Mexico

November 4, 2022

Tenaris to Increase US OCTG Output After Trade Case Ruling

Written by Laura Miller

With the recent trade case decision resulting in antidumping duties placed on both seamless and welded oil country tubular goods (OCTG) imports, Tenaris plans to ramp up its OCTG production in the US as demand and pricing remain strong, according to company executives speaking on a third-quarter earnings conference call with analysts on Friday, Nov. 4.

Global tube producer Tenaris SA has been paying high duties on its OCTG shipments to the US since the preliminary ruling in May of this year. The duties impacting the Luxembourg-based company are 78.3% for shipments from Argentina and 44.93% for shipments from Mexico.

“As the largest producer and investor in the domestic industry, we find it difficult to understand these findings which contradict the evidence that domestic OCTG prices are at their highest ever level and that domestic producers are showing record results for their tubular businesses,” chairman and CEO Paolo Rocca commented on the call.

As a result of the high duties, Tenaris plans to increase its production levels in the US, Rocca said. With additional capacity ready to come online, the main issue at present is the lack of workers. As such, the company plans to accelerate its hiring, and is also looking at additional investment opportunities, Luca Zanotti, president of US operations, said.

Recall that during Q3, Tenaris consolidated its Canadian operations into a manufacturing hub in Sault Ste. Marie, Ontario, with an annual production capacity of 200,000 metric tons of ERW and 362,000 metric tons of seamless OCTG. Earlier in the quarter, it announced plans to purchase a 400,000-metric-ton seamless production facility from Benteler Steel & Tube Manufacturing Corp. And in January, it announced it would be boosting OCTG production at its welded mill in Hickman, Ark.

While economic growth is slowing globally, conditions in the energy sector and OCTG market are not, with global OCTG demand expected to surpass pre-Covid levels next year, the company said.

Tenaris’ Q3 sales were 6% higher sequentially on higher pricing despite lower shipments. North American sales of $1.761 billion were nearly double that of year-ago levels and accounted for 62% of Tenaris’ total sales. OCTG sales and pricing remain strong in both the US and Canada.

Q3 welded tube sales were very strong at 106,000 metric tons – this was 41% higher than Q2 and 49% higher than Q3 2021. Seamless tube sales volumes of 750,000 metric tons were down 8% sequentially and up 11% on-year.

Q4 sales are expected to be boosted by increasing shipments to pipeline projects, as well as higher prices.

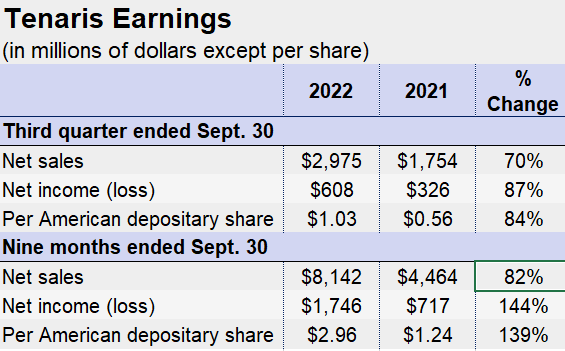

All told, Tenaris’ Q3 net income was 87% higher year-on-year at $608 million on 70% higher sales at $2.975 billion.

By Laura Miller, Laura@SteelMarketUpdate.com