Government/Policy

July 10, 2024

Licenses to import steel tumble in June

Written by Laura Miller

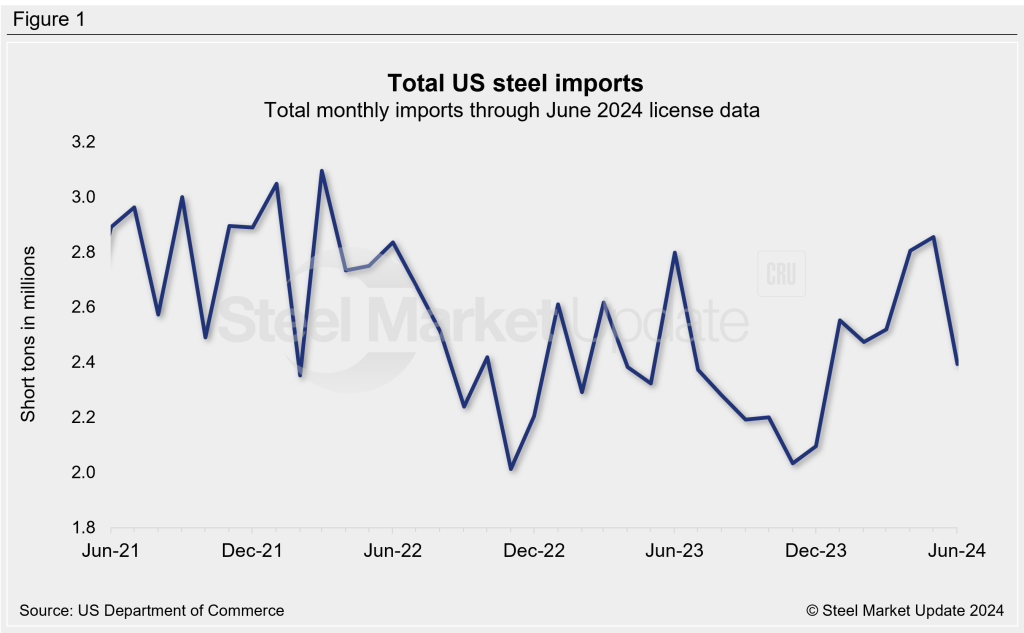

US steel imports registered a steep decline from May, with June licenses falling to the lowest monthly level so far this year.

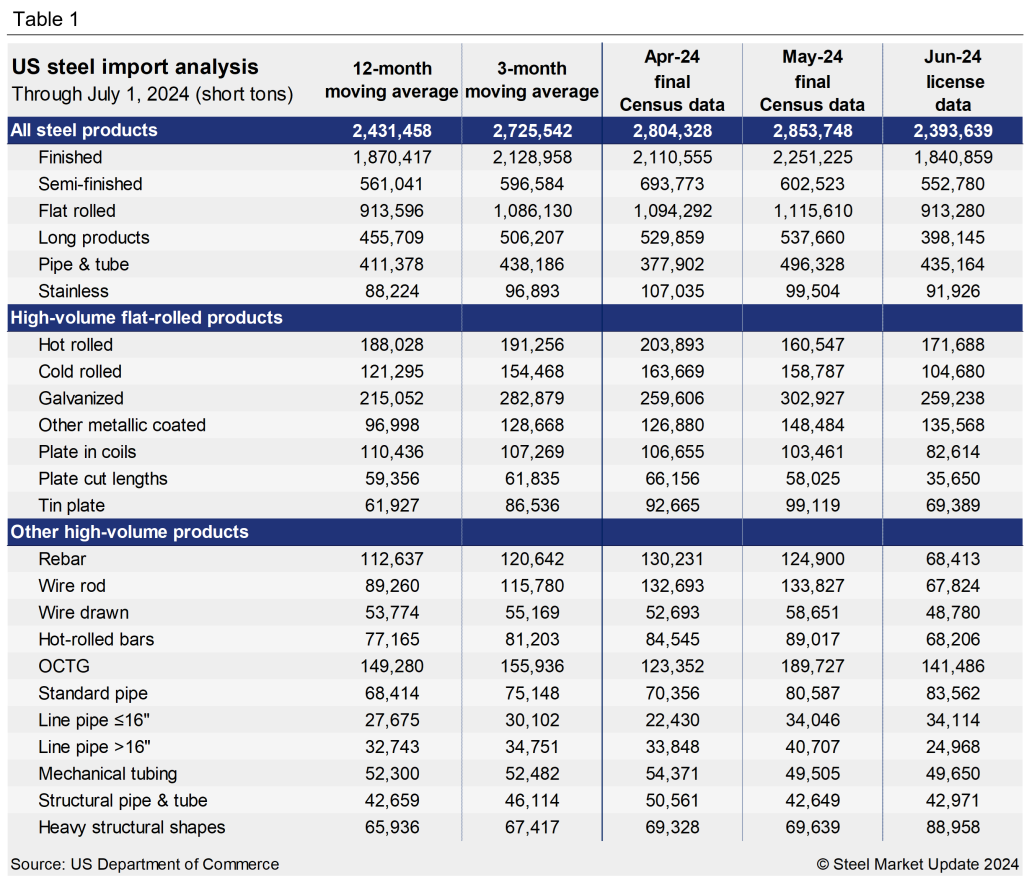

Figures from the US Department of Commerce show 2,393,640 short tons (st) of steel import licenses registered for the month of June. That’s a 16% drop from May’s 26-month high of 2,853,750 st.

