Analysis

April 18, 2023

Final Thoughts

Written by David Schollaert

Has the domestic hot band pricing rally run its course? Data and market sentiment seem to suggest as much, and prices could indeed be heading down. Hot-rolled coil just slipped for the first time since late November, according to SMU’s latest check of the market.

I’m certainly not willing to speculate what will happen next, but several indicators have turned and are pointing lower. Lead times have contracted a bit, and we’ve seen a recent shift in mills’ willingness to negotiate lower prices as inventories have moved up.

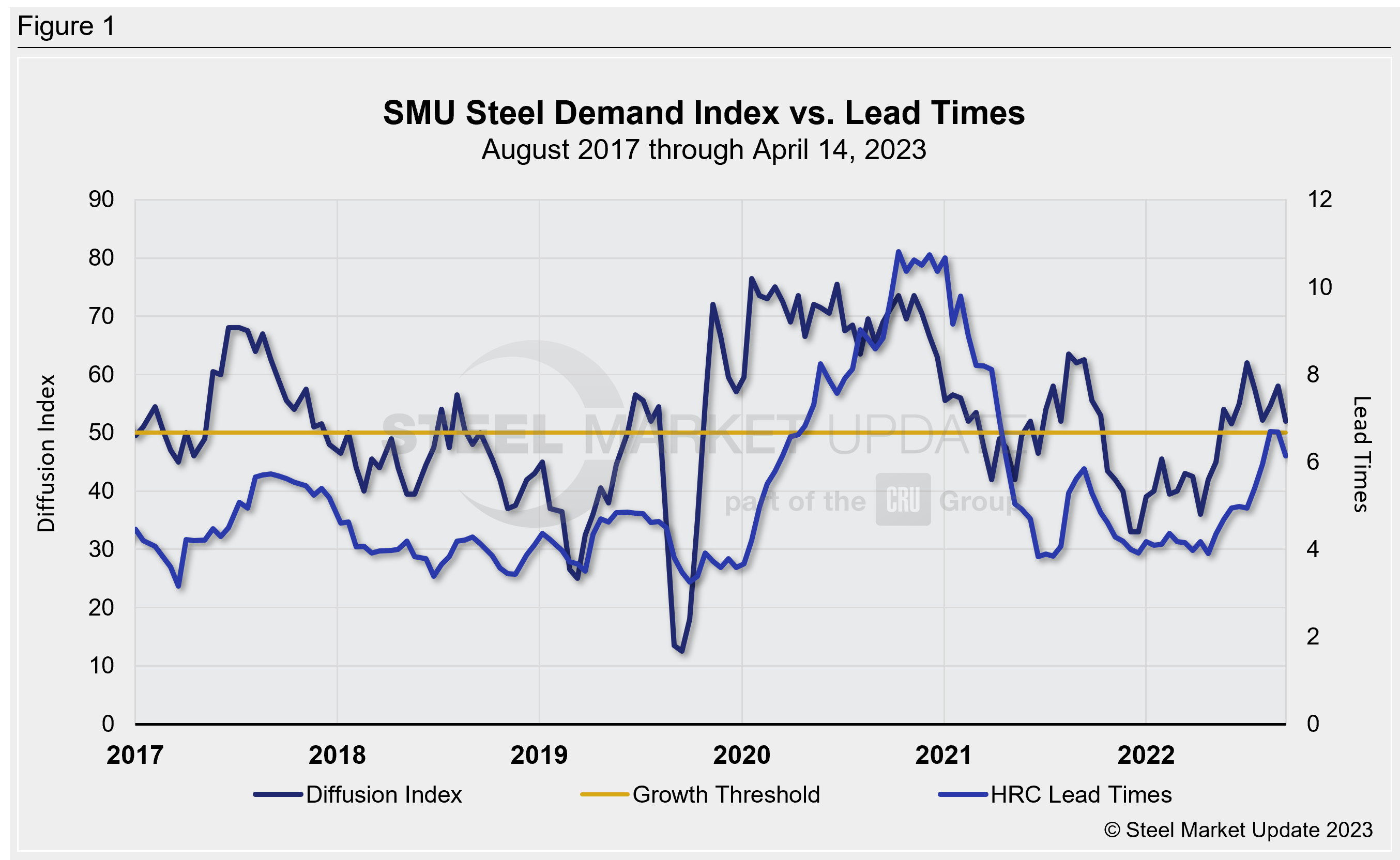

SMU’s Steel Demand Index also indicates apparent demand for flat-rolled steel in the US may have turned. The index is still above 50, which indicates improving demand. But it is down 6 points, the sharpest decrease since last September.

This indicator is worth monitoring as it compares lead times and demand, and is a diffusion index derived from our bi-weekly market surveys. This index has historically preceded lead times, which is notable given that lead times are often a leading indicator of steel price moves.

