced to keep ahead of spiraling raw material costs. Supply chain shocks caused by Russian forces’ invasion of Ukraine have led to higher pig iron prices, expectations of big gains in scrap prices next month – and all that comes on top of already ballooning costs for everything from fuel to zinc. SMU’s average hot-rolled coil price is at $1,400 per ton ($70 per cwt), up $140 per ton from $1,260 per ton last week. The increase, while enormous by historic standards, is less than what we saw last Tuesday, when we recorded our biggest week-over-week price gain ever. Despite the price shock, most sources reported stable or improving demand. Consumers previously on the side lines are now looking to buy ahead of further anticipated price hikes. And some – in an echo of market conditions last year – questioned whether steel might be in short supply in the months ahead. But others warned that lead times had not stretched out in tandem with the surge in prices and questioned whether demand was indeed strong enough to support such swift price gains. Increases were more modest on the coated side, where some sources reported greater import competition and a greater emphasis by mills on enforcing new, higher extras. On the plate side, stable prices were attributed in part to differing mill pricing structures – which were said to have effectively kept prices flat this week. Pricing momentum indicators for all products have remain at “higher” this week.

Hot Rolled Coil: SMU price range is $1,350-$1,450 per net ton ($67.50-$72.50/cwt) with an average of $1,400 per ton ($70.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $180 per ton compared to one week ago, while the upper end increased $100 per ton. Our overall average is up $140 per ton from last week. Our price momentum on hot rolled steel continues to point toward Higher prices over the next 30 days.

Hot Rolled Lead Times: 4-8 weeks

Cold Rolled Coil: SMU price range is $1,740-$1,900 per net ton ($87.00-$95.00/cwt) with an average of $1,820 per ton ($91.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $140 per ton compared to last week, while the upper end increased $100 per ton. Our overall average is up $120 per ton from one week ago. Our price momentum on cold rolled steel continues to point toward Higher prices over the next 30 days.

Cold Rolled Lead Times: 5-8 weeks

Galvanized Coil: SMU price range is $1,600-$1,800 per net ton ($80.00-$90.00/cwt) with an average of $1,700 per ton ($85.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to one week ago, while the upper end increased $60 per ton. Our overall average is up $30 per ton from last week. Our price momentum on galvanized steel continues to point toward Higher prices over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,697-$1,897 per ton with an average of $1,797 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 6-8 weeks

Galvalume Coil: SMU price range is $1,660-$1,870 per net ton ($83.00-$93.50/cwt) with an average of $1,765 per ton ($88.25/cwt) FOB mill, east of the Rockies. The lower end of our range increased $60 per ton compared to last week, while the upper end remained unchanged. Our overall average is up $30 per ton from one week ago. Our price momentum on Galvalume steel continues to point toward Higher prices over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,951-$2,161 per ton with an average of $2,056 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7-10 weeks

Plate: SMU price range is $1,850-$1,860 per net ton ($92.50-$93.00/cwt) with an average of $1,855 per ton ($92.75/cwt) FOB mill. The lower end of our range increased $50 per ton compared to one week ago, while the upper end declined $40 per ton. Our overall average is up $5 per ton from last week. Our price momentum on plate steel continues to point toward Higher prices over the next 30 days.

Plate Lead Times: 4-8 weeks

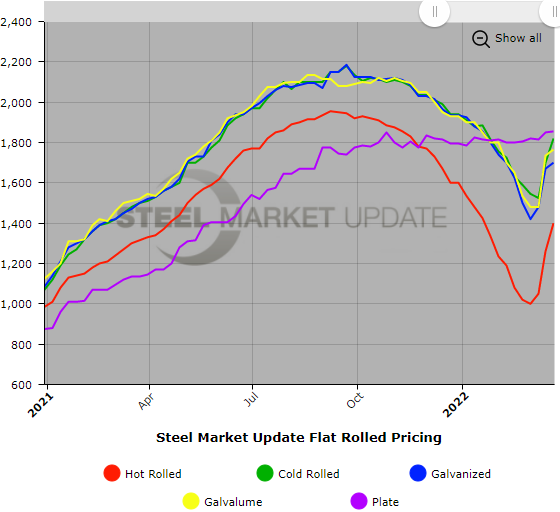

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.