Analysis

August 25, 2023

CRU: Mexico Increases Import Tariffs on Steel

Written by Diego Giangreco

The Mexican government has placed temporary levies of 25% on inward-bound shipments of steel products from countries with which it does not have a free trade agreement.

The steel goods are among the 483, including some aluminum, copper alloys, and nickel products, covered by the duties. Most levies are set at 25%, with some at 5%, 10%, or 15%, and are effective from Aug. 16, 2023, through July 31, 2024.

“With this measure, it is expected to benefit around 206,000 micro-, small- and medium-sized companies, which generate more than one million jobs,” economic minister Raquel Buenrostro Sanchez was quoted as saying in local media.

The economy ministry argues it “has the obligation to implement mechanisms that generate stability in domestic industrial sectors, to eliminate trade imbalance and to safeguard the balance of the global market in accordance with international law and commitments … [The tariffs will] provide certainty and fair market conditions to all vulnerable sectors, allow the national industry to recover and promote its development and support the internal market.”

Steel sector body Canacero said the measure will strengthen national output and help promote the integration of regional value chains, trade, industrialization, and job creation with the US and Canada through the USMCA trade pact.

Mexico’s steel makers expect to invest $4.2 billion in the coming months, following on from around $3.6 billion in the previous three years, in projects that will increase local production and favor substitution of imports.

Other now-protected sectors and goods include clothing, rubber, tires, chemicals, oils, soap, paper, cardboard, ceramics, glass, electrical equipment, and musical instruments.

Steel Sheet Import Offers to Become More Expensive in Mexico

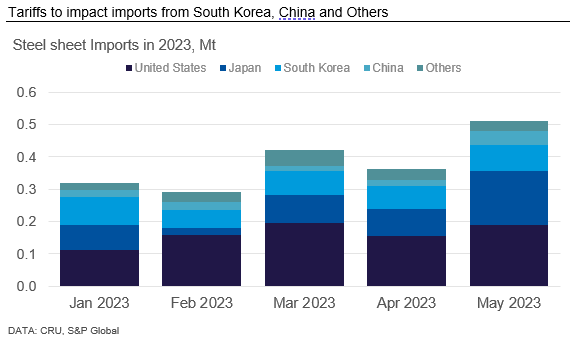

Mexico has historically relied on imports to supply its domestic steel demand. For steel sheets, last year’s net imports were equivalent to 40% of apparent demand. Looking at import figures from January to May 2023, the main exporters to Mexico were the US, Japan, South Korea, and China, accounting for around 90% of import volumes.

The Mexican government has recently increased steel products import tariffs to 25% for countries without trade deals with Mexico. The temporary levies are effective from Aug. 16, 2023, to July 31, 2025. As the country has trade agreements with the US and Japan, its main trading partners in terms of steel, this increase in tariffs will affect around 30~35% of current import volumes.

AHMSA, the largest integrated steel plant in Mexico, stopped production in December 2022 and still does not have a clear restart date. This has increased the need for imports in the country, which will persist until this mill resumes its production. Therefore, we expect to see an increase in imports from Japan and the US as well as higher prices domestically.