Government/Policy

December 29, 2023

Imports fall to year low in November

Written by Laura Miller

November’s preliminary count shows US imports falling, but to a lesser degree than an earlier license count had suggested, according to the latest government figures.

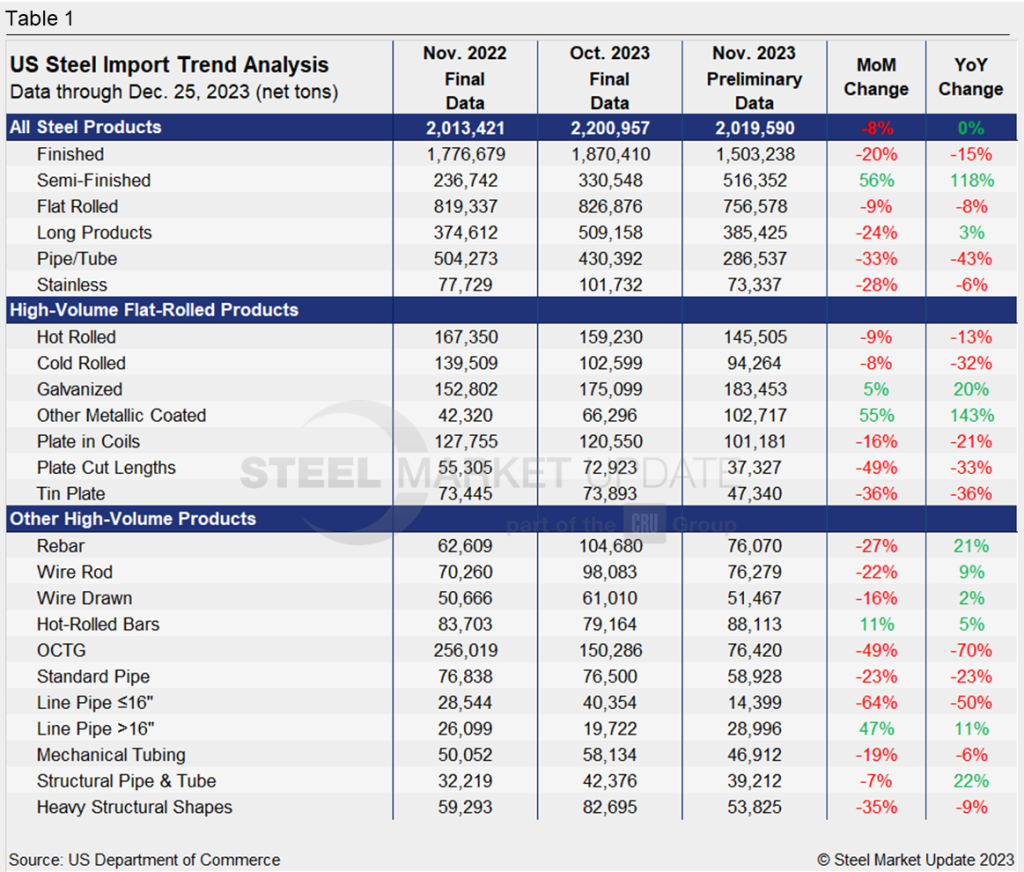

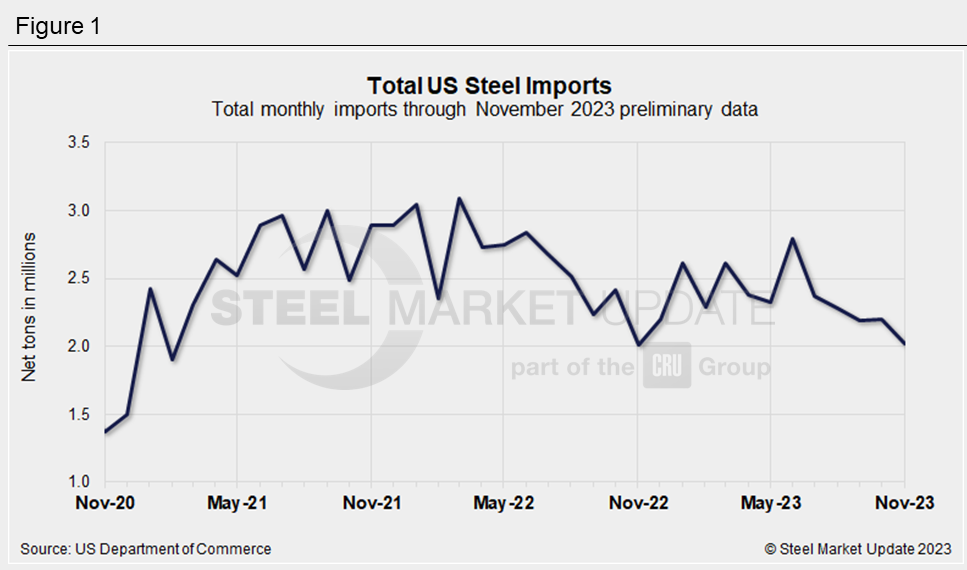

A license tally earlier in December had suggested that steel imports fell to a 33-year low in November. But November’s preliminary import count of 2,019,590 net tons was just barely higher than November 2022’s count of 2,013,421 tons. Thus, November’s imports were at a 12-month low (Figure 1).

