Market Data

March 12, 2024

January steel exports rebound from previous month’s low

Written by Brett Linton

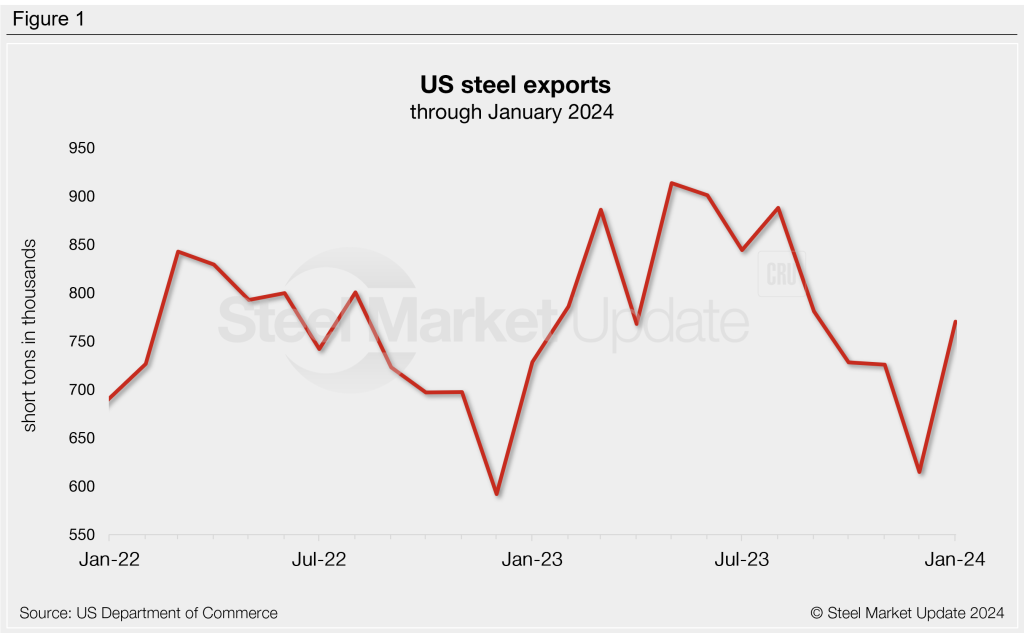

US steel exports jumped to 770,649 short tons (st) in January, rising 25% from the 12-month low recorded one month prior. This is the highest monthly export rate since September 2023, according to the latest US Department of Commerce data.

Monthly averages

Looking at exports on a 3-month moving average (3MMA) basis can smooth out the monthly fluctuations. Shipments had trended downward throughout the second half of 2023, reaching an 11-month low in December. The 3MMA changed course as it entered the new year, now averaging 703,734 st through January.

Exports can be annualized on a 12-month moving average (12MMA) basis to further dampen month-to-month variations and highlight historical trends. From this perspective, steel exports have overall trended upwards since mid-2020. January’s 12MMA figure surpassed 800,000 st, now the highest 12MMA recorded since October 2018.

