Analysis

March 22, 2024

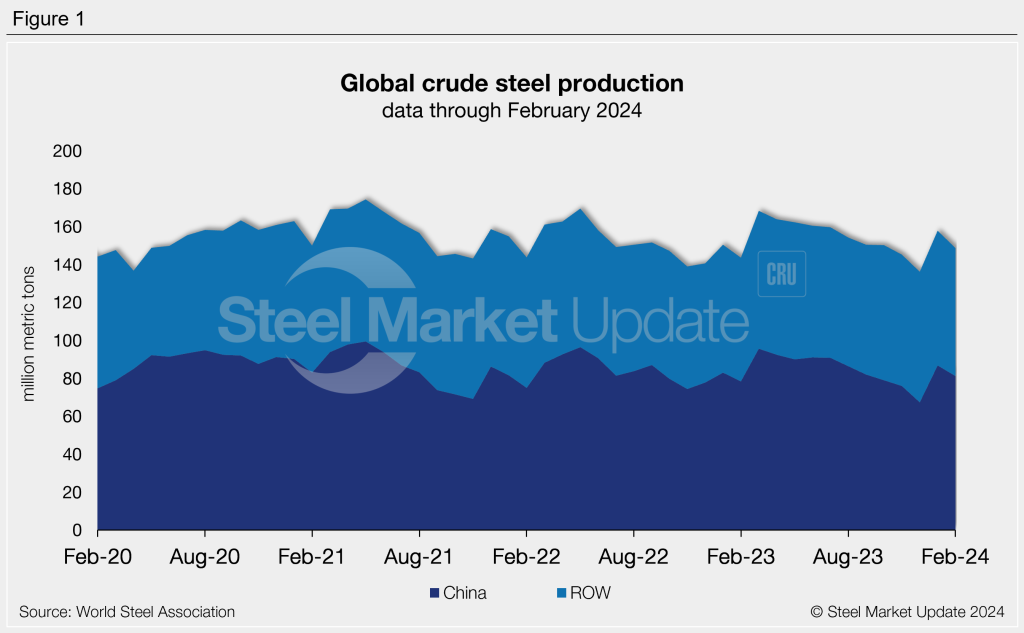

Global steel production falls in Feb following Jan surge

Written by Brett Linton

World steel output slipped in February, according to World Steel Association’s (worldsteel) latest monthly report. With the exception of January’s surge, monthly production levels have declined 10 out of the past 11 months.

Steel mills around the world produced 148.8 million metric tons (mt) of steel in February. This is 5.8% less than the 158.0 million mt produced the month before, but 3.7% greater than the same month one year prior.

On a daily basis, production averaged 2.8 million mt per day in February, unchanged from January. Daily production was marginally higher the same month one year ago at 2.804 million mt. Recall that this daily rate had reached a near seven-year low back in December of 2.174 million mt.

Regional breakdown

China, the world’s top steel maker, produced 81.2 million mt in February. Despite the 6.5% decrease m/m, China’s production was up 3.4% year on year (y/y). February’s output was the fourth-lowest monthly rate seen over the past year. Chinese production represented 54.6% of the world’s total output in February, down from 54.9% in January and 54.7% in February 2023.

Meanwhile, steel output in the rest of the world (row) also eased 5.1% month on month (m/m). Production in these regions totaled 67.6 million in February, up 3.8% y/y.

Looking at production by country, Indian mills held the number two spot in February, producing 11.8 million mt of steel. Next up was Japan at 7.0 million mt, followed by the US, Russia, and South Korea, all in the 5-6 million mt range.