Compared to the month prior, however, November imports were down 8%.

Imports as a 3MMA

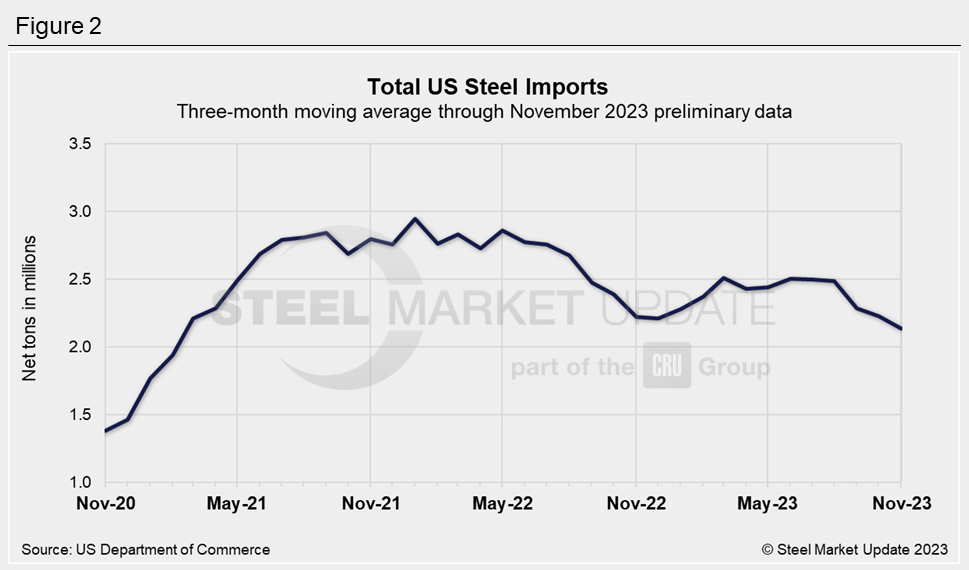

We can look at imports on a three-month moving average (3MMA) basis to smooth out the variability in monthly readings. The 3MMA has been falling notably since August (Figure 2).

November’s import slowdown brought the 3MMA down to a 33-month low of just over 2,137,400 tons.

Semi-finished and finished steel

After dropping in October, imports of semi-finished steel bounced back in November thanks to a rebound in slab shipments from Brazil. Total semi imports reached 516,352 tons in November.

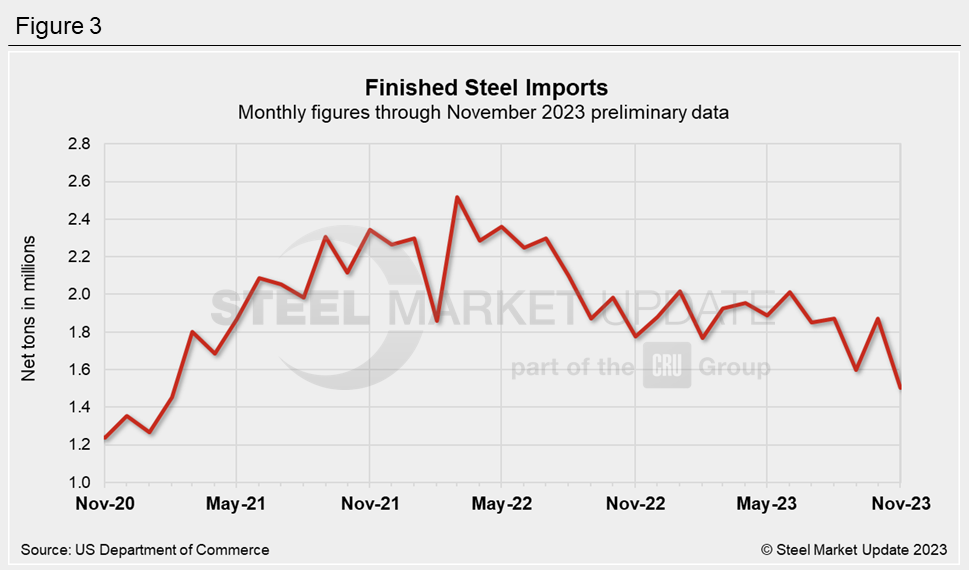

Finished steel imports, meanwhile, fell to a 33-month low of 1,503,238 tons in November (Figure 3).

The American Iron and Steel Institute (AISI) estimates the finished steel import market share to be 19% in November and 21% in the first 11 months of 2023.