Exports by product

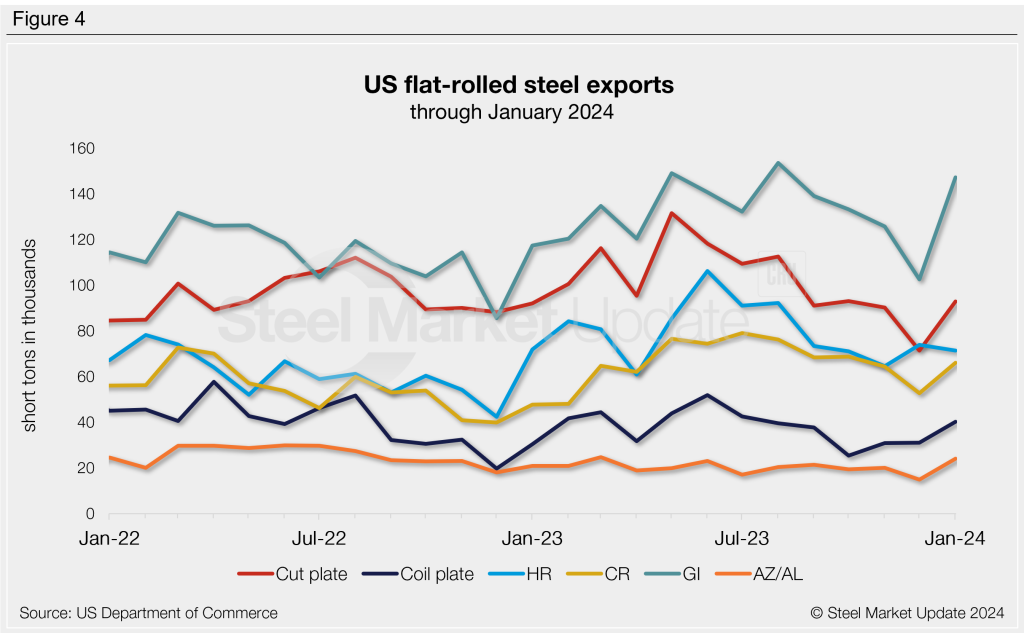

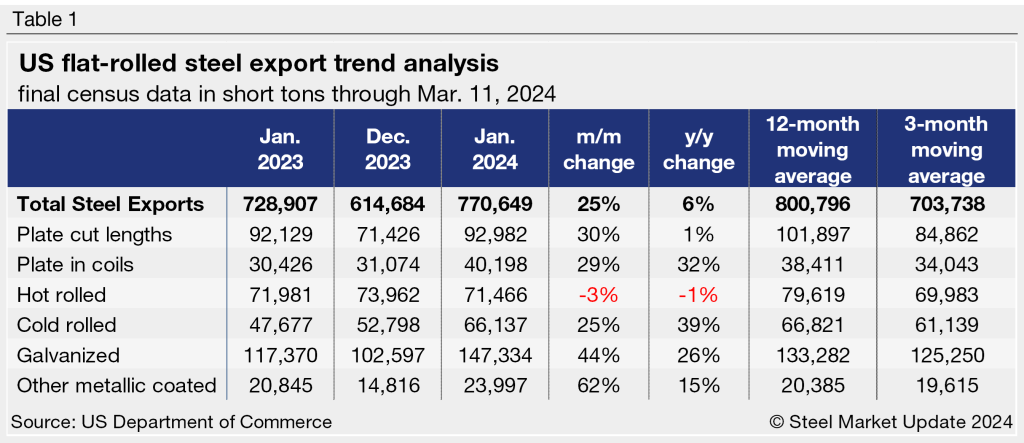

Exports of all major flat-rolled steel products showed significant month-on-month (m/m) increases from December to January, except for hot-rolled sheet, which declined 3%.

Notable year-on-year (y/y) increases were seen in exports of cold-rolled sheet, plate in coils, galvanized sheet, and other-metallic-coated products, with each up between 15-39%.

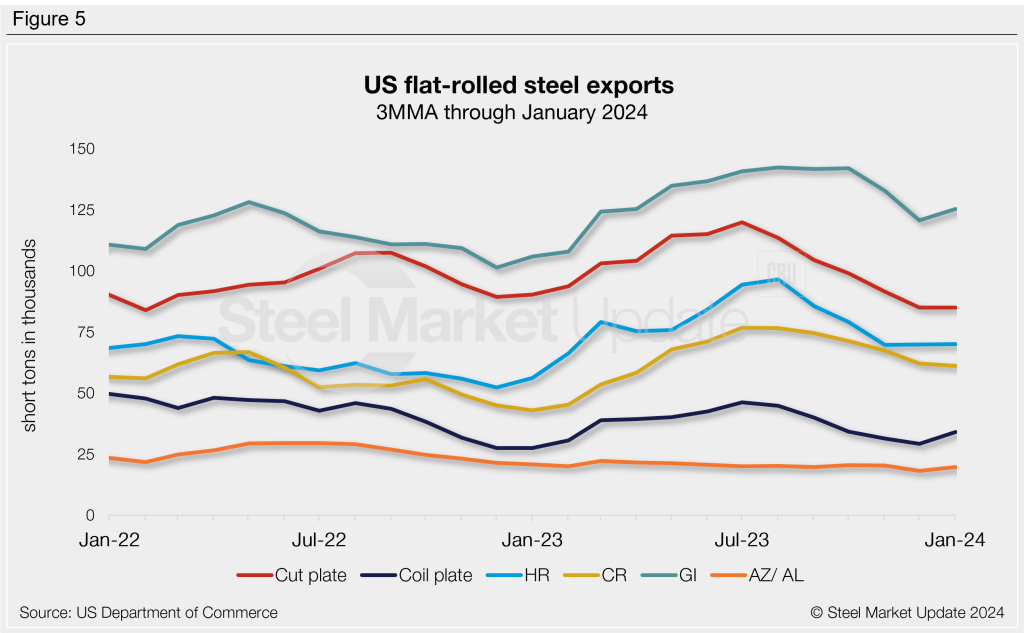

On a 3MMA basis, January saw trend reversals in galvanized sheet, plate in coils, and other-metallic-coated products, with increasing trade levels for each product. The remainder (cut plate, hot-rolled sheet, and cold-rolled sheet) were relatively unchanged from the month prior.

Note that most steel exported from the US is destined for USMCA trading partners Canada and Mexico.