Plate

November 1, 2022

Plate Report: Prices Hold, Another Round of Declines Expected

Written by David Schollaert

US plate prices were unchanged this week — the first sideways move in nearly a month. Tags had been eroding slowly of late though buyers have remained largely on the sidelines of the spot market, focused on managing inventories.

Nucor’s $120-per-ton ($6-per-cwt) price cut on plate back in mid-September now serves as the top end of the market, with repeated deals from Midwest mills confirmed below the $1,600-per-ton mark. But buying is still hand-to-month and project-specific, sources told SMU.

“Not a lot of activity currently and I don’t think it’s going to improve in the future,” a source said. “No one is buying now except for orders and maybe conservatively buying inventory.”

And while current buying dynamics are limited due to the expectation that tags are likely to fall again in the near term, sources say additional price erosion is unlikely to spur buying.

“[Mills] don’t stand to gain anything by lowering pricing; it won’t generate more orders,” said another source. “We do expect the pressure on pricing to boil over but it’s going to be pretty quiet until then.”

“It is remarkable that plate prices are holding up well in light of the current environment,” a third source remarked. “Plate prices will come down and most likely pretty hard — just a matter of when.”

Despite the sentiment, the market almost unanimously agrees that everyone is waiting for Nucor to make its next price announcement. But any price decrease will likely just lower inventory values rather than generate business, sources have cautioned.

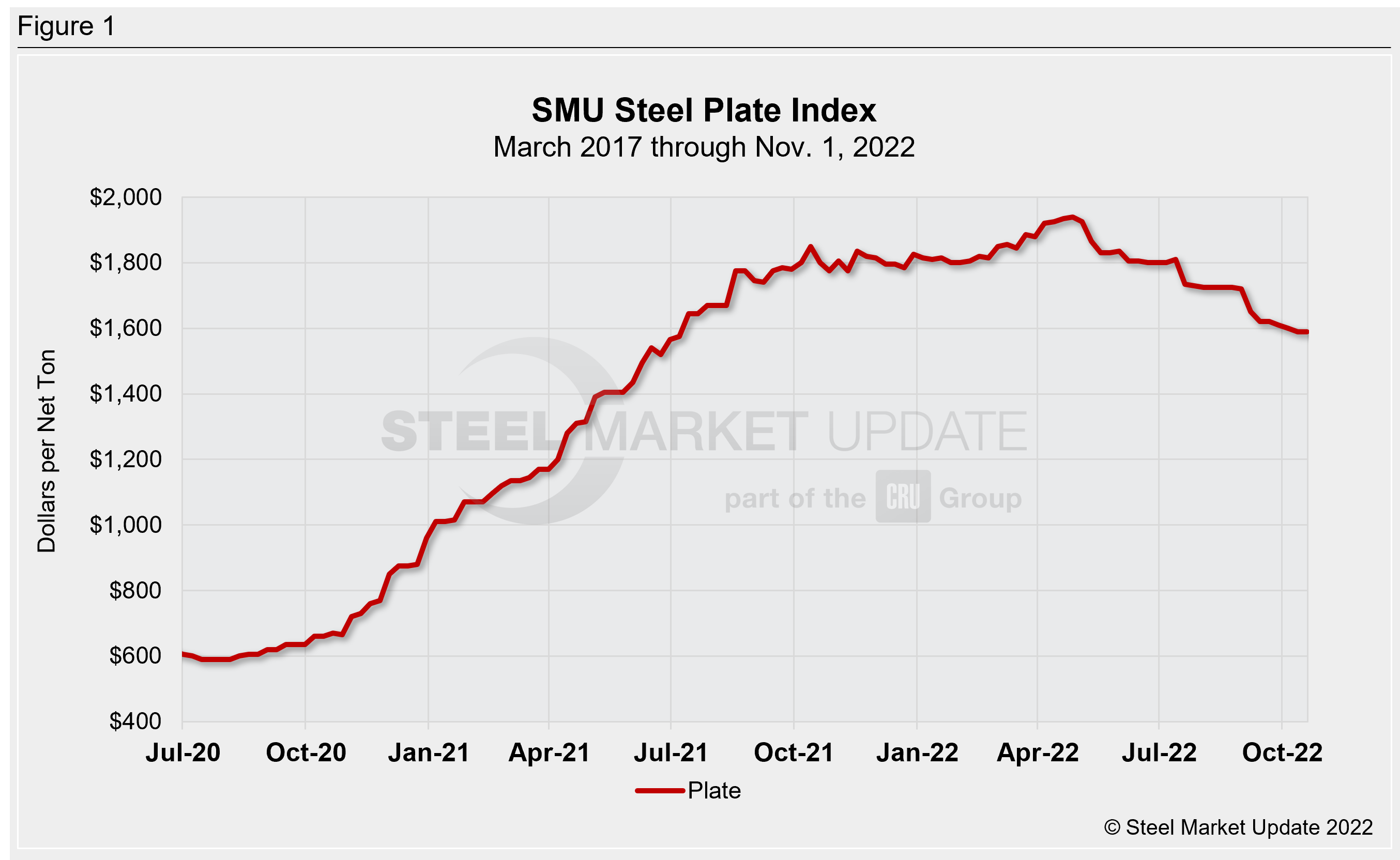

SMU’s most recent check of the market on Nov. 1 placed plate prices between $1,560 and $1,620 per ton with an average of $1,590 per ton FOB mill, according to our interactive pricing tool (Figure 1). No spot deals were confirmed at the top of the range, though Nucor’s stated price was repeatedly mentioned. The bulk of the market has been reporting sales below the $1,600 per ton mark for the past couple of weeks.