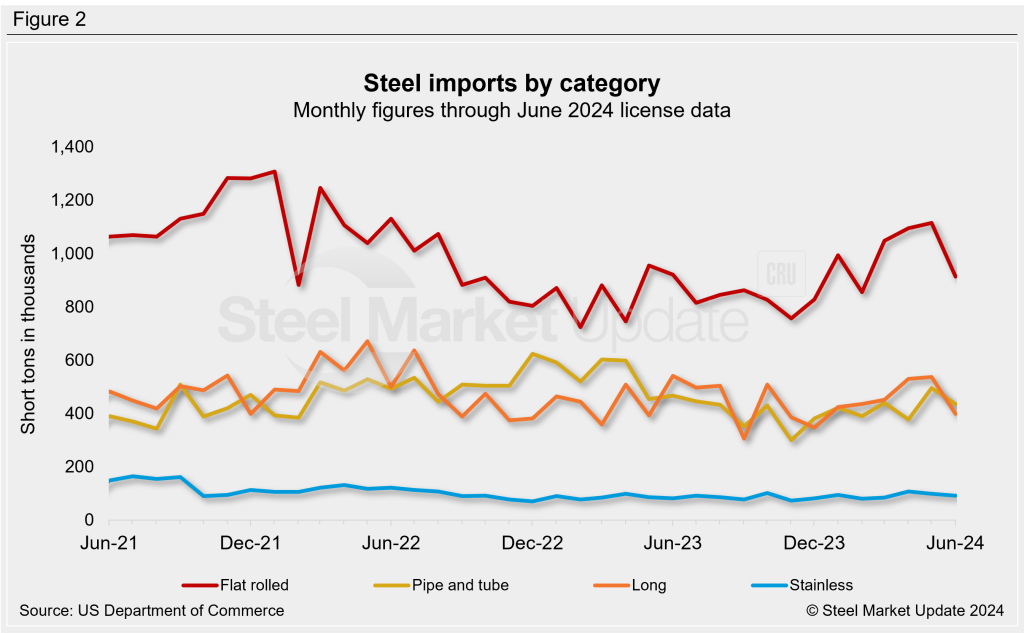

Monthly declines were seen in all major product categories: June licenses for flat-rolled products dropped 18% from May, pipe and tube products fell 12%, long products tumbled 26%, and stainless licenses were down 8%.

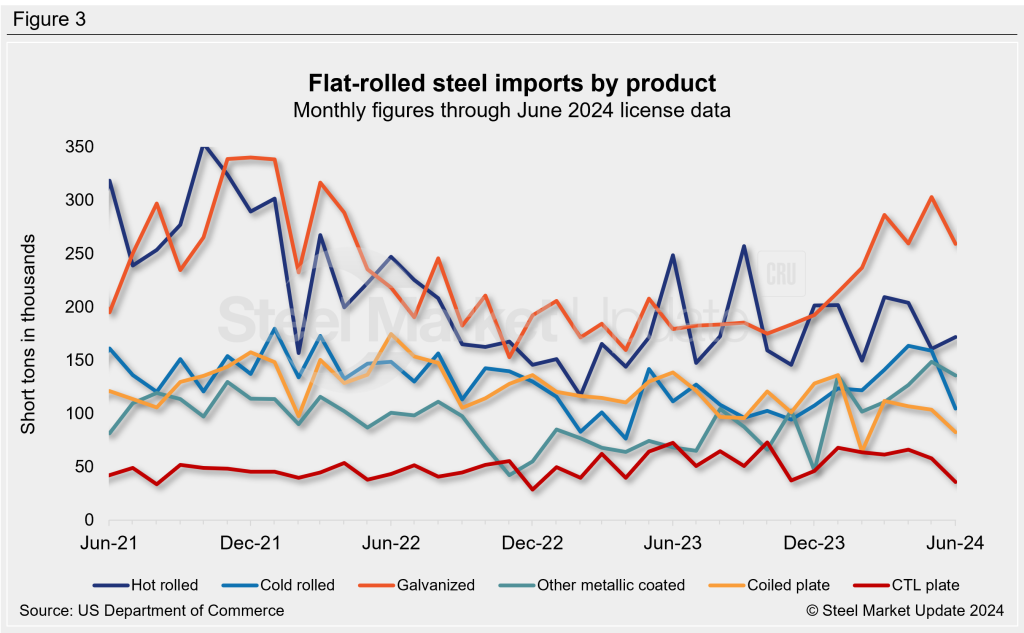

While June licenses for most major flat-rolled products declined from May, licenses to import hot rolled increased 7% to 171,670 st on higher shipments from Japan.

Galvanized sheet licenses fell 14% from a 26-month high in May to 259,240 st in June – a level comparable to April’s import total. While licenses declined from the top three foreign sources of galv – Canada, Mexico, and Vietnam – hot-dipped galvanized (HDG) license applications increased from Brazil, South Korea, and UAE.

Licenses to import cold-rolled sheet dropped by more than a third from May to a seven-month low of 104,680 st in June. CR licenses were down noticeably from Mexico, Australia, Vietnam, and Taiwan.

Other metallic-coated sheet imports have been above 100,000 st every month so far this year, with June import licenses totaling 135,370 st. While total licenses declined 9% from May, licenses were higher for product from Vietnam, Brazil, and Australia.

Plate imports declined notably in June. Coiled plate licenses of 82,610 st were at a four-month low, while cut-to-length plate licenses of 35,650 st were at their lowest level since December 2022.

Table 1 below details import levels over the last three months by product and shows the three- and 12-month moving averages for comparison.