Prices

June 6, 2023

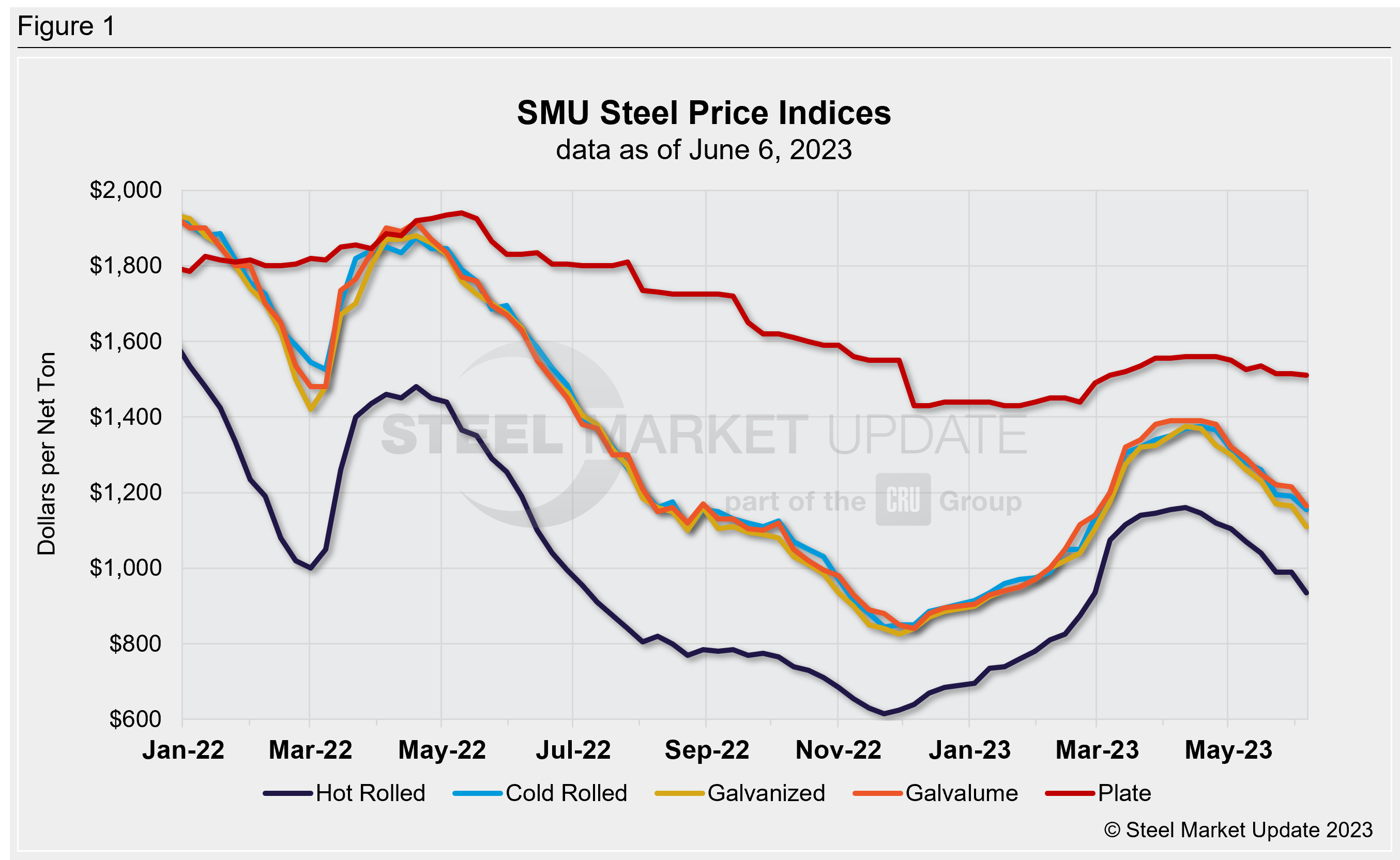

SMU Prices Ranges: Sheet Sees Biggest Declines Since June '22

Written by Michael Cowden

Sheet prices fell hard across the board this week as business ramped back up after Memorial Day.

