Prices

July 19, 2022

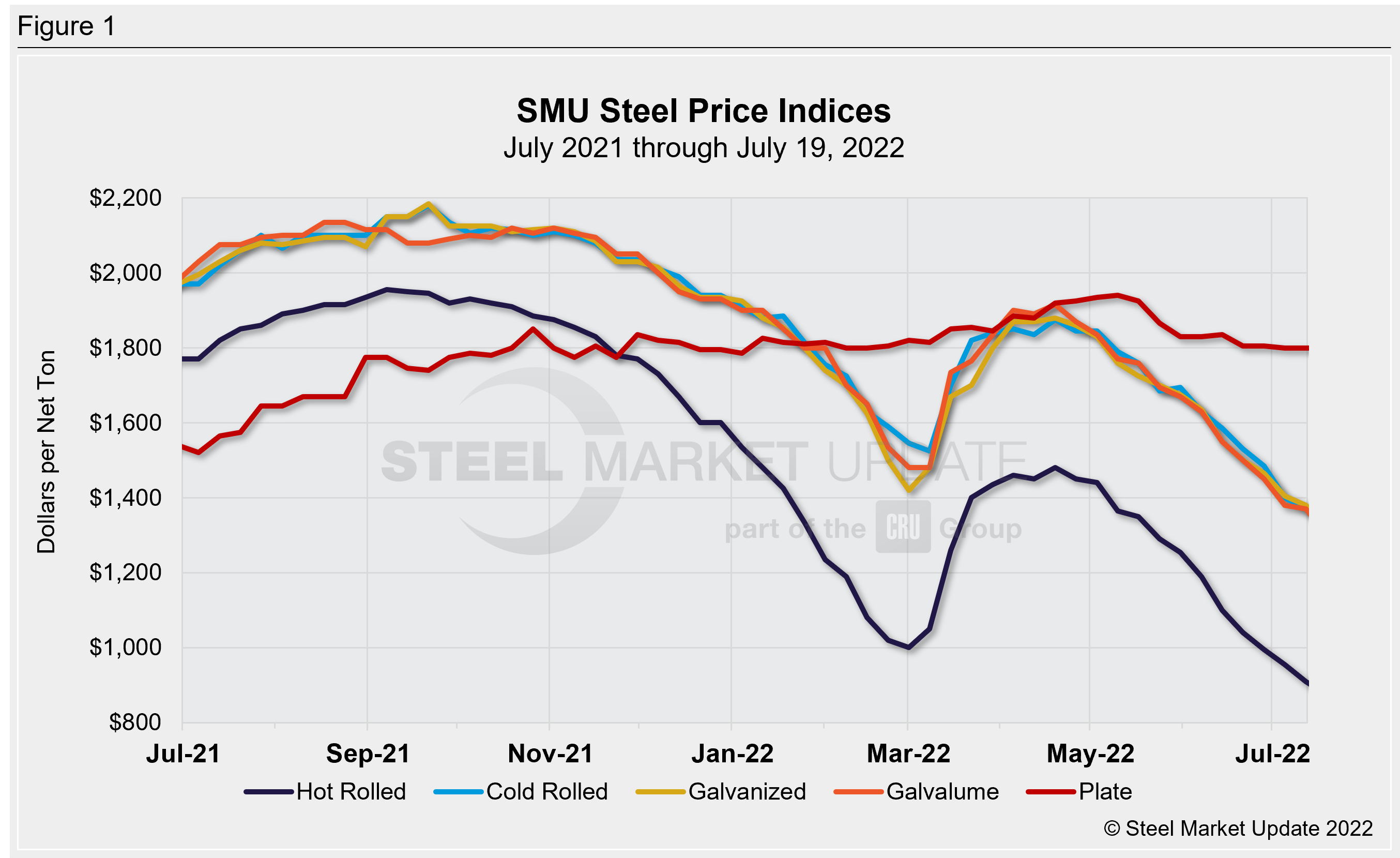

SMU Price Ranges: HR Dives Below $900/ton as Steel Seeks Floor

Written by Brett Linton

SMU’s average hot-rolled coil prices dropped below $900 per ton ($45 per cwt) for the first time since December 2020.

And some sources, citing short lead times and spotty demand, said they see little reason for the trend to reverse in the short term.

SMU’s hot-rolled coil prices now stand at $875 per ton ($43.75 per cwt), down $35 per ton from last week and down $605 per ton from a post-Ukraine war peak of $1,480 per ton.

HRC prices, in other words, have fallen an average of $46.50 per ton each week over that period.

While some market participants continued to report prices above $900 per ton, others said that prices in the low $800s per ton were widely available from domestic mills – and that it was not necessary to order thousand of tons to attract such prices.

Prices for cold rolled (down $50 per ton this week), galvanized (down $65 per ton) and Galvalume (down $70 per ton) came down even more sharply than those for hot band.

Plate prices remained flat despite continued drops in coil prices, although some market participants said it was only a matter of time before plate follows sheet downward.

SMU prices momentum indicators remain on Lower, meaning we expect prices to decline in the next 30 days.

Hot Rolled Coil: SMU price range is $800-950 per net ton ($40.00-47.50/cwt) with an average of $875 per ton ($43.75/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $40 per ton compared to one week ago, while the upper end decreased $30 per ton. Our overall average is down $35 per ton from last week. Our price momentum indicator on hot rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Hot Rolled Lead Times: 3-6 weeks* (preliminary ranges from our ongoing market survey, final lead times data will be released on Thursday)

Cold Rolled Coil: SMU price range is $1,230-1,410 per net ton ($61.50-70.50/cwt) with an average of $1,320 per ton ($66.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $70 per ton compared to last week, while the upper end decreased $30 per ton. Our overall average is down $50 per ton from one week ago. Our price momentum indicator on cold rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Cold Rolled Lead Times: 4-9 weeks*

Galvanized Coil: SMU price range is $1,220-$1,410 per net ton ($61-70.50/cwt) with an average of $1,315 per ton ($65.75/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $110 per ton compared to one week ago, while the upper end decreased $20 per ton. Our overall average is down $65 per ton from last week. Our price momentum indicator on galvanized steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,317-1,507 per ton with an average of $1,412 per ton FOB mill, east of the Rockies. Effective this week, we have decreased the galvanized extras used in our benchmark prices from $106 to $97 per ton, in response to the revised US Steel galvanized coating extras.

Galvanized Lead Times: 3-8 weeks*

Galvalume Coil: SMU price range is $1,200-1,400 per net ton ($60-70/cwt) with an average of $1,300 per ton ($65.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $140 per ton compared to last week, while the upper end remained unchanged. Our overall average is down $70 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,494-$1,694 per ton with an average of $1,594 per ton FOB mill, east of the Rockies. Effective this week, we have decreased the Galvalume extras used in our benchmark prices from $319 to $294 per ton, in response to the revised US Steel Galvalume coating extras.

Galvalume Lead Times: 4-8 weeks*

Plate: SMU price range is $1,740-1,860 per net ton ($87-93/cwt) with an average of $1,800 per ton ($90/cwt) FOB mill. Both the lower and upper ends of our range remain the same compared to one week ago. Our overall average is unchanged from last week. Our price momentum indicator on plate steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Plate Lead Times: 4-7 weeks*

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com