Market Data

September 26, 2024

SMU survey: More buyers report mills willing to talk price

Written by Brett Linton

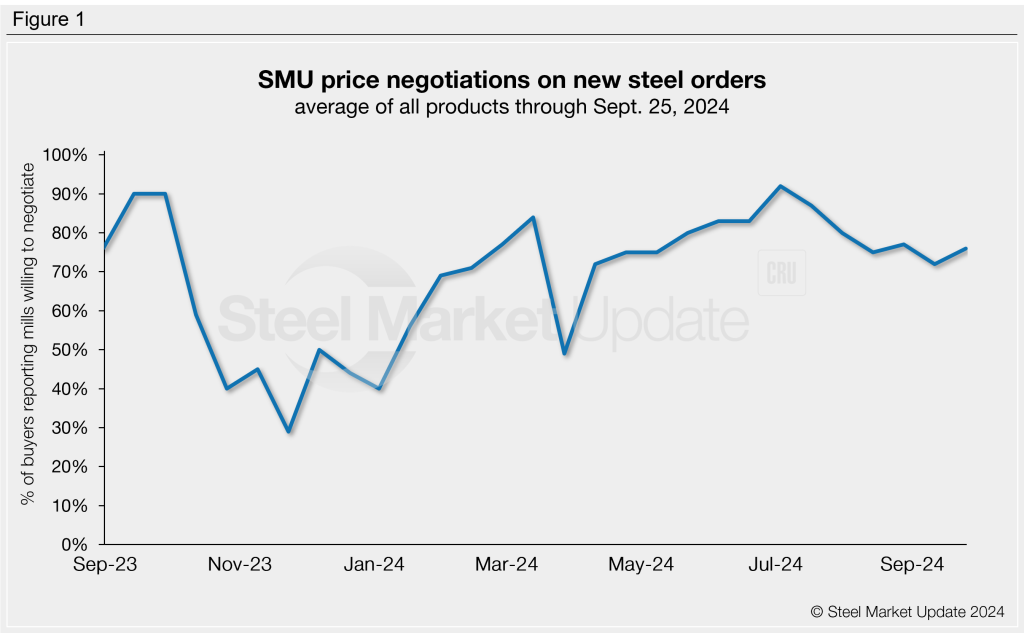

More than three-quarters of the steel buyers participating in our market survey this week reported that mills are negotiable on prices for new order. Negotiation rates have been in this range for the last six weeks, following the gradual decline across July and into early August.

Every other week, SMU polls hundreds of steel market executives asking if domestic mills are willing to negotiate lower spot pricing on new orders. As shown in Figure 1, 76% of all buyers we surveyed this week reported that mills were willing to budge on price. This is four percentage points higher than our negotiation rate two weeks prior, and within 1% of those in August. Compare this to early July when we saw a multi-year high rate of 92%.

Negotiation rates by product

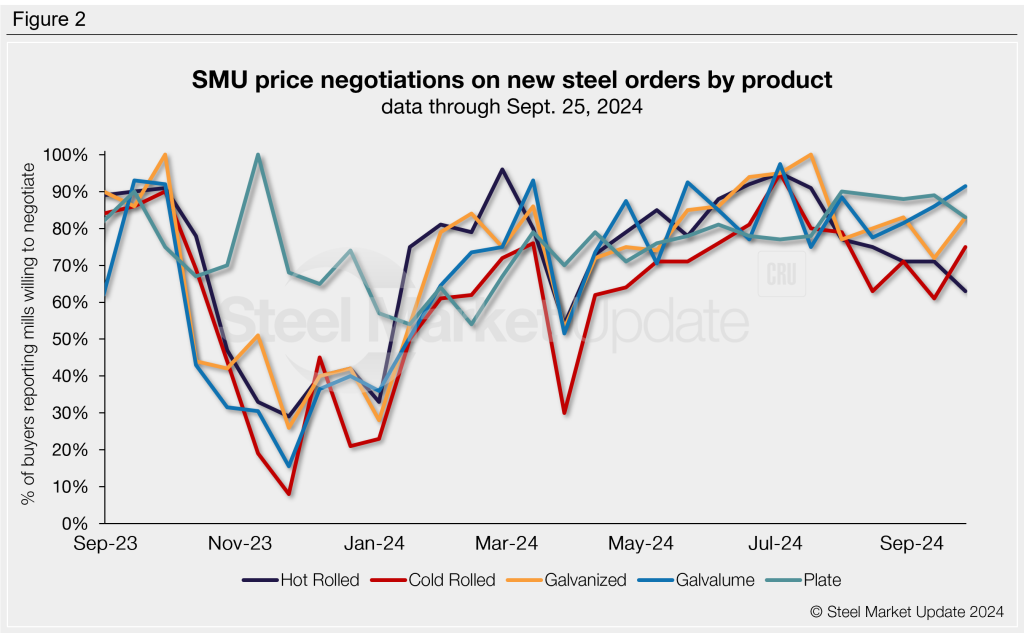

As seen in Figure 2, negotiation rates differ across our various sheet and plate products, ranging from 63-92%. Negotiation rates were highest for Galvalume, galvanized, and plate products. The biggest movers from our prior survey were cold rolled, followed by galvanized and hot rolled. Negotiation rates by product are:

- Hot rolled: 63%, down eight percentage points from Sept. 11. This is the lowest rate recorded since March.

- Cold rolled: 75%, up 14 percentage points and the highest since July

- Galvanized: 83%, up 11 percentage points

- Galvalume: 92%, up six percentage points and the highest since July

- Plate: 83%, down six percentage points and the lowest since July

Here’s what some survey respondents had to say:

“We aren’t working directly with any mills right now, but I have heard some of the folks out on the West Coast are pushing for [hot rolled] tons.”

“I think there is a small range, but larger [hot rolled] buys can get something off.”

“[Negotiable on hot rolled] depending on their order book.”

“[Negotiable on cold rolled] based on tonnage.”

“Mills have definitely worked to push [galvanized] prices up with the latest trade cases, expecting more.”

“[Negotiable on hot rolled] but not all mills.”

Note: SMU surveys active steel buyers every other week to gauge their steel suppliers’ willingness to negotiate new order prices. The results reflect current steel demand and changing spot pricing trends. Visit our website to see an interactive history of our steel mill negotiations data.