Prices

January 23, 2024

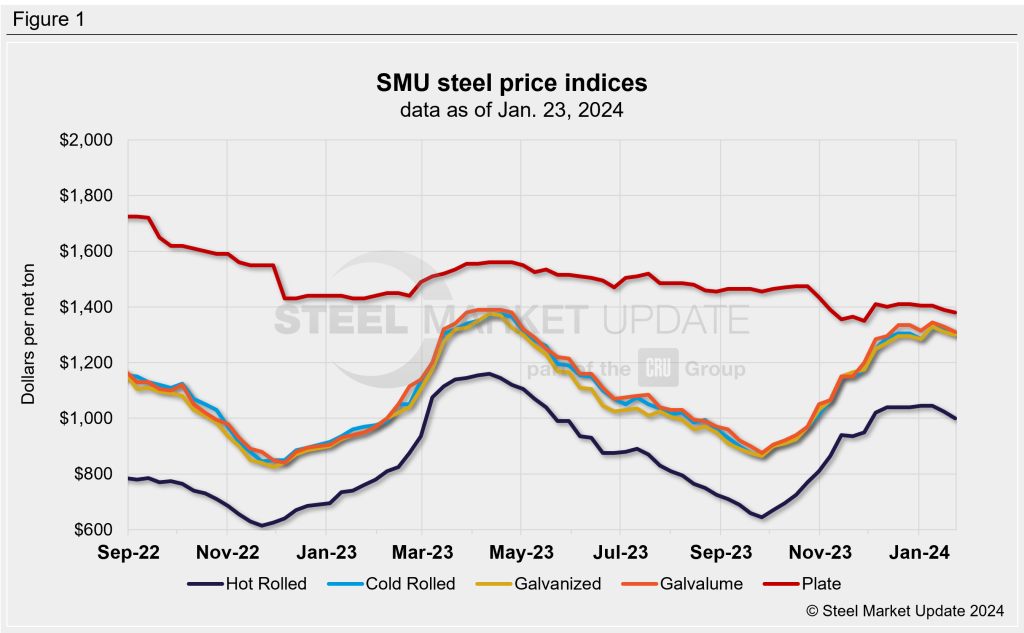

SMU price ranges: HR falls again, tandem products hold up slightly better

Written by David Schollaert & Michael Cowden

Domestic sheet prices slipped again this week, marking the first week of consecutive declines for hot-rolled (HR) coil since September.

SMU’s HR price now stands at $1,000 per short ton (st) on average, down $25/st from last week and down $45/st from the start of the year.

Prices for tandem products held up slightly better. CR was at $1,305/st on average (down $20/st from last week), galvanized base prices were at $1,300/st on average (down $10/st), and Galvalume base prices were at $1,310/st on average (down $20/st).

While some sources said CR and coated prices would follow HR lower, others said that they were seeing little, if any, weakness in prices for tandem products.

“Hot rolled is the weak sister, no doubt about it.” one industry source said. “But our coated business is very, very buoyant.”

“Tandem products look like they will remain strong – and Galvalume is strong through at least the first half,” a second source predicted.

Why the discrepancy between the outlooks for HR and those for CR and coated?

One theory: Delays on the Panama Canal have slowed import arrivals for CR and coated product from suppliers in East and Southeast Asia. Meanwhile, tensions in the Red Sea have delayed containerized shipments of light-gauge galv from the Middle East.

Another: Several mills continue to struggle with production issues on CR and coating lines. When that happens, big automotive customers tend to be prioritized over smaller spot buyers. Those downstream production issues, meanwhile, probably mean that affected mills have more HR than anticipated to sell – resulting in lower prices for HR and firmer pricing for CR and coated.

SMU’s price momentum indicators, however, continue to point lower. Because even if tandem products are holding up better than HR, prices in general continue to inch downward.

Hot-rolled coil

The SMU price range is $950–1,050 per st, with an average of $1,000/st FOB mill, east of the Rockies. The bottom end of our range was down $20/st vs. one week ago, while the top end of our range was down $20/st week on week (w/w). Our overall average has, as a result, declined $25/st w/w. Our price momentum indicator for HRC has shifted from neutral to lower, meaning SMU expects prices will move lower over the next 30 days.

Hot rolled lead times: 6–8 weeks

Cold-rolled coil

The SMU price range is $1,270–1,340/st, with an average of $1,305/st FOB mill, east of the Rockies. The lower end of our range was $30/st lower vs. the prior week, while the top end of our range was down $10/st w/w. Our overall average, as a result, is down $20/st when compared to last week. Our price momentum indicator for CRC has shifted from neutral to lower, meaning SMU expects prices will move lower over the next 30 days.

Cold rolled lead times: 6–12 weeks

Galvanized coil

The SMU price range is $1,260–1,340/st, with an average of $1,300/st FOB mill, east of the Rockies. The lower end of our range was down $20/st vs. the prior week, while the top end of our range was unchanged. Thus, our overall average is $10/st lower vs. the week prior. Our price momentum indicator for galvanized has shifted from neutral to lower, meaning SMU expects prices will move lower over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $1,357–1,437/st with an average of $1,397/st FOB mill, east of the Rockies.

Galvanized lead times: 6-11 weeks

Galvalume coil

The SMU price range is $1,260–1,360/st, with an average of $1,310/st FOB mill, east of the Rockies. The lower end of our range was $40/st lower vs. the prior week, while the top end of our range was unchanged. Our overall average is down $20/st when compared to the week prior. Our price momentum indicator for Galvalume has shifted from neutral to lower, meaning SMU expects prices will move lower over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,554–1,654/st with an average of $1,604/st FOB mill, east of the Rockies.

Galvalume lead times: 6-15 weeks

Plate

The SMU price range is $1,330–1,430/st, with an average of $1,380/st FOB mill. The lower end and the top end of our range were down $10/st w/w. Our overall average is down $10/st vs. one week ago. Our price momentum indicator for plate has shifted from neutral to lower, meaning SMU expects prices will move lower over the next 30 days.

Plate lead times: 4-7 weeks

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

David Schollaert

Read more from David Schollaert