Mills have been dialing back their operating rates as demand has declined. Nucor said in its Q3 earnings that mills were running at 77% during the third quarter — down from 85% in Q2 — and present reports suggest plate mills might be sliding closer to the 60% mark.

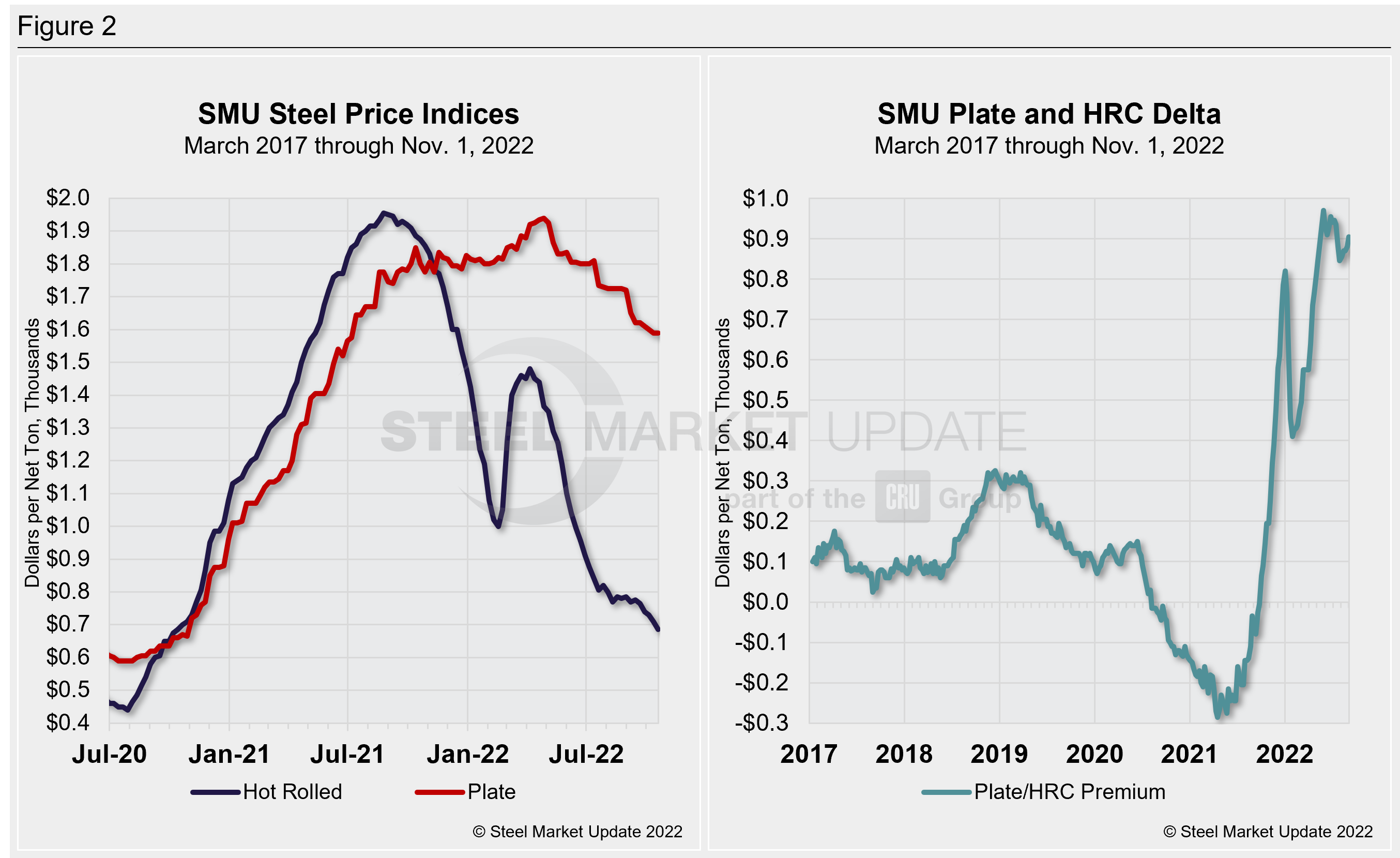

Also, while hot-rolled coil and plate have completely decoupled from each other — the delta is more than double and historically wide (Figure 2) — sources think the key to pricing going forward will still be scrap. And, despite a traditional correlation between HRC and plate, some sources think the two products are unlikely to move in tandem again as market dynamics diverge further.

SMU’s average HRC price now stands at $685 per ton, according to our latest check of the market on Nov. 1. Our overall average is down $25 per ton week-on-week. Prices have been trending down more recently after hovering in the mid-to-upper $700s per ton for nearly two months.

Another thing to keep an eye on are import prices. Current offers from South Korea are $1,370 per ton ($68.50/cwt) DDP West Coast for early first quarter 2023 ship dates. Though unlikely to cause domestic mills to chase business, they likely could take some share of the market should US prices remain near current levels.

Discrete plate lead times are still running at four weeks, but in some cases are even lower. Sources told SMU that some plate lead times are as short as 2–3 weeks.

By David Schollaert, David@SteelMarketUpdate.com