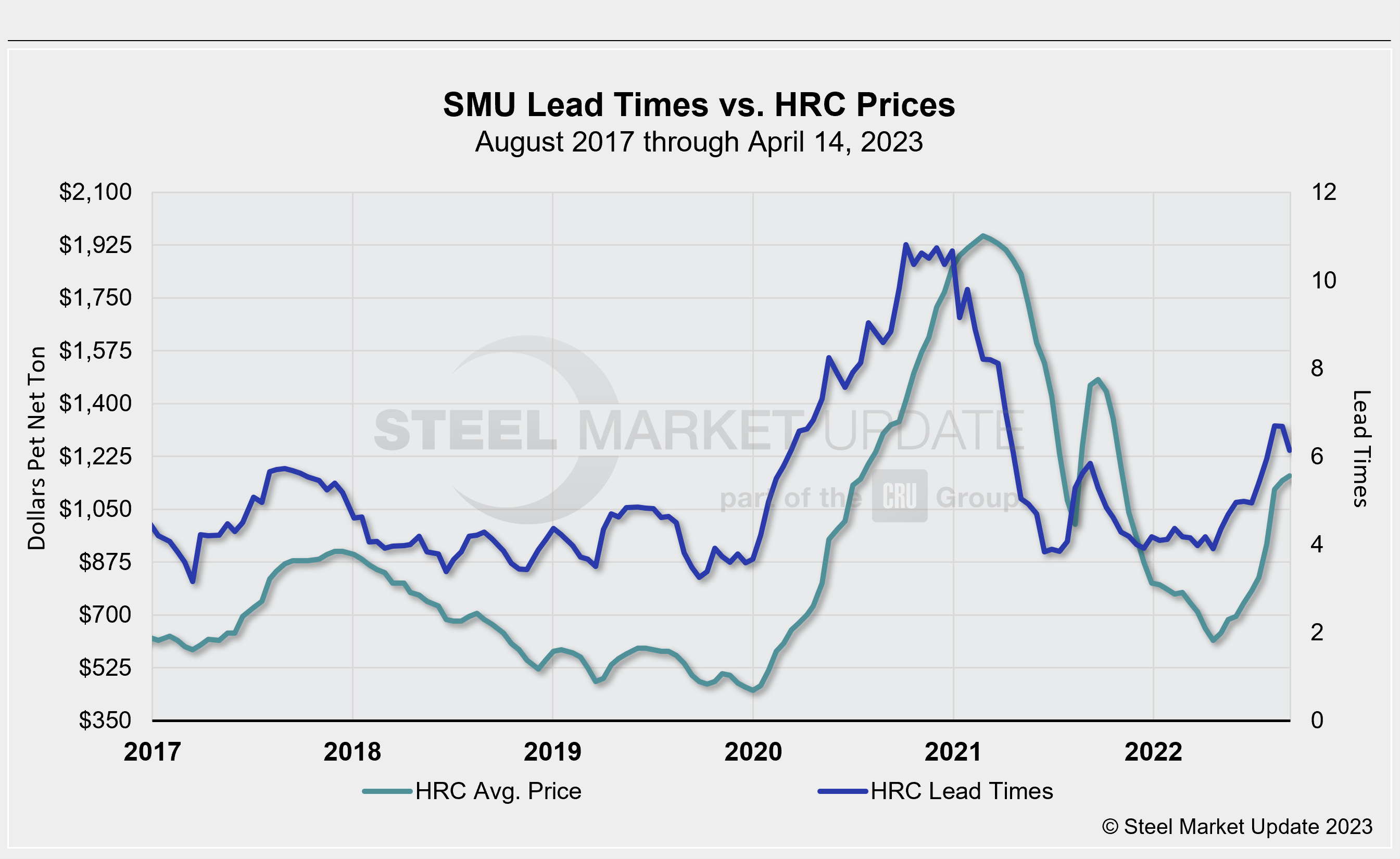

SMU’s demand diffusion index has, for nearly a decade, preceded moves in steel mill lead times. (Figure 1 shows the past five years.) Historically, SMU’s lead times have also been a leading indicator for flat-rolled steel prices, and HRC prices in particular. (Figure 2 features the past five years.)

Take a look at the data below. As noted above, an index score higher than 50 indicates an increase in demand and a score below 50 indicates a decrease.

Survey responses also have seemed to shift of late, with more than two-thirds of survey respondents in our latest flat-rolled market analysis saying that prices have already peaked or will peak this month.

There’s also been a noticeable shift in sentiment’s undertone over the past couple of survey results, potentially indicating the perceived pricing inflection is now here.

And while some sources continue to point to steady backlogs, many argue that core businesses are already starting to show signs of slowing, while specialty markets are the ones likely to see large backlogs.

Yet still many say there are far too many unknowns across the marketplace. These include the rapid increase in interest rates that will continue to take a toll on the economy, and steel demand as a proxy with new capacity ramping up.

Another thing to keep in mind while prices seem to be turning, and the latest run-up loses steam, is that prices are still historically high for current market conditions. There is now some concern that high-cost material could become a sore spot in a potentially falling market.

SMU Events: Introduction to Steel Hedging

In a volatile marketplace, learn to better manage the ebb-and-flow with steel futures. Consider attending our Introduction to Steel Hedging training course on April 26 at CME Group headquarters in Chicago. You can find out more and register here.

By David Schollaert, david@steelmarketupdate.com