Analysis

January 9, 2025

SMU Survey: Most buyers still report mills are flexible on prices

Written by Brett Linton

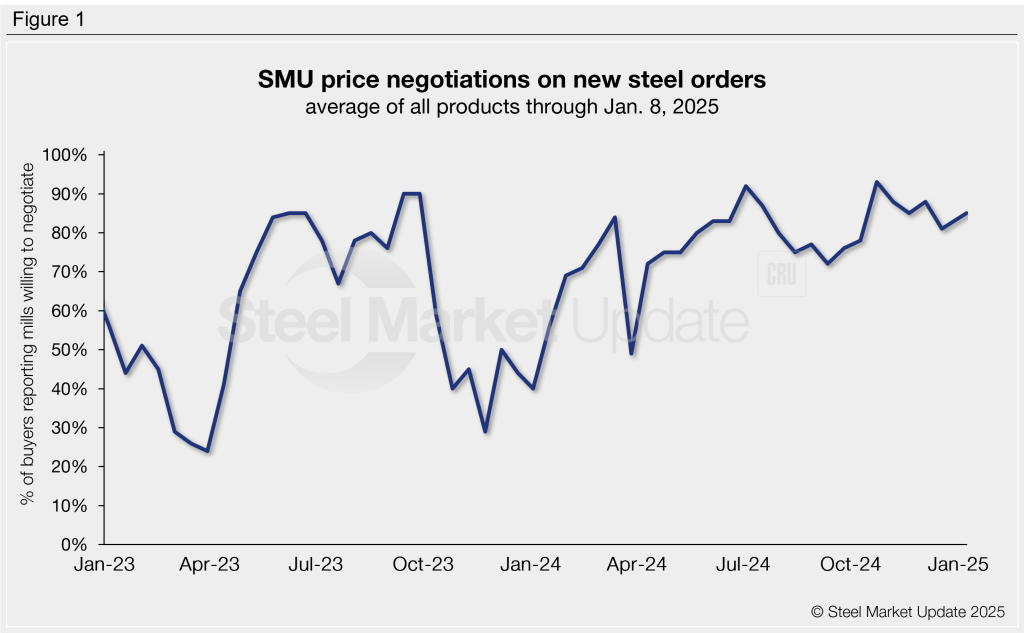

Steel buyers say mills remain open to negotiation on sheet and plate spot prices this week, slightly more so than in mid-December, according to our most recent survey results. Recall that negotiation rates were high for the majority of 2024, especially in the second half of the year.

SMU polls hundreds of service center and manufacturer buyers every two weeks asking if domestic mills are flexible on new spot order prices. This week, 85% of the buyers we surveyed reported that mills would talk price to secure a new order (Figure 1). This rate has remained in the 80-90% range since November, following the multi-year high of 93% seen in October. This time last year we saw much lower negotiation rates (44-56%).

Negotiation rates by product

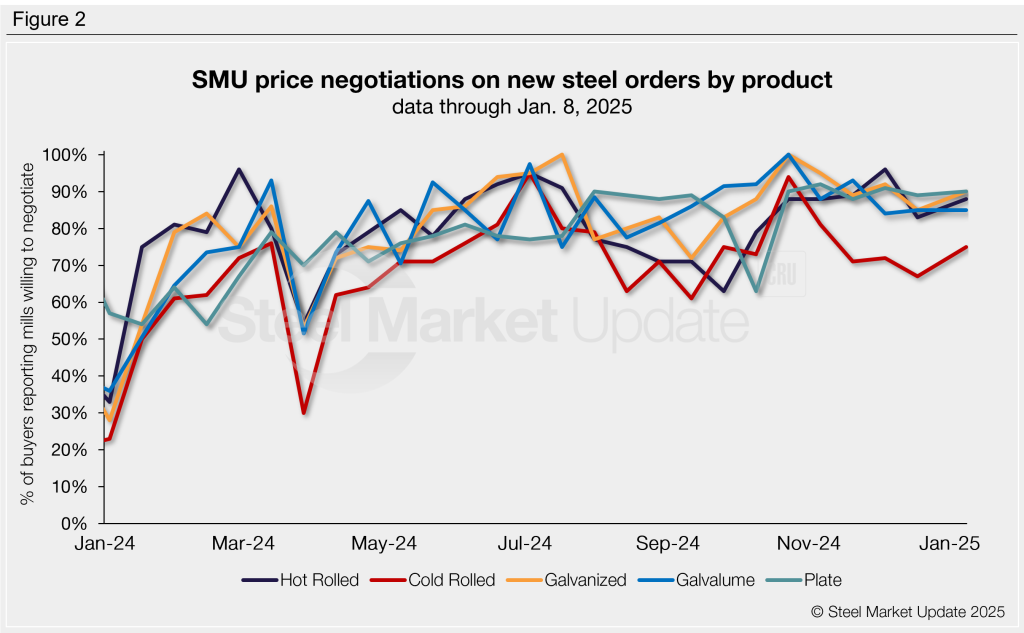

Negotiation rates remain strong on both sheet and plate products (Figure 2). Rates were highest this week for galvanized and plate products. Negotiation rates by product this week are:

- Hot rolled: 88%, up five percentage points from Dec. 18.

- Cold rolled: 75%, up eight percentage points and the highest rate recorded since early November.

- Galvanized: 90%, up five percentage points to a near-three-month low.

- Galvalume: 85%, unchanged.

- Plate: 90%, up one percentage point.

Here’s what some survey respondents had to say:

“Some are willing to negotiate on hot rolled, but not much room to move.”

“Tons talk right now.”

“Only negotiable on larger tonnage deals.”

“Not negotiable on plate, prices have bottomed out.”

“Still depends on who and how much [hot rolled] you are buying.”

“Some plate mills are negotiable, some are not.”

Note: SMU surveys active steel buyers every other week to gauge their steel suppliers’ willingness to negotiate new order prices. The results reflect current steel demand and changing spot pricing trends. Visit our website to see an interactive history of our steel mill negotiations data.