Analysis

February 18, 2024

Final thoughts

Written by Michael Cowden

Everyone knows the old saying that “a picture is worth a thousand words.” Just because it’s a cliché doesn’t mean that it’s wrong.

A lot of ink has been spilled trying to figure out why prices are falling now. I thought it might be as simple as this: Market dynamics in the fourth quarter (UAW strike, companies buying ahead of an anticipated post-strike price spike, etc.) pulled forward restocking activity that typically happens in the first quarter.

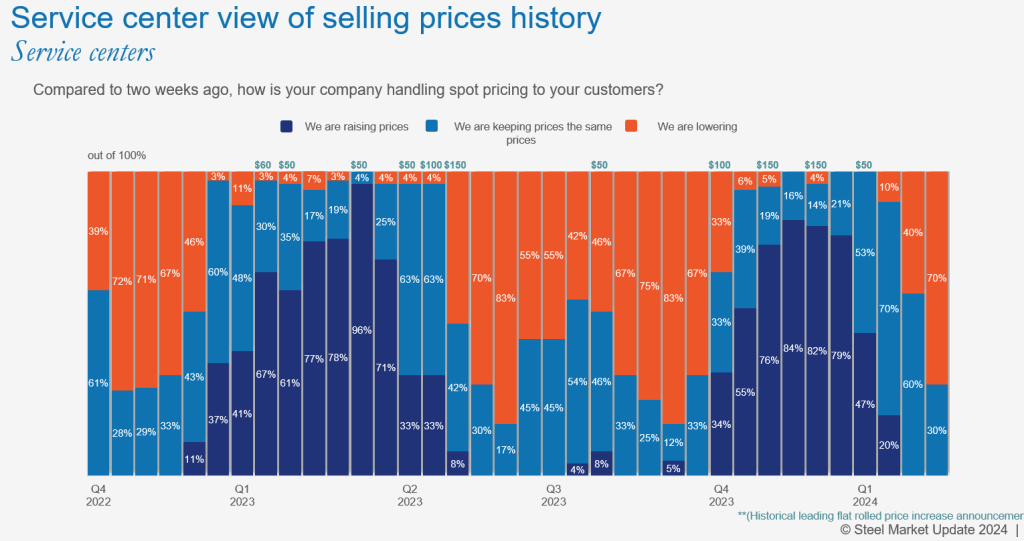

I’d also thought that was maybe a little too simple. But the chart below, on service center prices, supports that hypothesis:

We don’t track service center pricing in absolute terms. We track it directionally. The dark blue bars represent service centers increasing pricing. The light blue bars represent them holding pricing steady. And the orange bars represent centers decreasing prices. We also note leading mill price increase announcements above those bars.

A tale of two restocks

If service center prices are a good indicator, one restock began late in 2022. Service centers began to raise prices late in Q4’22. This was after prices fell to $615 per short ton (st) on average around Thanksgiving of that year, according to SMU’s pricing archives. Cleveland-Cliffs subsequently a announced a price hike, one that was soon followed by other mills. (Our price increase calendar is useful for keeping track of those. It’s here.) The gains accelerated into Q1’23.

But by early Q2’23, and despite continued mill price increases, service centers were mostly holding prices steady. And before long, the pendulum had swung the other way with mills and service centers decreasing prices. (There were of course no price decrease announcements from sheet mills. Because in sheet, unlike in plate, prices never officially fall.)

That approximately quarter-long price upswing might normally have represented the big restock for 2023. Instead, we saw one more.

Service centers started increasing prices in Q4’23 – just after hot-rolled (HR) coil prices fell to a 2023 low of $645/st on average in late September. They continued to raise prices throughout the fourth quarter. But the pace of gains slowed down early in the first quarter, despite a price increase by Cliffs. Service centers briefly held prices steady. But, more recently, we’ve seen service centers decreasing prices along with domestic mills.

To recap, we saw one restock in Q1’23 and another, one that was pulled forward, in Q4’23. With demand stable, and with sheet inventories high compared to last year, it’s not obvious (at least to me) where another round of sharply higher prices might come from.

Where do prices go from here?

Take a look at Laura Miller’s ‘Market Chatter’ article, which also pulls out some highlights from our latest steel market survey. Almost no one thinks prices will bottom this month. And more than half don’t think the market will find a floor until Q2.

Also, nearly two-thirds think that HR prices in mid-April will be below $900/st, with 23% predicting numbers in the $700s/st. We didn’t give folks an option to predict prices in the $600s. But some alluded to that in comments they left with us.

Generally speaking, the consensus seems to be that post-pandemic prices have a higher floor than pre-pandemic prices. And, as best as I can tell, that has been interpreted to mean that prices won’t fall into the $600s/st. That said, we’ve seen two price floors in the $600s per ton – as noted above, a 2023 low of $645/st last September and a 2022 low of $615/st on average in November of that year.

I don’t think we’ll see prices for standard spot buys fall into the $400s or $500s/st as we did before the pandemic. But why couldn’t we see HR prices fall, at least briefly, into the $600s/st again – especially if scrap continues to move lower? To be clear, I’m not predicting that. And I’d be curious to hear your thoughts.

SMU Community Chat

Don’t miss our next Community Chat on Wednesday, Feb. 21, with Mercury Resources CEO Anton Posner.

We’ll talk about the fighting on the Red Sea, the drought on the Panama Canal, and what that means for global supply chains. We’ll talk about issues closer to home as well – from truck and rail to how inland barges have dealt with fluctuating water levels on the Mississippi River.

You can register here.