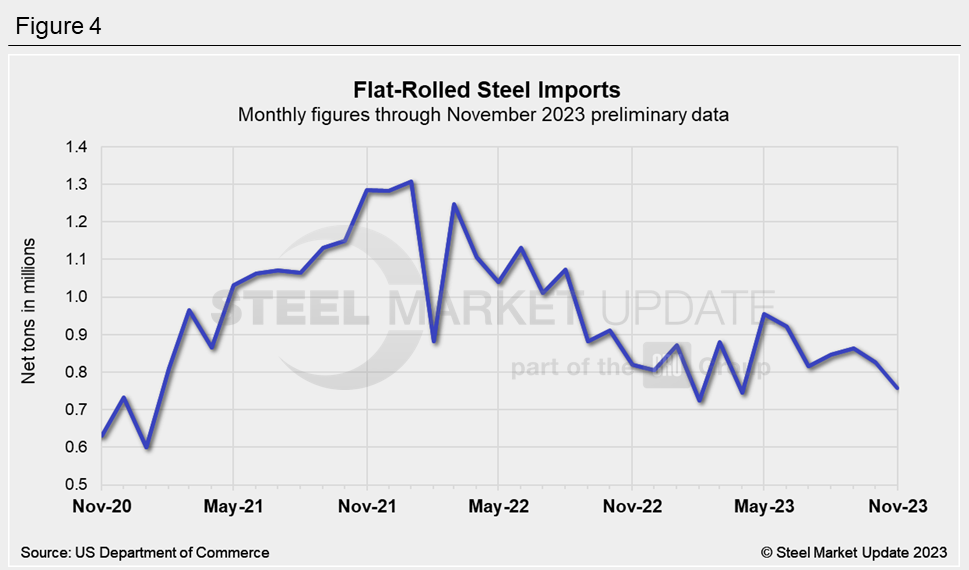

Flat-rolled steel

Flat-rolled steel imports were at a seven-month low of 756,578 tons in November.

Imports of hot-dipped galvanized sheet – the most imported flat-rolled product – rose 4.8% month on month to 183,453 tons. Hot-rolled sheet and cold-rolled sheet imports were also at seven-month lows of 145,505 tons and 94,264 tons, respectively. All-other metallic coated sheet products, meanwhile, jumped in November to a three-month high of 102,717 tons.

Cut-to-length plate imports of 37,327 tons were at an 11-month low. Coiled plate imports totaled 101,181 tons in November.

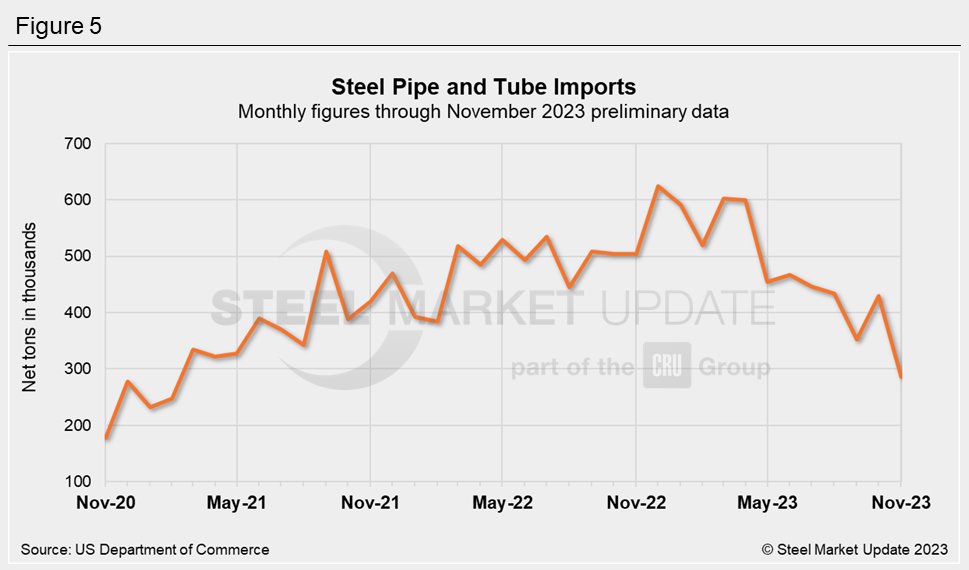

Pipe & tube

Pipe and tube imports were also at a 33-month low of 286,537 tons, with the majority of categories showing declines.

OCTG imports fell to a three-year low of 76,420 tons in November on fewer shipments from most major suppliers, including South Korea, Canada, Thailand, Mexico, and Japan.

Imports by product

The chart below provides further detail into imports by product, highlighting high-volume steel products.

As detailed below, there were many month-on-month and year-on-year declines in November. Increases of note can be seen in semi-finished steel, galvanized sheet, other metallic coated sheet, hot-rolled bars, and line pipe greater than 16” in diameter.