Recall that prices were steady last week largely because of a lack of activity following the holiday.

SMU’s hot-rolled coil price now stands at $935 per ton ($46.75 per cwt), down $55 per ton a week ago and down $225 per ton from a 2023 high of $1160 per ton in mid-April.

That marks the sharpest drop since June 21, 2022, when HRC prices fell $60 per ton week over week as the price spike following Russia’s invasion of Ukraine subsided.

Value-added products also posted significant declines with cold-rolled down $35 per ton, galvanized down $55 per ton, and Galvalume down $55 per ton.

At least one mill lowered coating extras on the heels of lower zinc prices. Others are likely to follow, market participants said.

Sources said they expected sheet-price declines to continue on more intense competition from imports, as new capacity ramps up, and on substantial discounting for larger buyers.

While some said activity remained strong, others said requests for new business had slowed slightly.

Plate prices – despite chatter about discounting from published prices – remained largely steady at $1,510 per ton.

Our sheet price momentum indicator remains at lower. Our plate price momentum indicator continues to point sideways.

Hot-Rolled Coil: The SMU price range is $890–980 per net ton ($44.50–49.00 per cwt), with an average of $935 per ton ($46.75 per cwt) FOB mill, east of the Rockies. The bottom end of our range was down $70 per ton vs. one week ago, while the top end was down $40 per ton week on week (WoW). Our overall average down $55 per ton WoW. Our price momentum indicator for hot-rolled coil points downward, meaning we expect the market will be down over the next 30 days.

Hot-Rolled Lead Times: 4–8 weeks

Cold-Rolled Coil: The SMU price range is $1,100–1,210 per net ton ($55.00–60.50 per cwt), with an average of $1,155 per ton ($57.75per cwt) FOB mill, east of the Rockies. The lower end of our range was down $30 per ton WoW, while the top end was down $40 per ton compared to a week ago. Our overall average is down $35 per ton WoW. Our price momentum indicator on cold-rolled coil points downward, meaning we expect the market will be down over the next 30 days.

Cold-Rolled Lead Times: 5–10 weeks

Galvanized Coil: The SMU price range is $1,040–1,180 per net ton ($52.00–59.00 per cwt), with an average of $1,110 per ton ($55.50 per cwt) FOB mill, east of the Rockies. The lower end of our range was down $60 per ton vs. last week, while the top end of our range was down $50 per ton vs. one week ago. Our overall average is down $55 per ton vs. the prior week. Our price momentum indicator on galvanized steel points downward, meaning we expect the market will be down over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,137–1,277 per ton with an average of $1,207 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5–10 weeks

Galvalume Coil: The SMU price range is $1,136–1,185 per net ton ($56.75-59.25 per cwt), with an average of $1,160 per ton ($58.00 per cwt) FOB mill, east of the Rockies. The lower end of the range was down $55 per ton WoW, while the top end of the range was also down $55 per ton vs. the week prior. Our overall average is down $55 per ton when compared to one week ago. Our price momentum indicator on Galvalume steel now points downward, meaning we expect the market will be down over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,429–1,479 per ton with an average of $1,454 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6–10 weeks

Plate: The SMU price range is $1,450–1,570 per net ton ($72.50–78.50 per cwt), with an average of $1,510 per ton ($75.50 per cwt) FOB mill. The lower end of our range was down $10 per ton compared to the prior week, while the top end of our range was unchanged WoW. Our overall average was down $5 per ton vs. the prior week. Our price momentum indicator on steel plate moved to neutral, meaning we are unsure what direction prices will go over the next 30 days.

Plate Lead Times: 5–10 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

By Michael Cowden, michael@steelmarketupdate.com